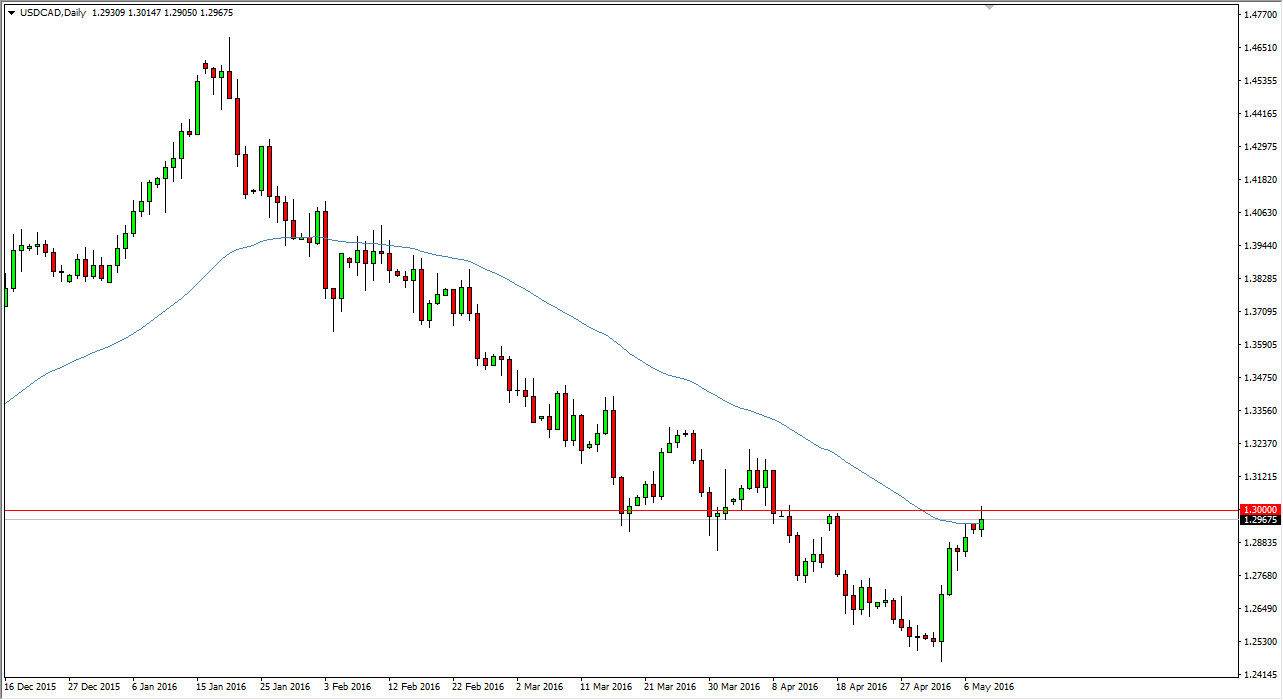

During the day on Monday, the USD/CAD pair gapped higher but found quite a bit of resistance near the 1.30 level as you would expect. This of course is a large, round, psychologically significant number, and of course was a very supportive in the past so it should now be extraordinarily resistive. Now that we are forming something that looks a bit like a shooting star, I feel that this market could very well fall from here. We have seen quite a bit of bearish pressure lately, and the fact that we have had a significant bounce does of course catch my attention, but it also is probably going to be very difficult to keep up the type of momentum that we’ve seen recently.

Looking at this market, you have to keep in mind that the Canadian dollar is highly sensitive to the value of oil itself. So with that, expect that this market should react to whatever goes on in the WTI Crude Oil market and other grades as well. As oil goes higher in value, this pair tends to fall as the Canadian dollar is more in demand.

Technical resistance

We also have resistance of the 1.30 level due to the fact that it’s a psychological round number, but we also have resistance due to the fact that we have the 50-day Exponential Moving average there as well. It will be interesting to see whether or not we break down, but if we do I think it’s just a simple continuation of the bearish pressure that we have seen.

A break down below the bottom of the range for the session on Monday would be reason enough for us to perhaps look towards the 1.25 handle, and possibly even lower than that. Having said that though, if we can break above the top of the shooting star, it’s very likely that we will work towards the 1.33 handle but it will probably be a bit of a grind as we’ve seen so much bearish pressure lately.