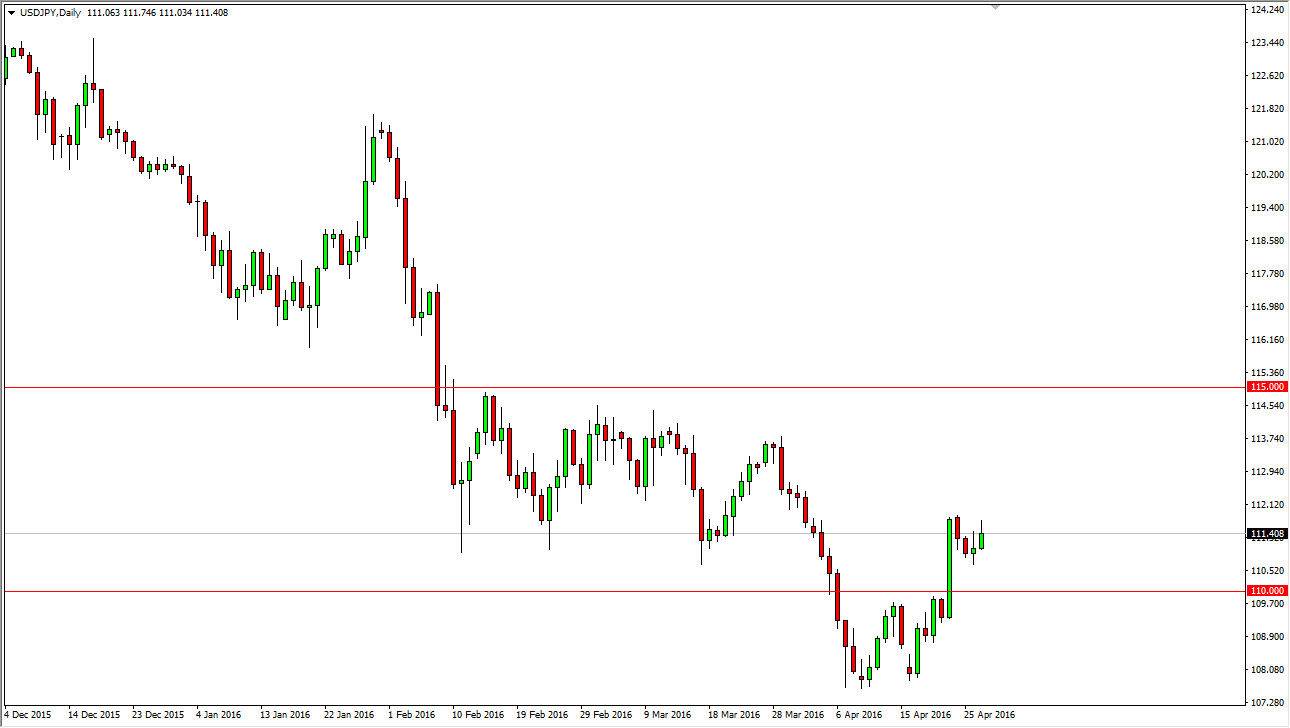

USD/JPY

The USD/JPY pair rose during the course of the session on Wednesday, as we continue to see a little bit of bullish pressure underneath to grind higher. This is a market that had recently consolidated between the 112 level on the bottom, and the 114 level on the top. This is a market that has a lot of noise in that area, so any rally at this point in time should a difficult thing to do, but it does seem as if the buyers are very insistent. The 110 level below is massively supportive, and in my opinion is essentially the “floor” in this market. As long as we can stay above there, I have no interest in selling but I do recognize that this might be a short-term “buy on the dips” type of scenario.

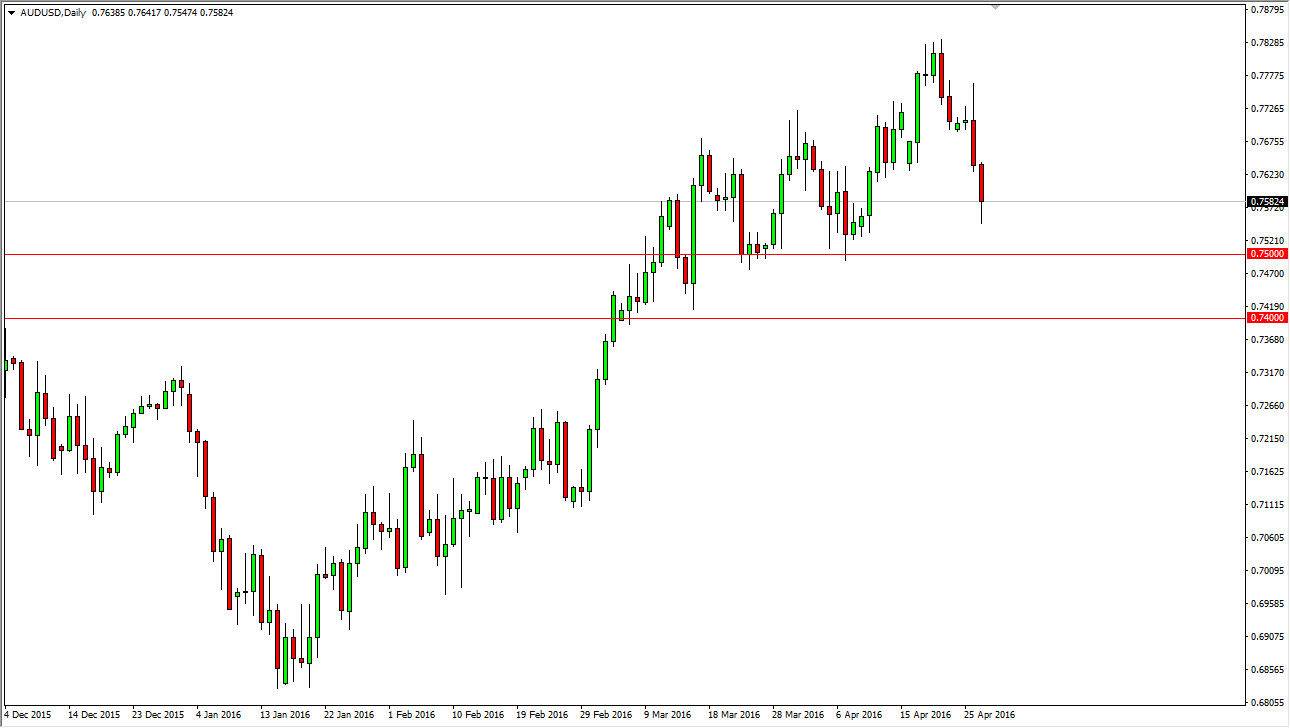

AUD/USD

The Australian dollar fell rather significantly during the day after receiving fairly negative news out of Australia in the form of economic announcements. However, this is a market that has a massive amount of support below at the 0.75 level and extending down to the 0.74 handle. With this being the case, I am simply waiting for some type of supportive candle to start buying. I may trade off of a lower time frames charts, but will continue to consult the daily chart for signs of which way to go. I think it’s not until we break down below the 0.74 level that it’s going to be able to be sold, as this market has seen such a bullish move recently. I would also point out that there is potentially an uptrend line that coincides with the area above the 0.74 handle, so that could tie together quite nicely to start buying. One thing I do know: there is going to be a lot of volatility and we will have to pay attention to gold markets as well, as they could be the main driver to the upside.