EUR/USD

The EUR/USD pair initially tried to rally during the day on Wednesday but turned right back around to form a fairly negative candle. By doing so, it looks as if the market is testing the 1.13 level, and I think that there is support below at the 1.1250 level as well. The European Central Bank of course has an interest rate announcement coming out today, as well as a statement, and that of course will more than likely at a lot of volatility to this market. I’m waiting to see whether or not we can bounce off of the 1.1250 level in order to start buying again, as we have had a significant uptrend recently. If we break down below there, the market will more than likely reach down towards the 1.11 handle.

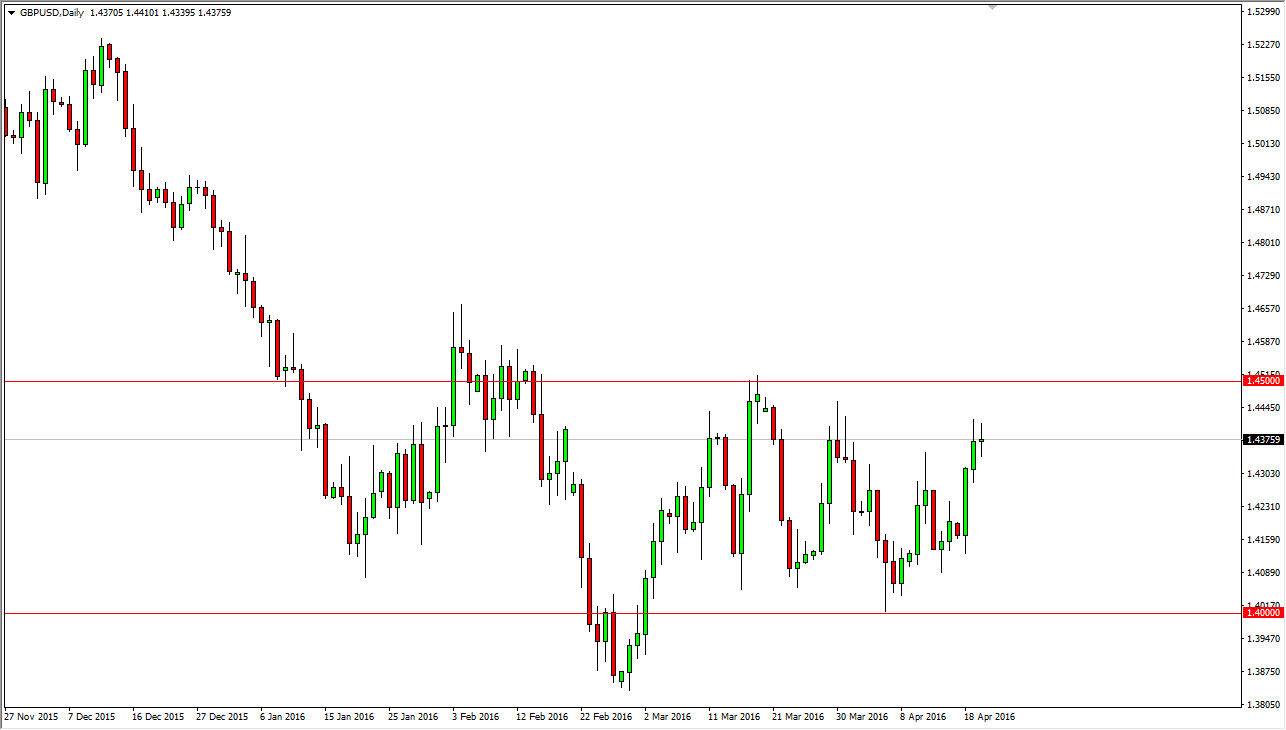

GBP/USD

The GBP/USD pair had a back-and-forth session essentially settling nothing. The neutral candle could suggest that the sellers are sitting just above, and with that it’s likely that this pair will continue to see quite a bit of volatility and more importantly stay within the consolidation area that has been stuck in for some time now. I believe that the 1.45 level above is the ceiling of the market right now, while the 1.40 level below is the floor. I think that we continue to bang around and it is going to be a market that’s very difficult to get excited about for anything more than a back-and-forth type of trading environment.

With this, we are at the top of the range currently, and as a result I think it’s probably easier to imagine this market going lower, and I believe that will continue to be the scenario that we will see for the next several sessions. A break of the lows for the session on Wednesday is probably enough to get me shorting again, but I’m not hanging onto the trade more than a couple of sessions.