GBP/USD Signals Update

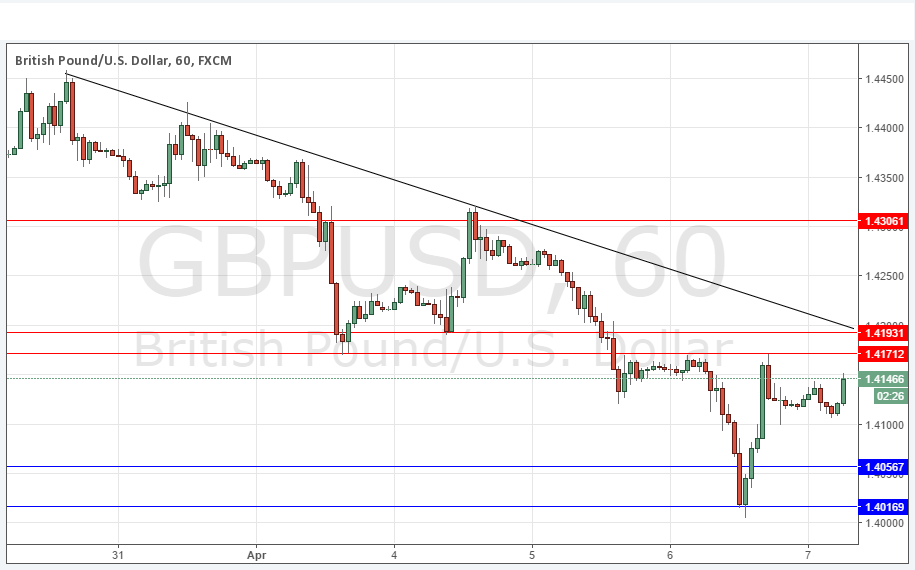

Yesterday’s signals were extremely accurate, almost to the pip, in forecasting both the high and low of the 24 hour period following their release. A long trade off the bullish rejection of 1.4017 may have been taken off the bullish candle there on the H1 chart – the level was marked in the chart, although the number was not given in the text as it seemed too far away. If taken, it would make sense to take at least partial profits already. The bearish rejection of the resistance level at 1.4171 came after London closed and therefore was not tradable.

Today’s GBP/USD Signals

Risk 0.75% per trade.

Trades may only be entered after 5pm London time today.

Long Trade 1

Long entry following a bullish price action reversal on the H1 time frame immediately upon the next touch of 1.4056.

Place the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 25 pips in profit.

Take off 50% of the position as profit when the price reaches 25 pips in profit and leave the remainder of the position to run.

Long Trade 2

Long entry following a bullish price action reversal on the H1 time frame immediately upon the next touch of 1.4017.

Place the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 25 pips in profit.

Take off 50% of the position as profit when the price reaches 25 pips in profit and leave the remainder of the position to run.

Short Trade 1

Short entry following a bearish price action reversal on the H1 time frame immediately upon the next entry into the zone between 1.4171 and 1.4193, especially if the reversal is confluent with the bearish trend line shown in the chart below.

Place the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 25 pips in profit.

Take off 50% of the position as profit when the price reaches 25 pips in profit and leave the remainder of the position to run.

GBP/USD Analysis

Yesterday was fairly wild for this pair, with the price at first plummeting down through the given support at 1.4056 before finally turning around just as quickly when New York opened from the support level marked in the chart at 1.4017. The actual low was just a few pips above the key psychological level of 1.4000. The price came back so strongly that a bullish pin candle was formed on the daily chart, with the price only being held at the resistance level of 1.4171.

Although the action looks bullish, we are now right at both a zone of resistance and a key bearish trend line that is almost confluent with this area, so it will not be surprising if the price turns again and starts to fall after another rejection from this zone.

Regarding the USD, there will be a release of Unemployment Claims data at 1:30pm London time. There is nothing due today concerning the GBP.