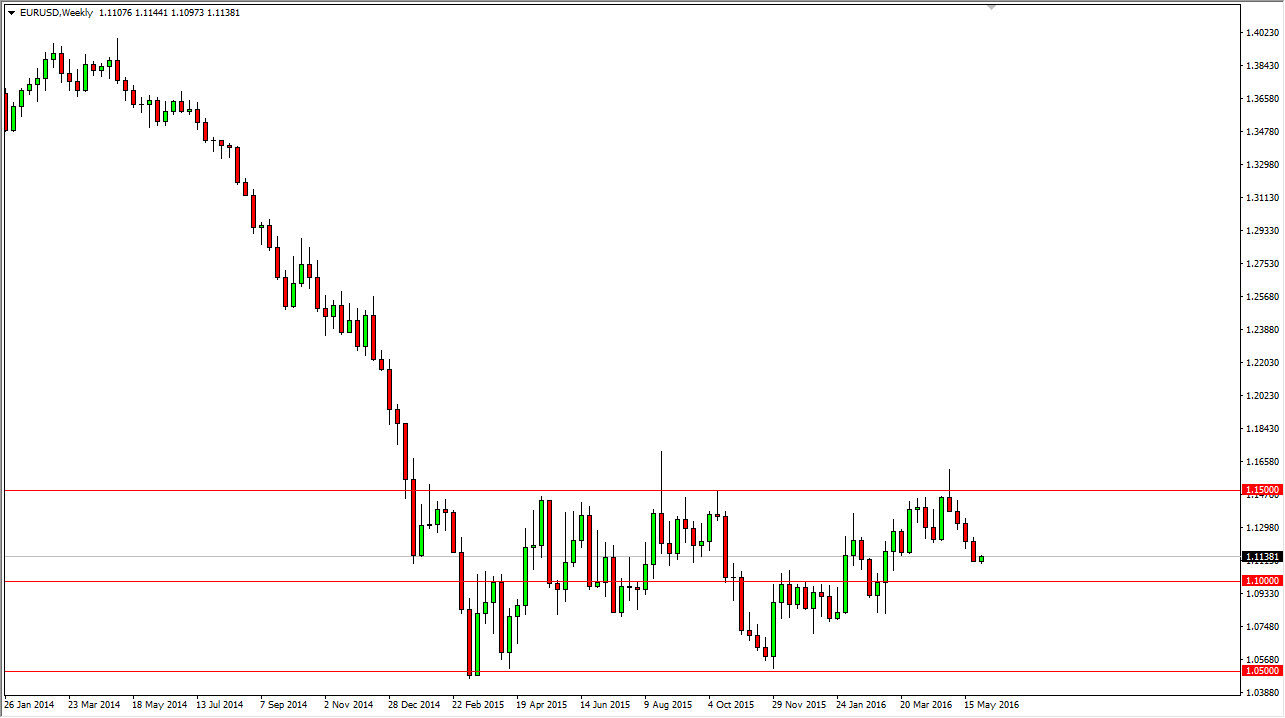

The EUR/USD pair has been falling during the entire month of May. However, I think that we have a little bit lower to go, perhaps reaching down towards the 1.10 level which was an area that had previously been resistive. Ultimately, I think that we would be buyers overall as far as the market is concerned in that area. This is an area that has attracted quite a bit of bullish pressure, so that would make quite a bit of sense. In that sense, I believe that June could eventually end up being positive, after a short-term pullback.

However, we could break down below the 1.10 level, and then we could end up finding this market trying to grind its way back to the 1.05 level. In that case, we would be simply continuing to consolidate from the beginning of 2015. That of course would be a significant amount of stagnation in this market, so having said that it would be very difficult to imagine trading outside of these ranges.

Federal Reserve

The Federal Reserve of course is at the forefront of this situation, mainly because the industry Outlook for the Federal Reserve is so clouded. Initially, the market had anticipated that we would have 4 separate interest-rate hikes during the course of 2016, but that now seems to be very unlikely. In fact, we are anticipating an interest-rate hike in June, but that could be the last one for the Americans during the course of the year. That throws everything into disarray, so will have to wait to see what the FOMC says, but given enough time we need clarity, something that we don’t have at this point in time.

If we can break above the 1.15 level during the month of June, that would be a massively bullish sign. If we can get above there, that would be a “buy-and-hold” sign. That seems to be very unlikely at this point in time though.