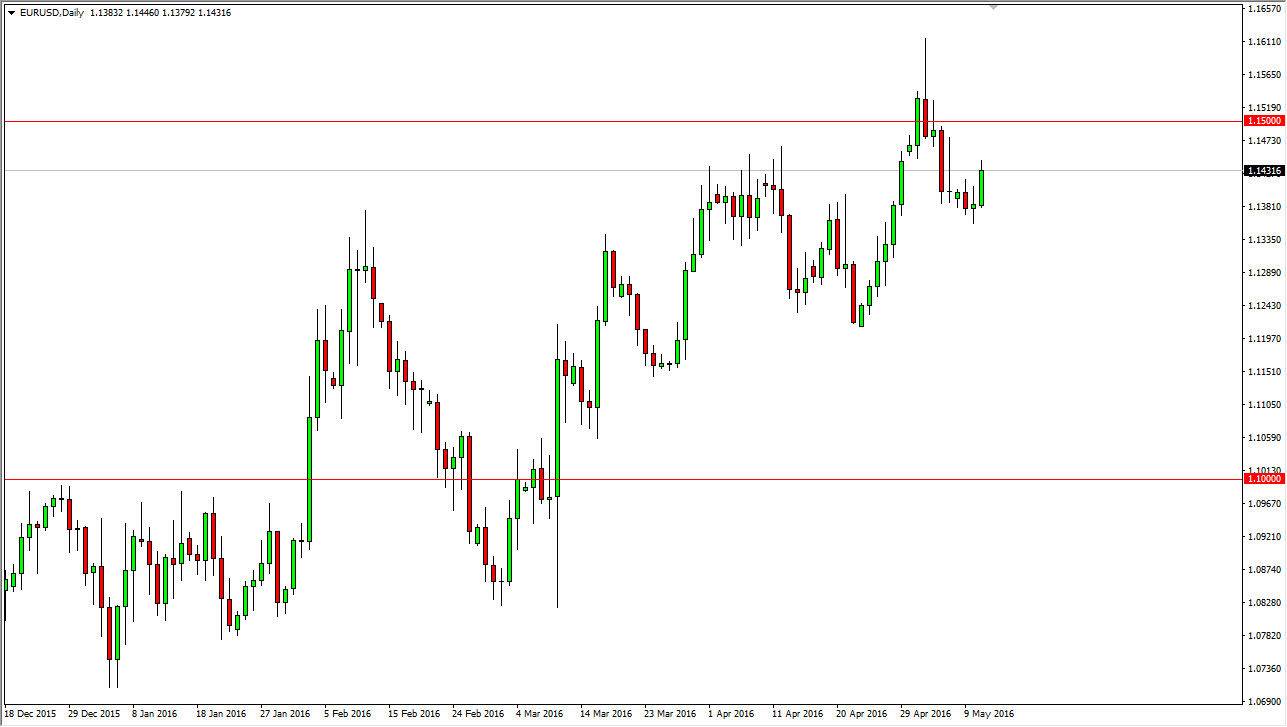

EUR/USD

The Euro rose during the course of the session on Wednesday, breaking the top of a shooting star from both Tuesday and Monday, and as a result it looks as if the market is starting to build up enough momentum to make a challenge to the 1.15 level again. That’s an area that offered significant resistance previously, and this pullback may have simply been an opportunity for market participants to try to build up enough momentum to go higher. I think that a move above the 1.15 level is a very bullish sign, and should get buyers involved again as we will more than likely find ourselves in a longer-term “buy-and-hold” type of scenario where we could reach the 1.18 level, and then eventually the 1.20 level. As far selling is concerned, I don’t really have any interest in doing so at the moment.

GBP/USD

The GBP/USD pair initially fell during the day on Wednesday but turned right back around to form a hammer. We are just below the vital 1.45 level, but today is more important than just that level, we also get an interest-rate announcement coming out of the Bank of England. While I do not anticipate the central bank doing anything drastic, what I do think is that the market will be paying attention to any accompanying statement, and as a result we will more than likely get some type of volatility. At this point time though, I think it’s a simple matter of whether or not we can get above the 1.45 level as to whether or not I can start buying. I think there is significant support just below, and therefore even if we break down from here I will more than likely ignore bearishness as it will be very choppy all the way down to roughly the 1.41 handle.

The entity can count on its volatility, but ultimately I do believe that the buyers are starting to reassert their control yet again, and that the market will eventually drift upward.