Gold prices rose on Monday but the precious metal's gains were limited by signs of stabilization in the risk environment and a firmer dollar. The XAU/USD pair climbed as high as $1288.60 an ounce yesterday, the highest level in six sessions, before giving up some gains to trade at $1276.94. Investors will now look to U.S. inflation data (today) and minutes of the Fed's April policy meeting (tomorrow) in an attempt to glean clues on the timing of the Fed’s future rate hikes. Richmond Fed President Jeffrey Lacker said "the case for raising rates looks to be pretty strong in June."

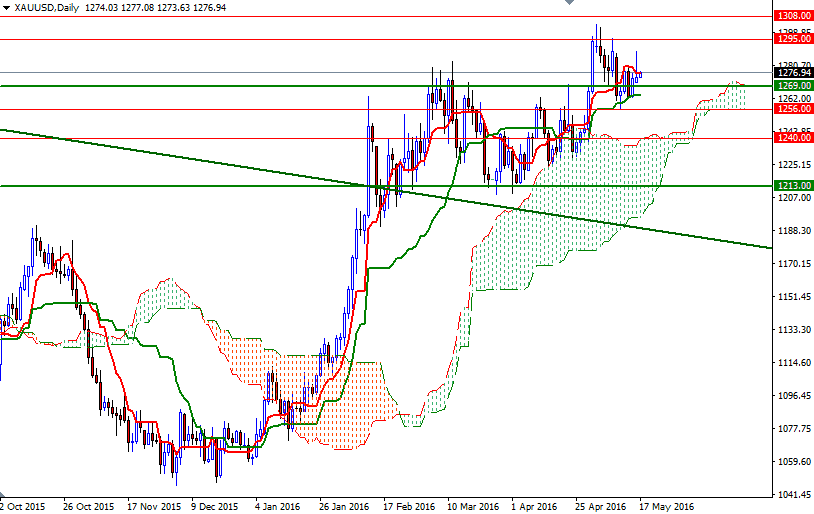

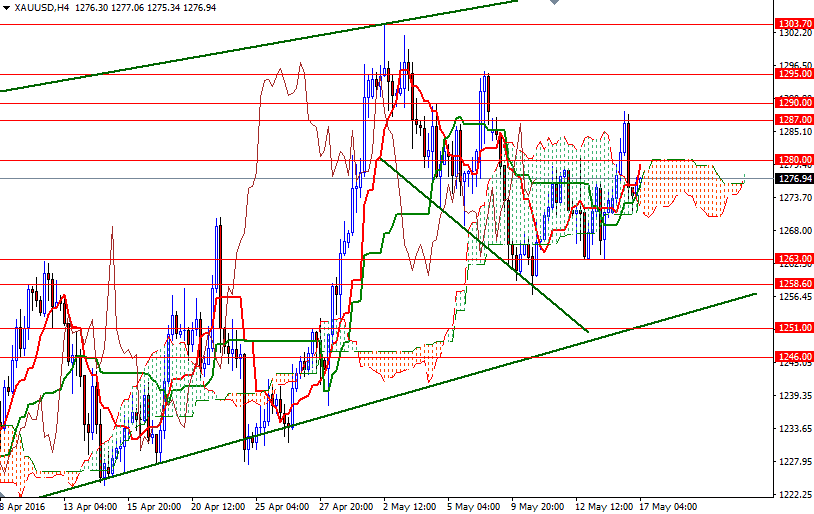

It appear that the bulls are going to make another attempt to climb above the 1282/0 area as the market is supported by the Ichimoku cloud on the 4-hour chart. At this point, lack of momentum is something to watch, especially when charts point to a neutral bias. We currently have bullish Tenkan-sen (nine-period moving average, red line) - Kijun-sen (twenty six-period moving average, green line) crosses on the weekly and daily time frames but both lines are flat.

If prices break through the 1290/87 area, the market will probably gain enough momentum to march towards 1297/5 which is the first significant resistance. I think a close above the 1297 level is essential for a bullish continuation towards 1308. However, if the bulls run out steam and prices return below the 4-hourly cloud, then keep an eye on the 1263 level. The bears will need to capture this level so that they can find a chance to challenge the 1258/6 support. Breaking below 1256 on a daily basis would make me think that the market is ready to test 1251.