S&P 500

The S&P 500 had a fairly strong session during the day on Monday, taking back all of the losses from the Friday session. The 2040 level has offered support yet again, and that is the bottom of the recent consolidation so it makes sense that we would have had a bit of a bounce. Ultimately, this is a market that should continue to go higher, perhaps reaching towards the 2080 level given enough time. I think we can break above there, and once we do we should continue towards the 2100 level. I have no interest in selling this market now, mainly because I have seen so much in the way of strength near the 2040 handle recently.

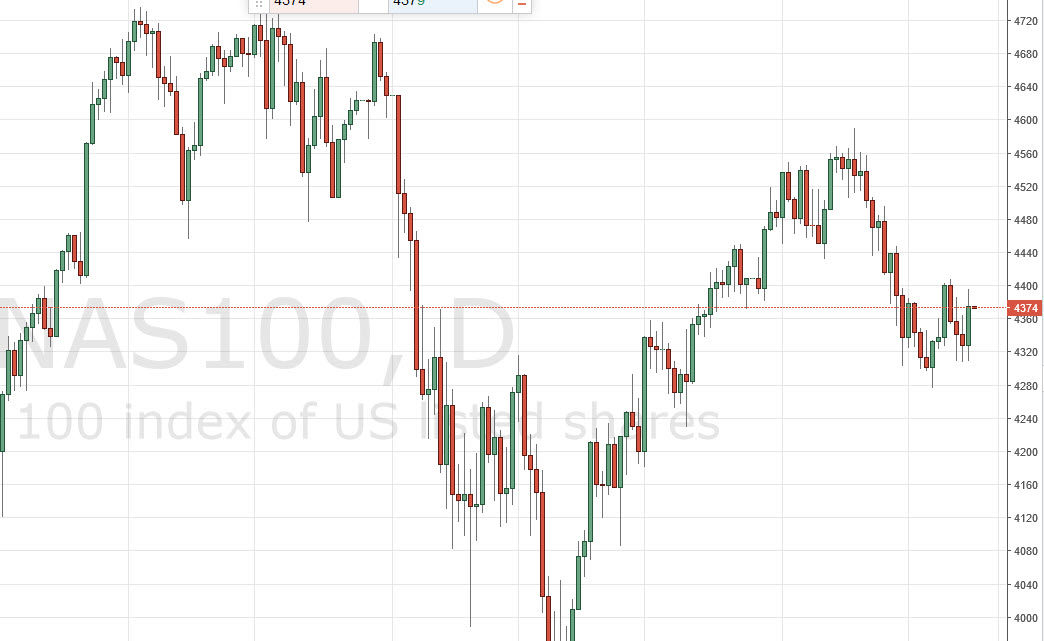

NASDAQ 100

The NASDAQ 100 did very much the same during the day on Monday, testing the 4400 level. If we can break above there, I believe that the market will continue to go higher, perhaps reaching all the way to the 4500 level. I think that the 4280 level is essentially the “floor” in this market right now, so pullbacks and show signs of support or supportive candles should be reason enough to start going long. I think that the declining US dollar will continue to help the stock markets in general, so I am very bullish when it comes to the US indices at the moment.

If we break above the 4400 level, we could very well find ourselves going to the 4550 level fairly soon as well, so I would be willing to be a bit more patient with a move higher than anything else at this point in time. I don’t like selling this index at the moment because I think there is more than enough support below the 4280 level to keep this market somewhat afloat at the moment as there was so much noise below there earlier this year.