AUD/USD Signal Update

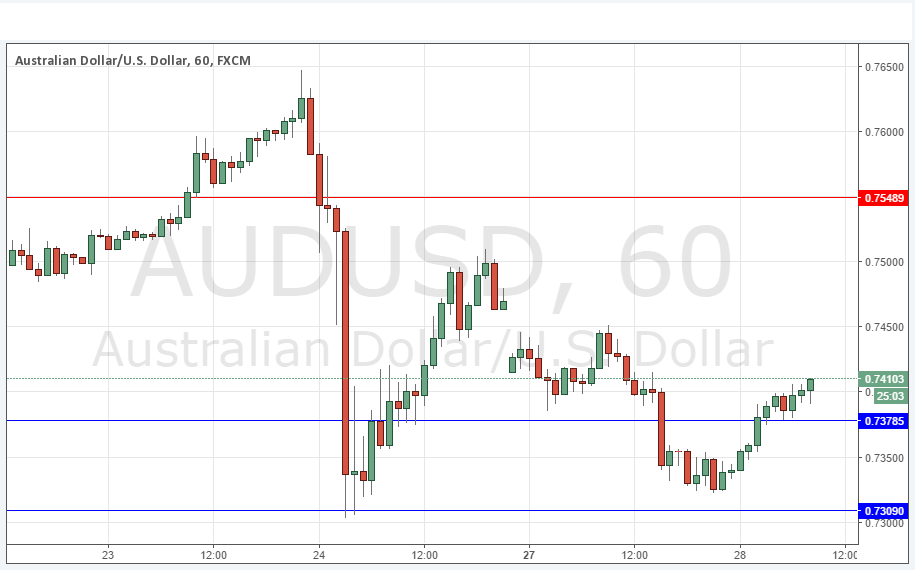

Yesterday’s signals expired without being triggered as there was no bullish price action at the anticipated support level of 0.7379.

Today’s AUD/USD Signals

Risk 0.75%

Trades may only be taken between 8am and 5pm New York time today.

Short Trade 1

Short entry following some bearish price action on the H1 time frame immediately upon the next touch of 0.7549.

Put the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Long Trade 1

Long entry following some bullish price action on the H1 time frame immediately upon the next touch of 0.7379.

Put the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

AUD/USD Analysis

This pair has been recovering since the late New York session yesterday and appears poised to rise as there is some kind of rebound in risk.

Technically, it is interesting to note that the support level at 0.7379 was reached and easily breached yesterday, but appears to have come back into play, acting as good support again over recent hours, so I think this level can still be respected.

It is hard to see how this rally can last beyond 0.7500.

There is nothing due concerning the AUD. Regarding the USD, there will be a release of Final GDP data at 1:30pm London time, followed later by CB Consumer Confidence at 3pm.