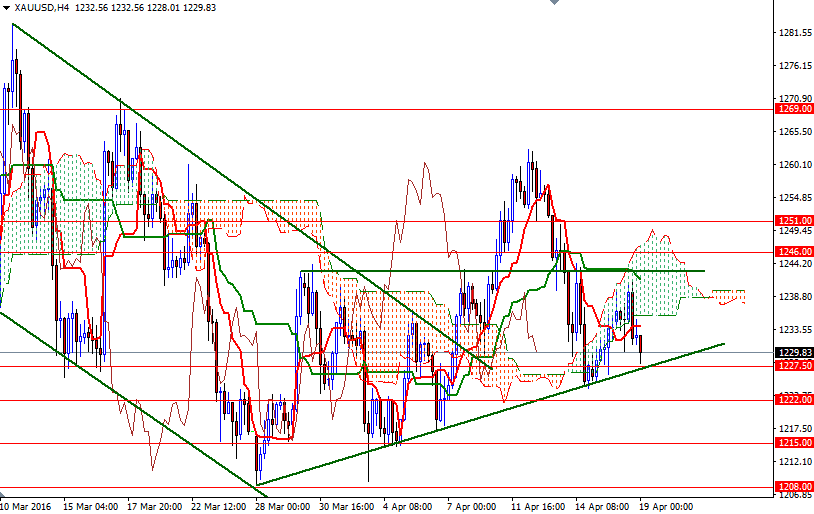

Gold prices ended Monday's session down $2.15 as safe-haven buying subsided after crude oil prices recovered from earlier losses and equities edged higher. The XAU/USD pair traded as high as $1241.59 an ounce but buying dried up and selling pressure increased below the 1243 resistance. As a result, the market reversed and headed back to the short-term bullish trend line which became confluent with the horizontal support at 1227.50.

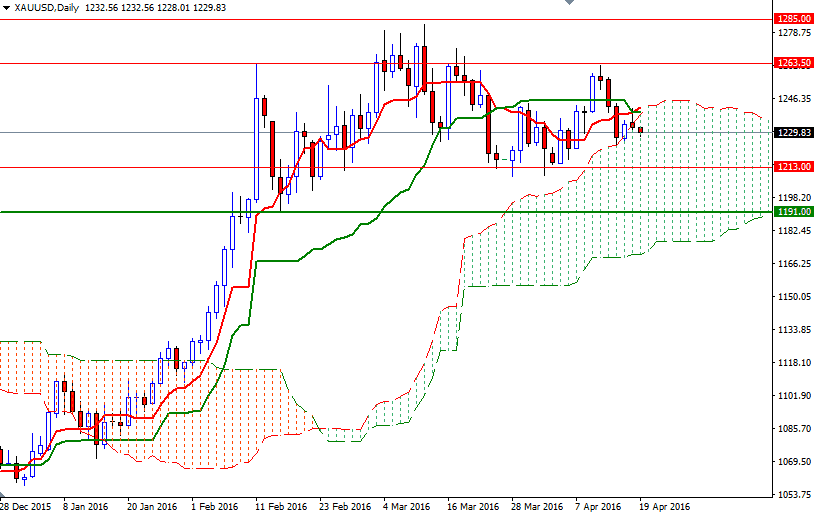

This trend line should be supportive and help produce a nice bounce but how far that will go is debatable as prices are below the Ichimoku clouds on the 4-hour chart - also beware of the bearish Tenkan-sen (nine-period moving average, red line) - Kijun-sen line (twenty six-period moving average, green line) cross on the same chart. To the upside, the initial resistance is located in the 1239-1235.75 area where the bottom of the 4-hourly cloud currently sits. The bulls have to destroy this barrier in order to set sail for the 1243. There is another crucial resistance level not far above at 1246. If the XAU/USD pair climbs and holds above 1246, we could possibly see the bulls make a run for 1251.

However, if prices break down below the 1227.50 level, then it is likely that the market will visit the 1222 level afterwards. A break below 1222 -a move that would cause the Chikou-span (closing price plotted 26 periods behind, brown line) to fall through the 4-hourly cloud- could trigger a drop towards 1215/3. Once below 1213, the market will be aiming for the 1208/5 area.