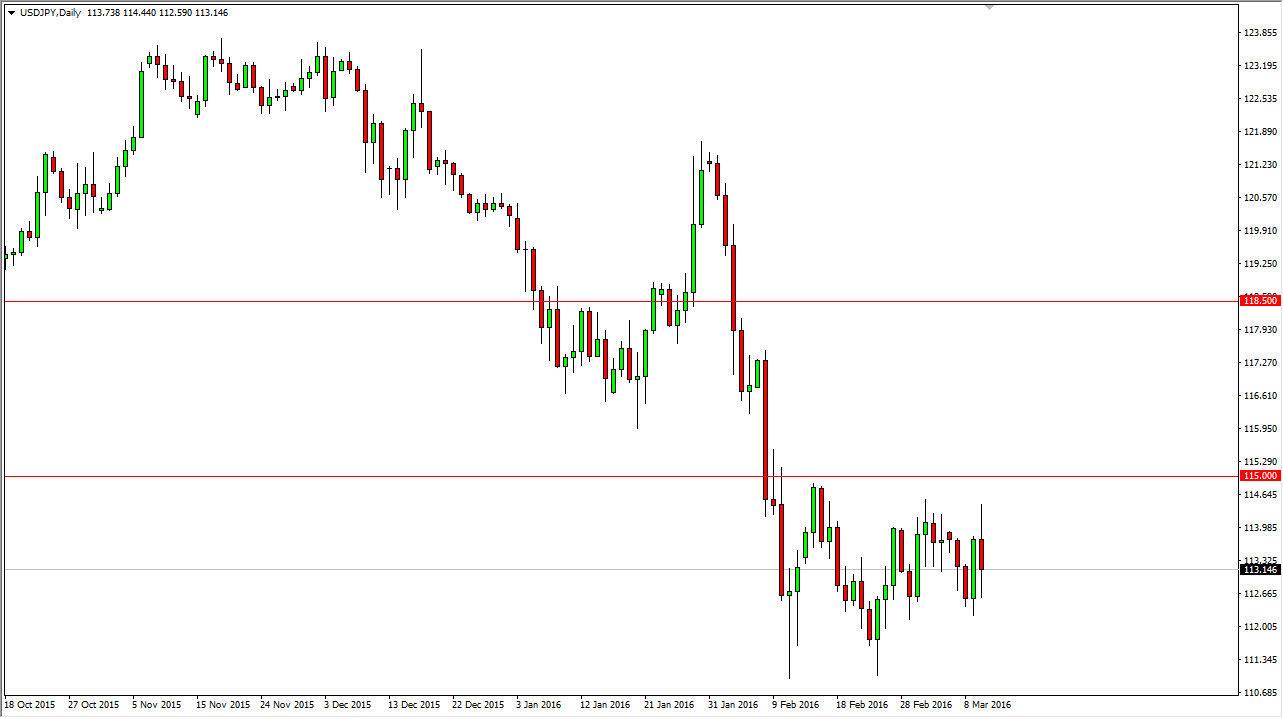

USD/JPY

The USD/JPY pair had a very volatile session during the day on Thursday, as we continue to bounce around in the recent consolidation area. Ultimately, I believe that the 112 level below is support, while the 114.50 level begins a significant amount of resistance all the way to the 115 level. This is a market that is very volatile and at this point in time I would anticipate quite a bit of back and forth type of trading. You have to keep in mind that the market will be very tight as we are trying to figure out what happens next. After all, the pair does tend to follow stock markets in general, as well as risk appetite. Pay attention to how the world indices behave, and that should give you an idea as to which direction we go from here.

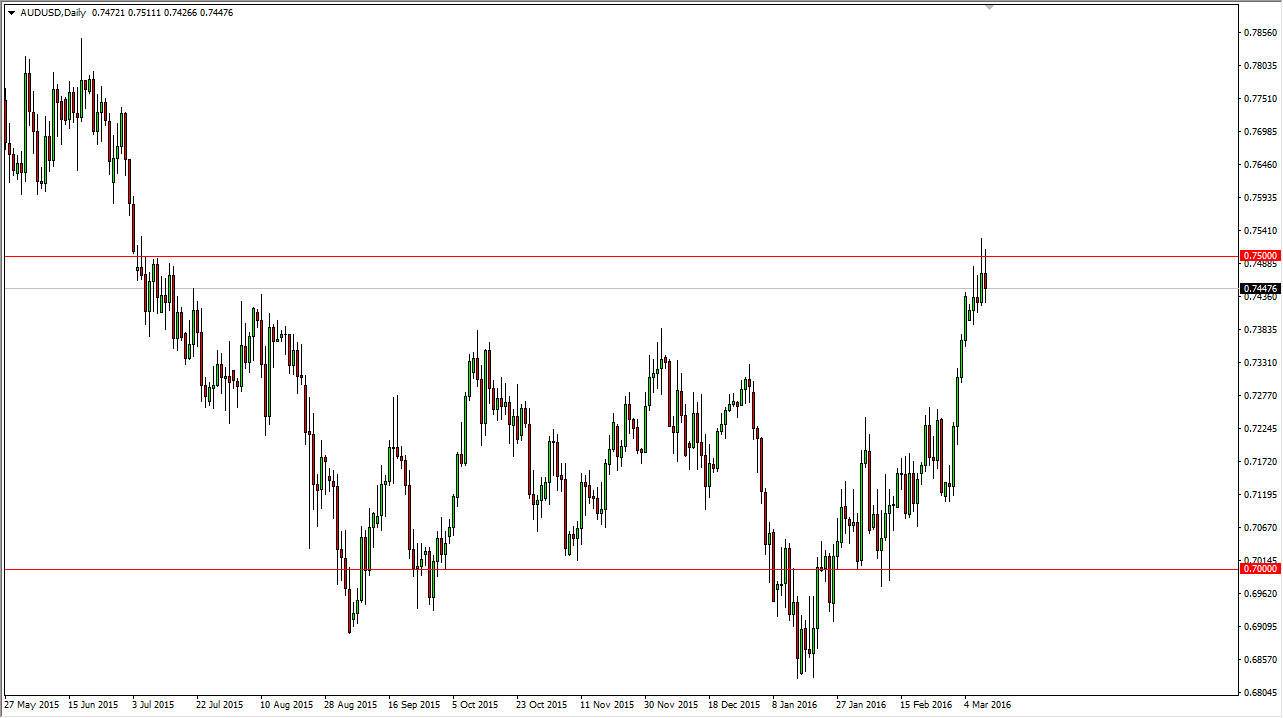

AUD/USD

The AUD/USD pair initially tried to rally on Thursday, but just as we had seen on Wednesday, somewhere above the 0.75 level there is a massive amount of resistance. Sellers come into the marketplace, and with that being the case I would anticipate that the Australian dollar could pull back from here as there is a significant amount of resistance, but you also have to keep in mind that the recent move has been rather drastic. Because of this, it would make perfect sense that we need to pull back and try to build up enough momentum to start buying. I think that if we can pull back from here and reach towards the 0.73 level to form a supportive candle, that might be a nice buying opportunity. Alternately, if we break above the top of the candles from the last couple of sessions, that is also a reason to start buying as we could continue to go much higher. I believe that we do go higher eventually, but we may have a bit of a pullback first.