USD/CAD Signal Update

Yesterday’s signals were not triggered.

Today’s USD/CAD Signals

Risk 0.75% per trade.

Trades must be entered between 8am London time and 5pm New York time today only.

Long Trade 1

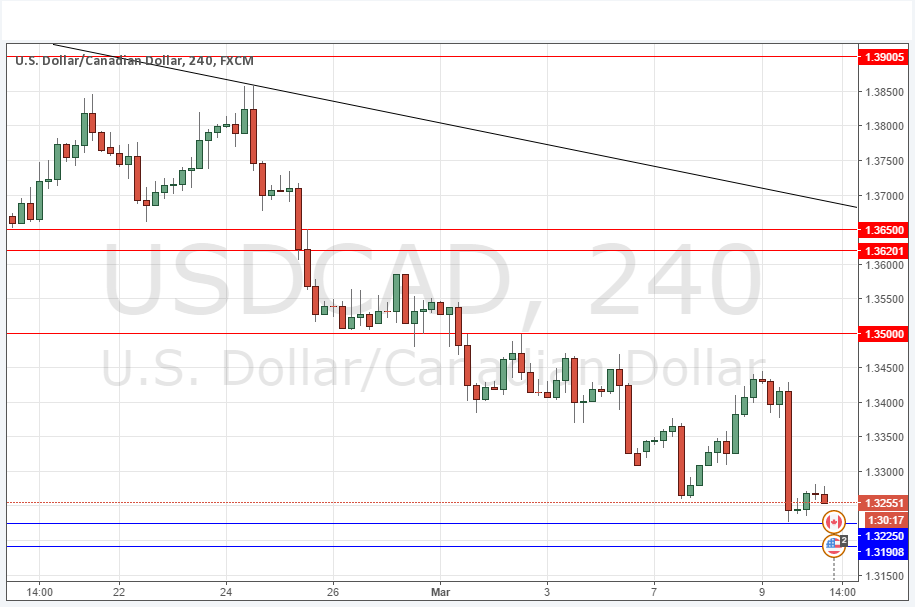

• Long entry after bullish price action on the H1 time frame following the next entry into the zone between 1.3225 and 1.3190.

• Place the stop loss 1 pip below the local swing low.

• Adjust the stop loss to break even once the trade is 20 pips in profit.

• Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

USD/CAD Analysis

Yesterday the Bank of Canada announced that it is maintain the Base Rate at 0.50%. The recovery in the price of Crude Oil continues. These and some other factors have contributed to a positive macro environment for the Canadian dollar, pushing this pair down sharply after the Bank’s release yesterday. The price got to within just a few pips of the anticipated support zone which I saw as beginning at 1.3225 before bouncing back. We are a long way from any key resistant levels, so the most probable set-up that might occur today off a key level would be another drop that this time would reach 1.3225 with another bullish bounce. This could be a good opportunity to go long, but that should be managed very conservatively as it is against a strong long-term bearish trend.

There is nothing due today concerning the CAD. Regarding the USD, there will be a release of Unemployment Claims data at 1:30pm London time.