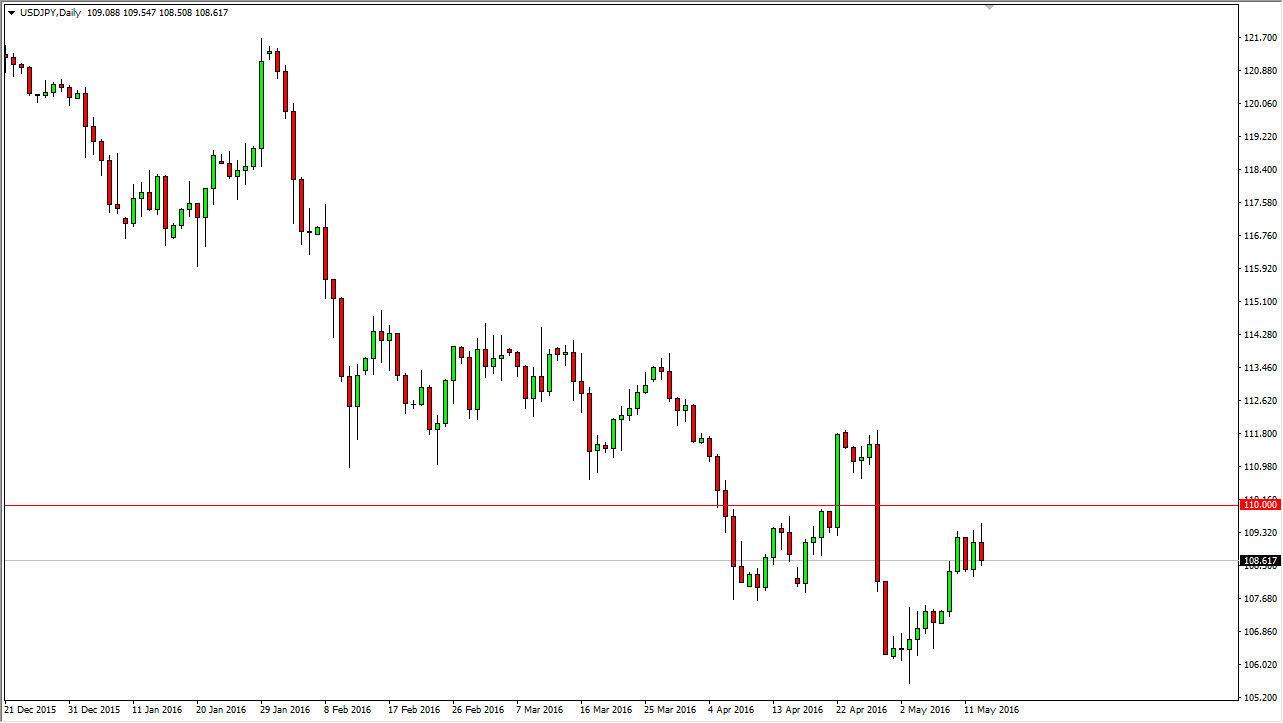

USD/JPY

The USD/JPY pair initially tried to rally during the day on Friday, but turned right back around just below the 110 level. With this being the case, the market looks as if it is trying to grind its way lower but I’m going to wait until we break down below the 108 level to start selling. At this point in time, I would anticipate that the market would reach towards the 106 handle, and then possibly even lower. Remember, the USD/JPY pair tends to be very sensitive to risk appetite, so pay attention to the stock markets. On the other hand, if we can break above the 110 handle, I believe that the USD/JPY pair will find itself reaching towards the 112 level.

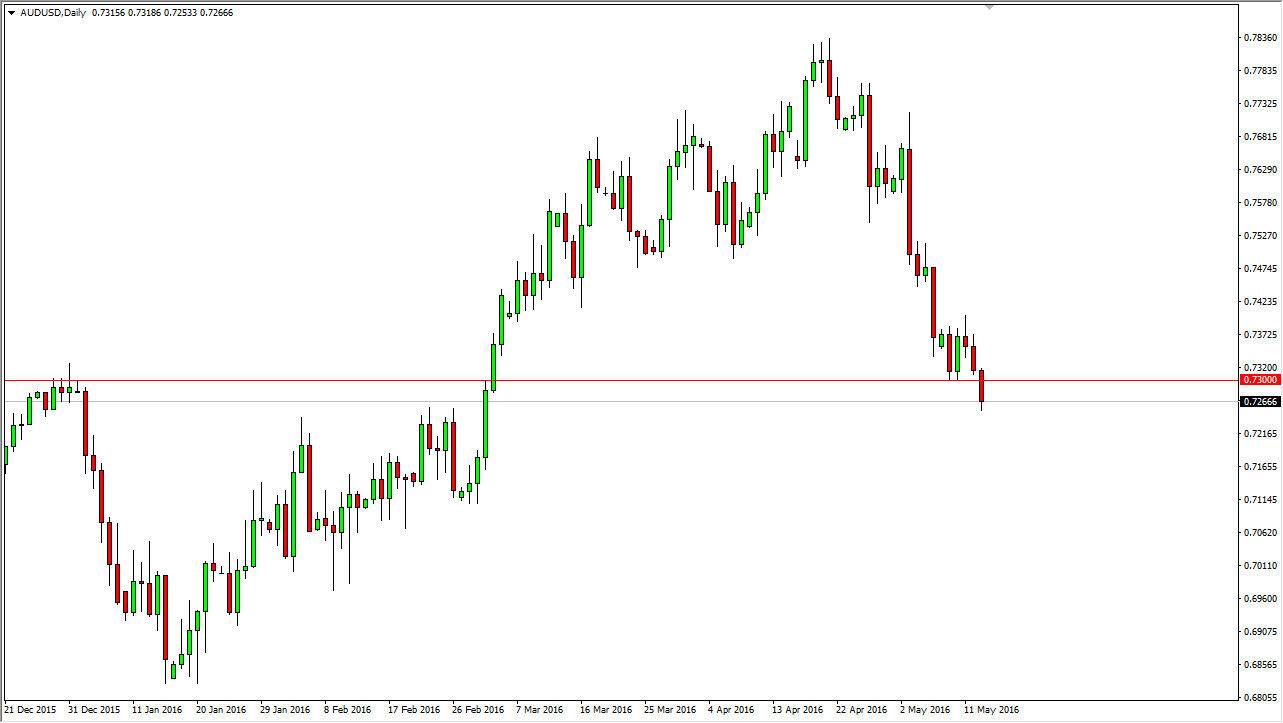

AUD/USD

The AUD/USD pair fell during the course of the session on Friday, clearing the 0.73 level to the downside. With this being the case, it looks as if we are going to continue to grind but I think grind would be the key word here as it’s not a silly going to fall apart with so much noise below. Yes, the Reserve Bank of Australia has cut rates recently, but there are also concerns about what’s going on with the Federal Reserve, so I think at this point in time even though the Aussie looks a bit soft, we are still wondering what’s going to go on with the Federal Reserve and its interest-rate cycle. With that being the situation it’s more than likely going to be a slow grind lower than anything else. I think we will probably try to reach the 0.70 level given enough time, but you also have to keep one eye on gold markets, as it tends to greatly influenced with happening with the Australian dollar anyways. It doesn’t mean that they can’t move in opposite directions, it just means it typically they don’t.