By: DailyForex.com

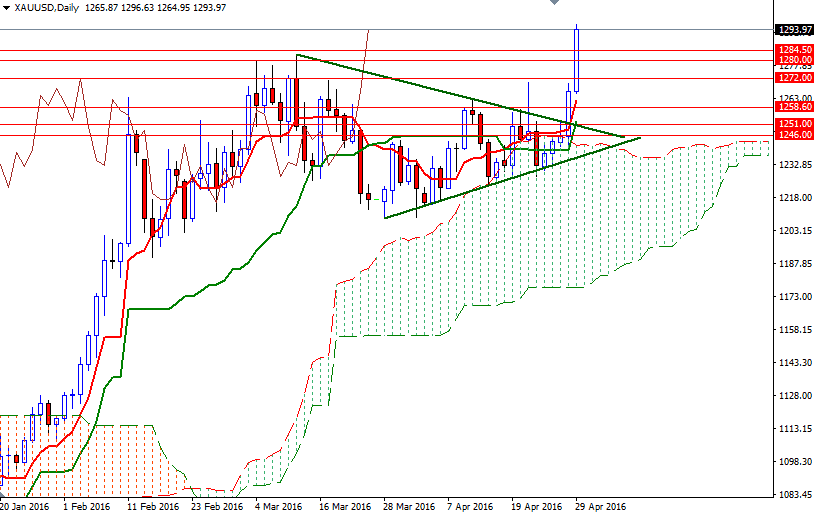

Gold prices settled at $1293.97 an ounce on Friday, making a gain of 2.2% on the day and 5% over the month. Although the market spent the last couple of weeks going back and forth, prices eventually invalidated a resistive trend line (the upper limit of the triangle seen on the daily chart) on Thursday, and rallied to a 15-month high. Gold's gains were mainly driven by the risk-off sentiment in the markets. The greenback came under pressure following a Federal Reserve statement that signaled a slower path of rate increases. Earlier last month, some FOMC members had suggested that several hikes were possible this year.

Gold is usually inversely correlated with the main reserve currency and correlated with the second reserve currency which is the Euro at the moment. A batch of disappointing U.S. economic data, including last week's GDP figures, definitely weakened the argument for "several rate hikes". However, keep in mind that economic growth in Q1 has been softer than expected since 2014 - so if history repeats itself, we could see the economy rebounding quickly in the spring and summer. Another important factor to pay attention in May is the performance of major stock markets as gold's upside potential was capped by strength in these markets. Disappointment over the Bank of Japan holding back on additional stimulus has caused steep losses and sent investors into safer assets. Increasing safe-haven demand could be supportive for gold for the time being.

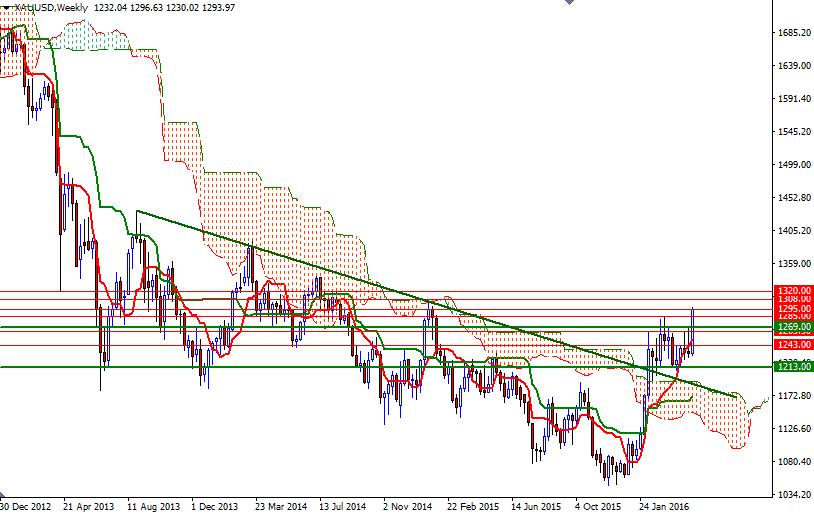

From a technical perspective, breaking through the 1269/3 is of course a bullish sign which tells that this bullishness has much further to run. We have positively aligned Tenkan-Sen (nine-period moving average, red line) and Kijun-Sen (twenty six-period moving average, green line) lines on all time frames. Adding to the bullish outlook is the Chikou-span (closing price plotted 26 periods behind, brown line) which indicates a solid momentum. To the upside, the key area to watch will be 1312/08. If prices get through, we could see the market testing 1332/0 and 1354/45. On the other hand, if the bulls fails to capture the strategic camp right above us at 1295, then I wouldn't rule out a retreat towards 1269/3. On its way down, expect some support at 1280. A break below 1263 could foreshadow a move to 1251/46.