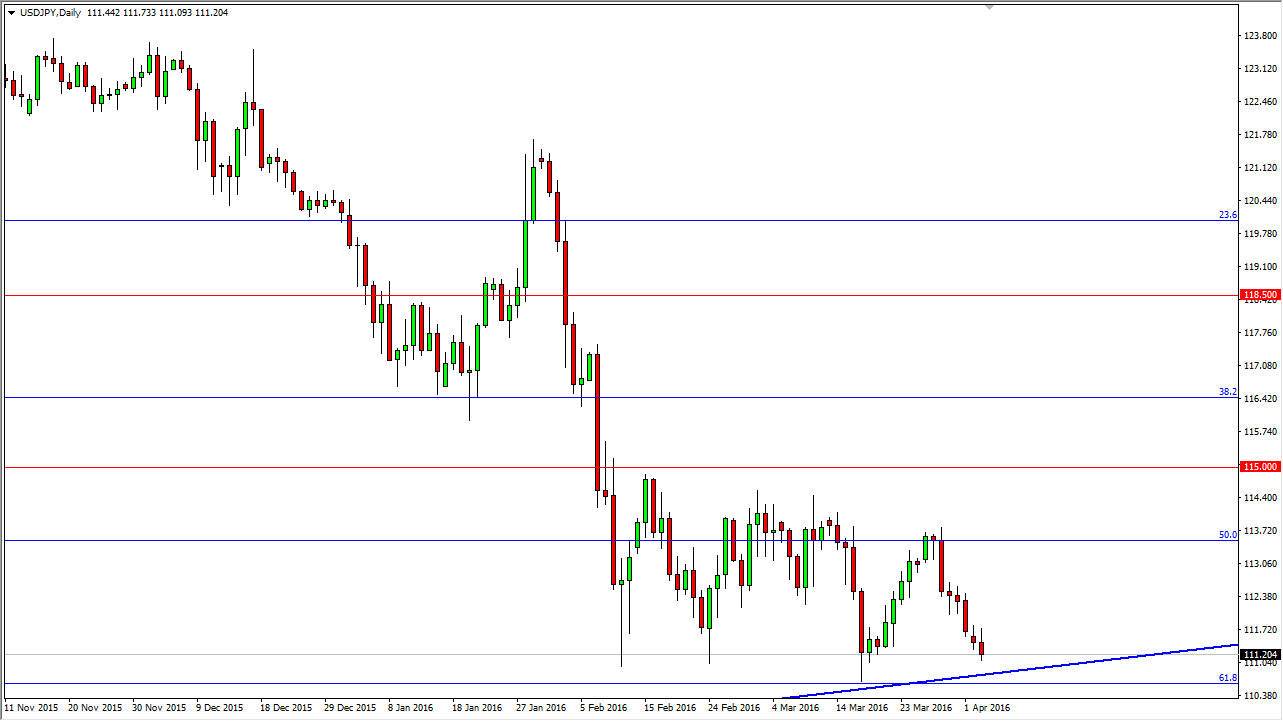

USD/JPY

The USD/JPY pair initially tried to rally during the course of the session on Monday, but turned back around to form a bit of a shooting star. This is a market that has quite a bit of support just below though, not only due to the fact that the 111 level is a large, round, psychologically significant number, but also because we have a massive amount of support at the 110 level. Beyond there, we have the 61.8% Fibonacci retracement level, so there should be plenty of reasons for this market to turn back around. However, we do not have a supportive candle at the moment that I would trust to start buying. On the other hand, we could get a break above the top of the shooting star which of course would also be a very positive move as well.

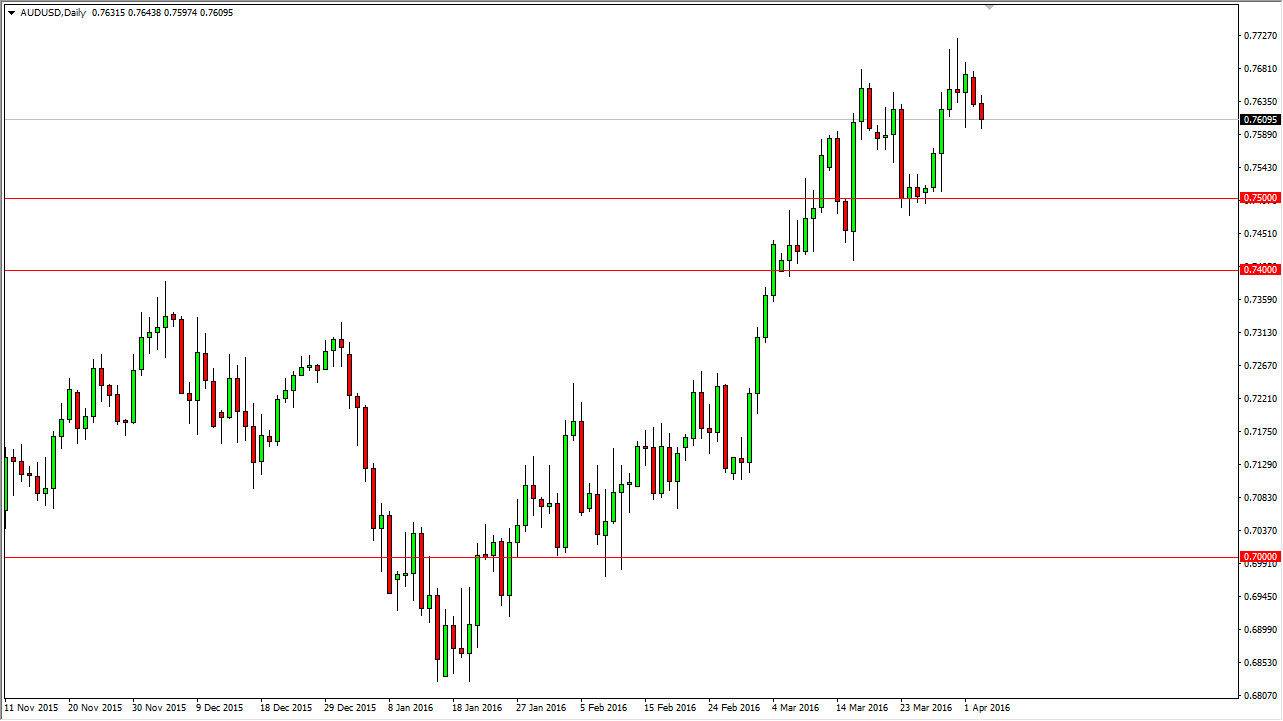

AUD/USD

The AUD/USD pair fell slightly during the course of the day on Monday, but we still have plenty of support just below. On top of that, I think even below there we have the 0.75 level that is the beginning of a massive “floor” below. The 0.74 level is the bottom of that level of support, so having said that it’s very likely that the buyers will return even if we pullback.

Given enough time though, you have to pay attention to the gold markets as well. Gold tends to drive the Australian dollar overall, and if we get a boost in the price of gold, it’s very likely that the market continues to go much higher. Keep in mind that the Reserve Bank of Australia has an interest rate announcement today, and that could very well put quite a bit of pressure in one direction or the other due to the accompanying monetary policy statement. Given enough time, we will get a move, and I believe that it’s going to be higher.