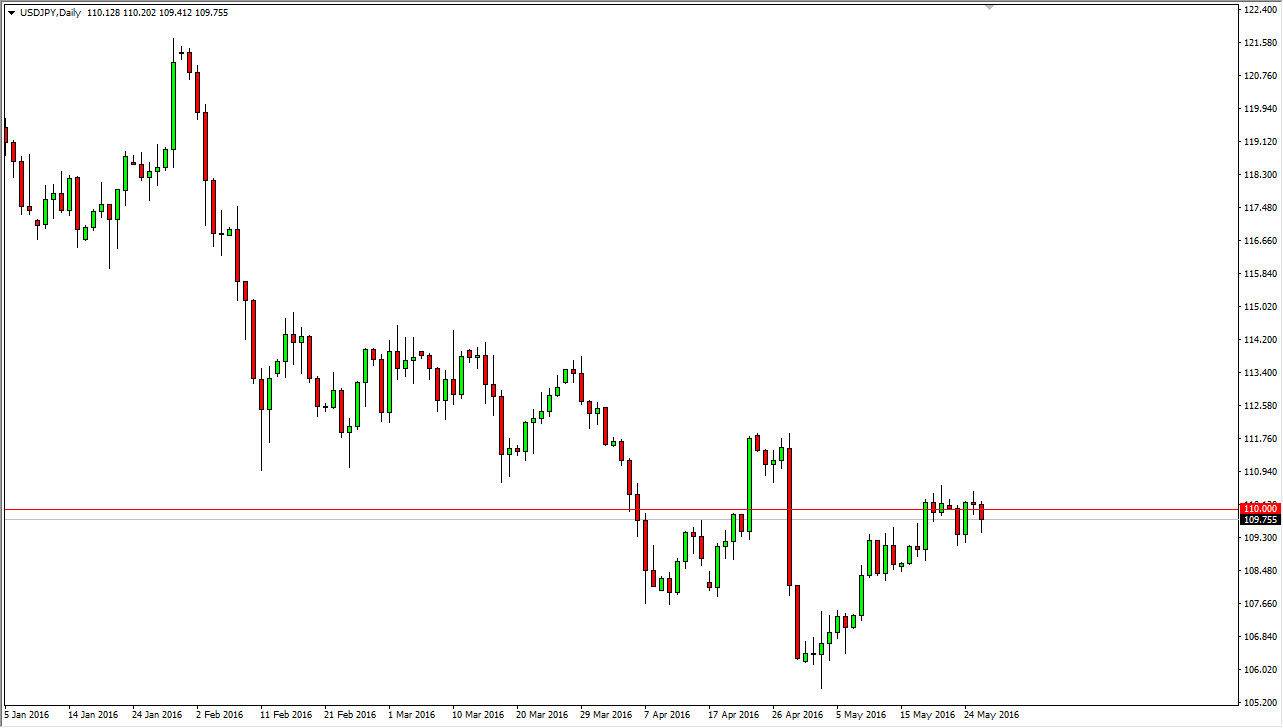

USD/JPY

The USD/JPY pair fell initially during the day on Thursday, but found enough support just above the 109 level to bounce and form a bit of a hammer. Ultimately, this is a market that still is consolidating, and with that being the case it is likely that the market is probably best left alone at this point in time. If we can break above the 111 level, I feel that the market will then reach towards the 112 level. A break down below the 108 level is needed for me to start shorting, as the market is simply going to be a bit difficult to be bothered with. I believe that the 110 level will continue to be fairly important, so it would not surprise me at all if we hang out in this general vicinity for the time being.

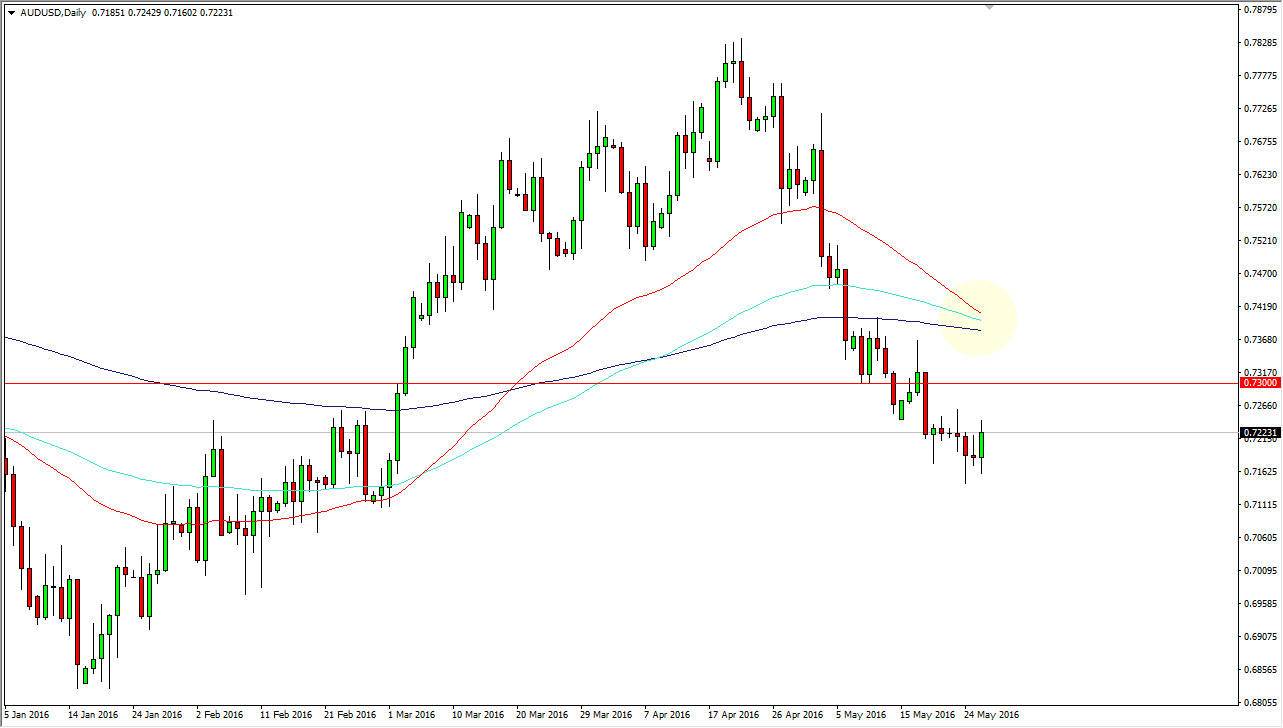

AUD/USD

The AUD/USD pair initially tried to fall during the day on Thursday, but turned right back around to form a positive candle. There is a significant amount of resistance just above, and that it extends all the way to the 0.73 level. With this, I’m waiting to see whether or not we get a short-term rally that show signs of exhaustion so I can start selling. Even if we break above there, I believe that the market has been interesting area above, as the 50, 100, and 200 day exponential moving averages are getting ready to cross as denoted by the yellow circle on the chart. I think that this is a market that can be almost impossible to start buying, at least until we break above the moving averages that I have highlighted.

If we do get above there, I think the market could go to the 0.76 level above. Ultimately, that’s the least likely scenario at this point, as I recognize that the bearish pressure has been extraordinarily strong.