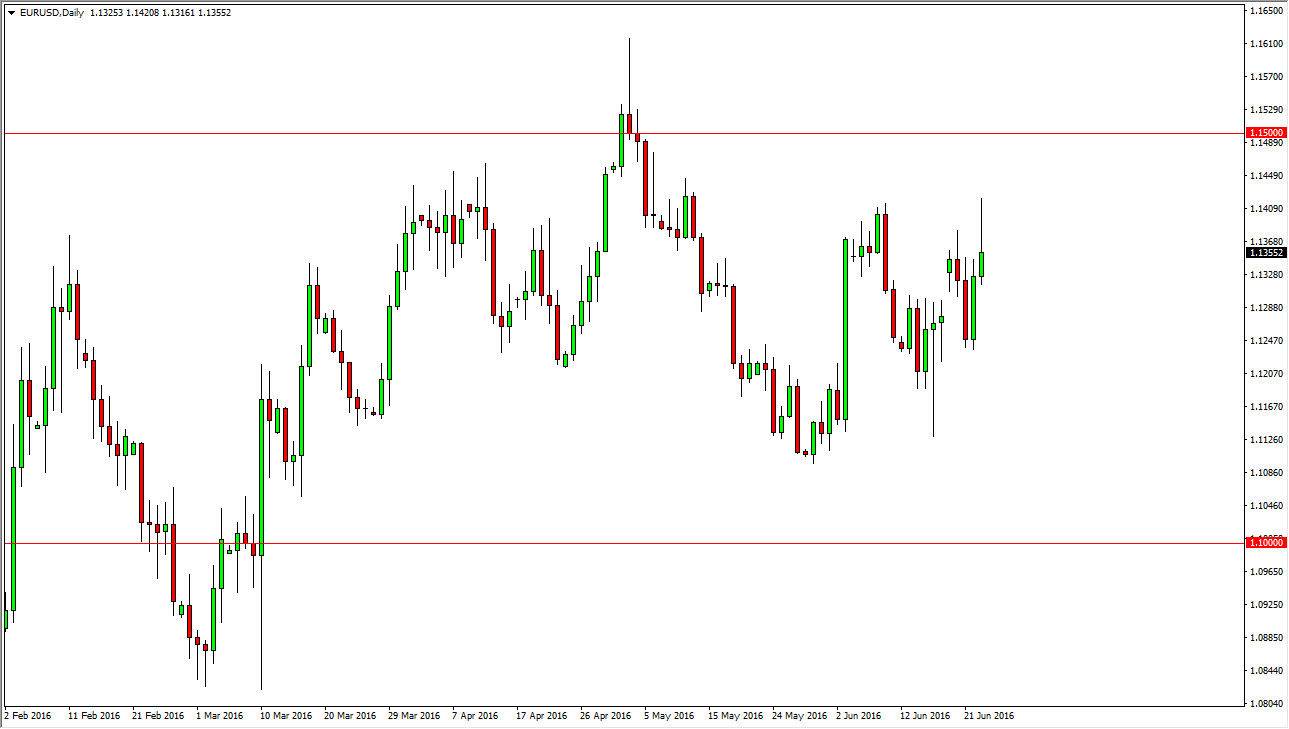

EUR/USD

The EUR/USD pair initially tried to rally during the course of the session on Thursday, but sold off as the 1.14 level above had provided quite a bit of resistance. With this being the case, we did up forming a bit of a shooting star, and it suggests that the market isn’t quite ready to take off yet, because we do not have the results of the EU referendum in the United Kingdom. Once we do get that announcement, expect that the market should continue to be focusing on that result, with the market probably rising with a “stay” vote, while a “leave” vote coming out of the United Kingdom would be negative.

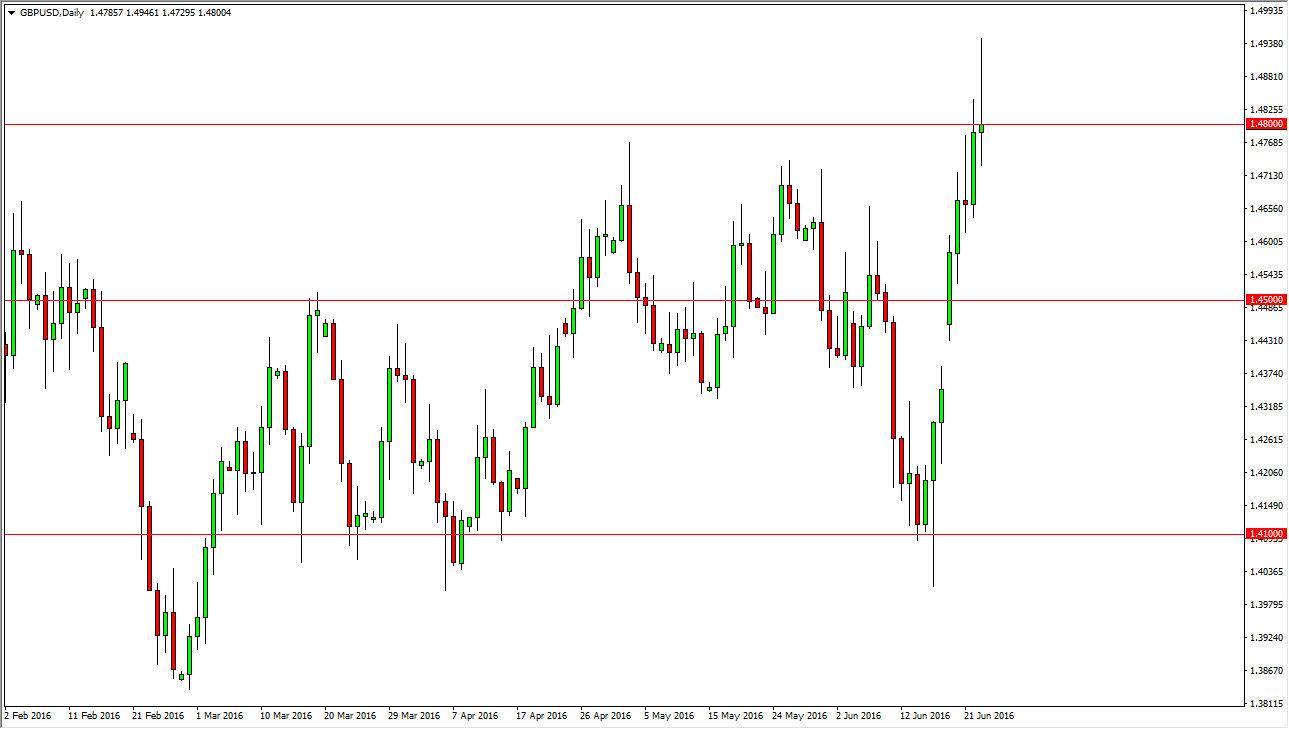

GBP/USD

The GBP/USD pair initially tried to fall and then shot straight through the 1.48 level as word came out that perhaps the British were willing to stay in the European Union. Ultimately, we did end up forming a shooting star, which of course is a very negative sign. A break down below the bottom of the shooting star is a very negative sign and should send this market looking for the gap that formed below. If we break above the top of the shooting star that would be very bullish and it should send this market much higher. I believe that will be a result of a “stay” vote, and as a result the British pound would take off to the upside as more confidence would be had with the British economy. However, if we break down below the bottom of the shooting star that it’s probably going to be a result of “leave” winning the referendum, and of course should sink the British pound overall. Ultimately, between now and then a lot of people are essentially guessing.