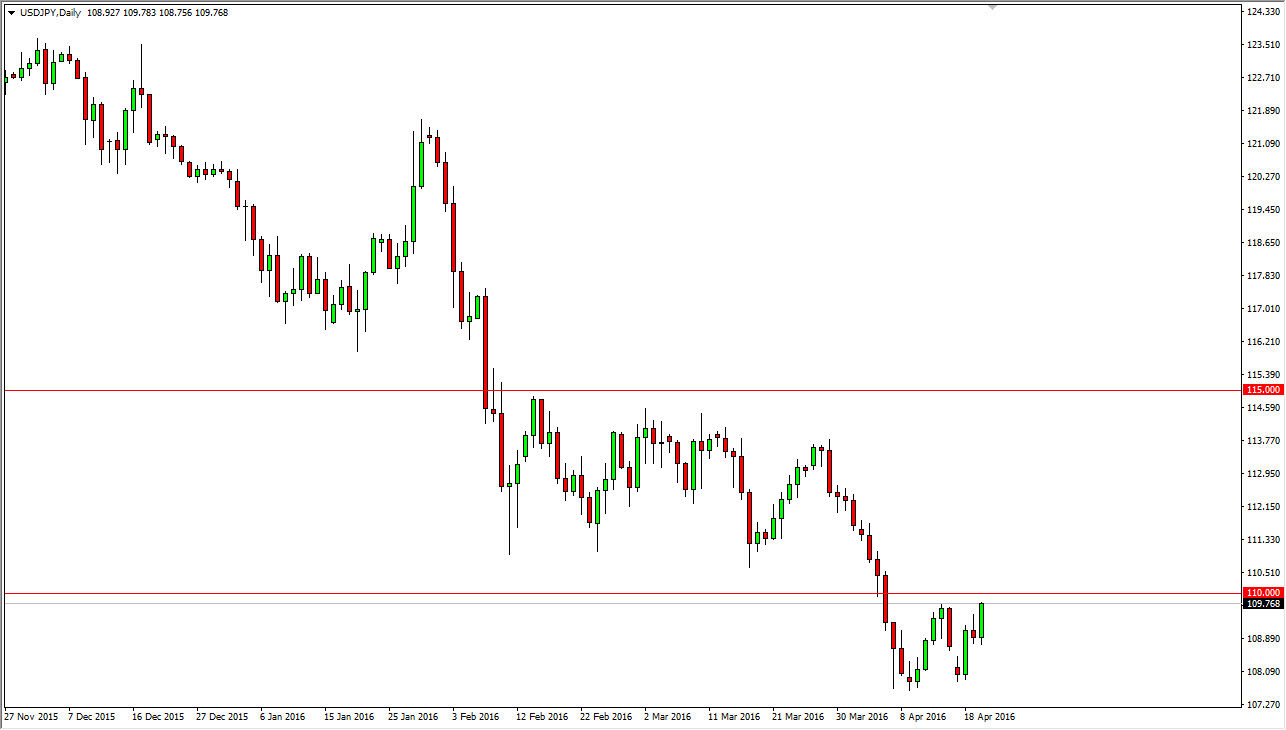

USD/JPY

The USD/JPY pair rose during the course of the day on Wednesday, as we continue to reach towards the 110 level. That is a significant area of resistance, so would not surprise us at all if the markets found a bit of resistance above here. That being the case, if we get an exhaustive candle, I would be more than willing to start selling this market. Having said that, the market does look like it’s going to form a very bullish candle for the day though, so we may have enough momentum to finally break out. It’s not that the area will be easy to get over though, so having said that I’m going to be hesitant to get involved to the upside until we get above the 111 level. Ultimately, the only thing that I can count on in this market is going to be volatility.

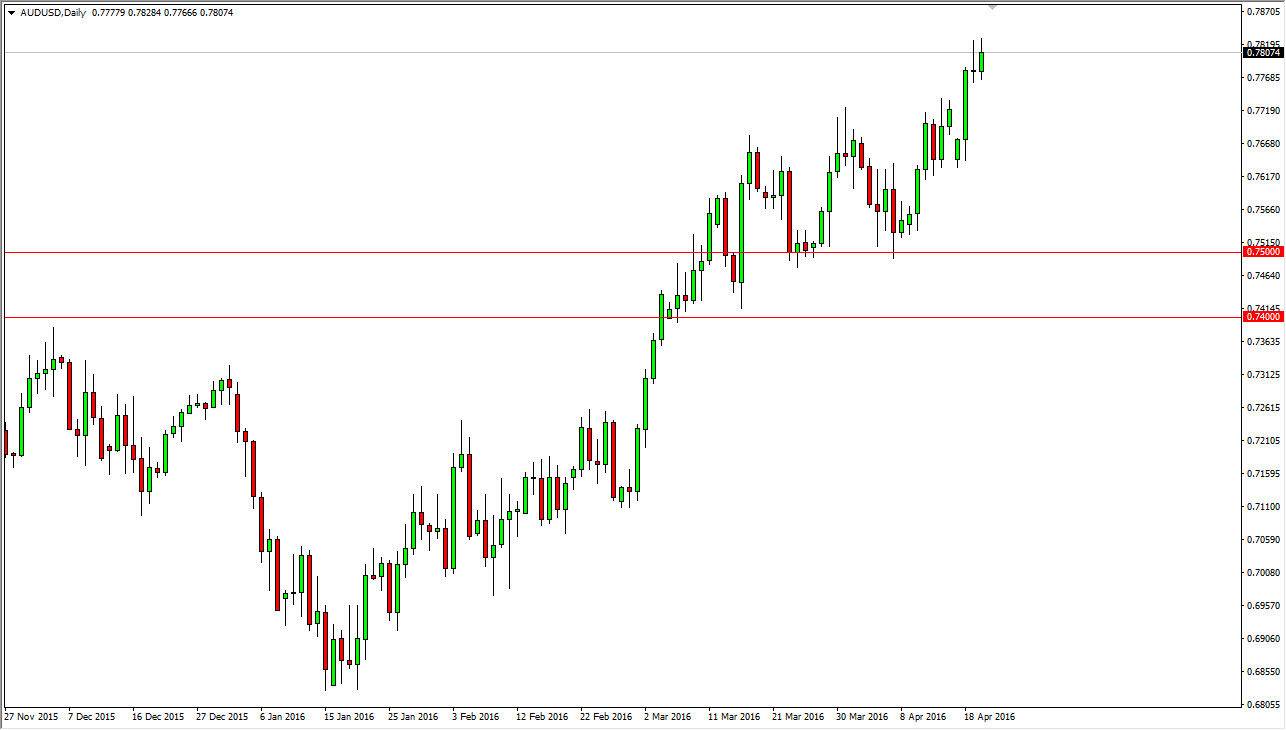

AUD/USD

The AUD/USD pair rose during the course of the day on Wednesday, testing the top of the shooting star from the Tuesday session. This of course is a very positive sign, even though we pulled back a little bit from there. Ultimately, a pullback from here will more than likely find buyers below so I do believe that the Australian dollar will continue to go higher. I would be a buyer on a supportive candle, especially near the 0.77 level where I see potential for real buying power, but also on a break above the top of the shooting star from the Tuesday session, which would simply show a continuation of the bullish momentum. I have no interest in selling the US dollar right now, it looks as if it is one of the more favored currencies around the world, and on top of that you have to keep in mind that the US dollar itself seems to be in a bit of trouble.