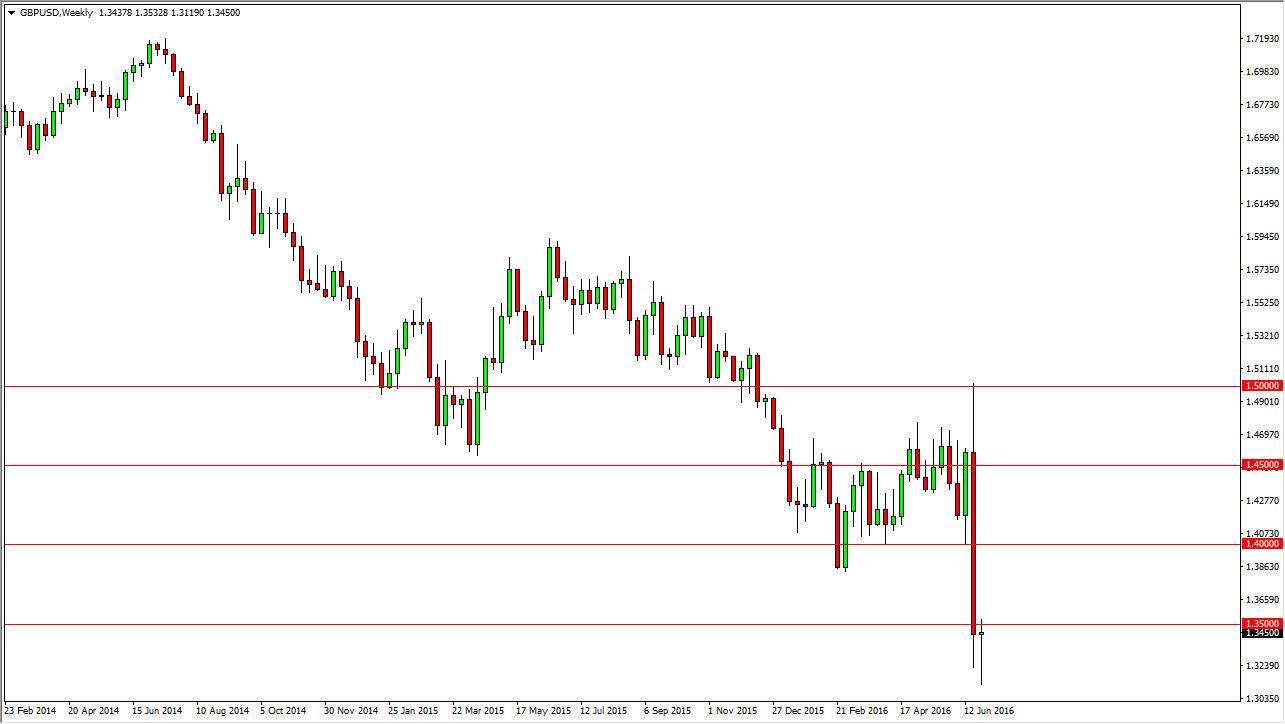

The United Kingdom voted to leave the European Union as you all know now, and this of course had a very disastrous effect on the British pound. With that, it looks as if the market will continue to sell off the British pound, but at this point in time it does look like we are trying to bounce a bit. Ultimately, any rally at this point in time will more than likely offer selling opportunities, and an exhaustive candle would be a nice opportunity to take advantage of US dollar strength, and of course the weakness coming out of the United Kingdom at the moment. I believe that this market should continue to be very negative, and I do think that we will eventually go lower. However, after the massive 12% drop that we initially had, it makes sense that we would have to have a bit of a “dead cat bounce.”

Patience will be needed

I believe that patience will be needed in order to take advantage of the longer-term trend. Even though there is a nice supportive looking candle at the moment, it looks as if you will be much more downside over the longer term, and quite frankly I would love to see this market try to reach all the way to the 1.40 level where I can search selling again. However, I would be a bit surprised if we could reach that level, and therefore will also consider exhaustive daily candles between here and there.

Alternately, if we break down below the bottom of the candle for the final week of the month, that could send this market even lower in a much quicker manner. That should send this market looking for the 1.30 level again, and then eventually the 1.28 handle. With this, I think that buying is simply out of the question right now as there are far too many sellers out there.