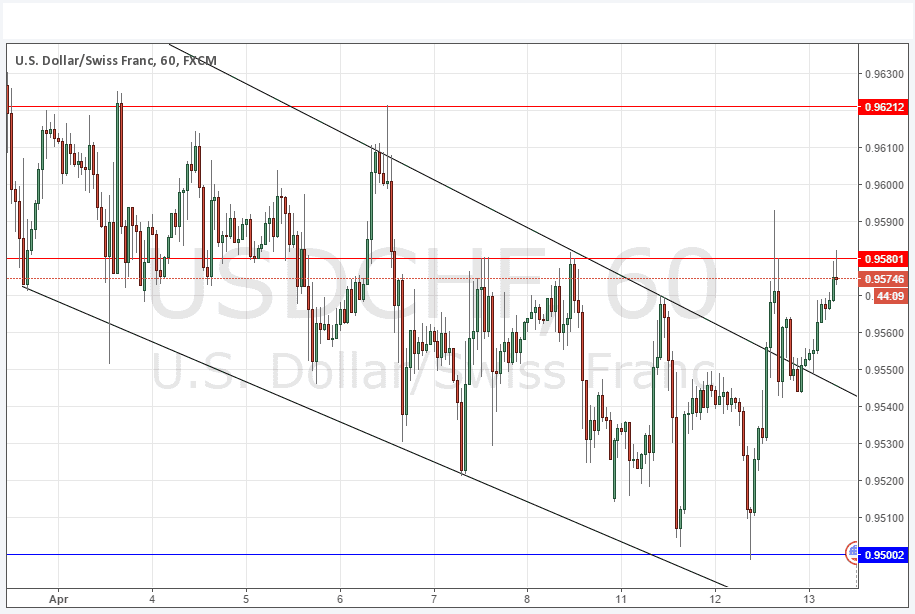

USD/CHF Signal Update

Yesterday’s signals produced both a very profitable long trade from the bullish pin bar rejecting 0.9500, and a slightly profitable short trade from the bearish pin bar rejecting 0.9580! The latter was only good for about 20 pips but it could be worth holding on to some of that long trade from 0.9500 is there is any left.

Today’s USD/CHF Signals

Risk 0.75% per trade.

Trades may only be entered between 8am and 5pm London time today.

Long Trade 1

Long entry after bullish price action on the H1 time frame following the next touch of the broken upper channel trend line currently sitting at around 0.9445.

Put the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Short Trades

Short entry after bearish price action on the H1 time frame following the next touch of 0.9580 or 0.9621.

Put the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

USD/CHF Analysis

Both of the key levels identified yesterday held and gave profitable trades. At the time of writing, the price has broken bullishly out of the bearish channel and used the broken upper trend line as a bullish Launchpad, but the price is being held so far by 0.9580. Although the action looks quite bullish, the long-term trend is bearish, so it seems likely that the next short-term move will be down to retest the broken trend line.

There is nothing due today regarding the CHF. Concerning the USD, there will be releases of Retail Sales, Core Retail Sales and PPI data at 1:30pm London time, followed by Crude Oil Inventories at 3:30pm.