GBP/USD Signals Update

Yesterday’s signals were not triggered.

Today’s GBP/USD Signals

Risk 0.75% per trade.

Trades must be entered before 5pm London time today only.

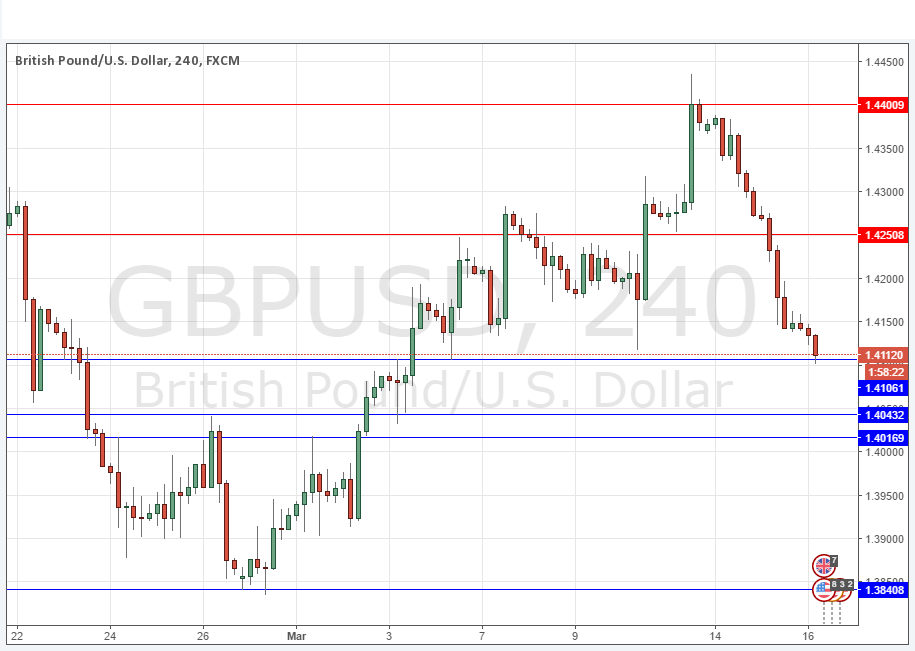

Short Trade 1

* Go short following a bearish price action reversal on the H1 time frame immediately upon the next touch of 1.4250.

* Put the stop loss 1 pip above the local swing high.

* Move the stop loss to break even once the trade is 25 pips in profit.

* Take off 50% of the position as profit when the price reaches 25 pips in profit and leave the remainder of the position to ride.

Long Trade 1

* Go long following a bullish price action reversal on the H1 time frame immediately upon the next entry into the zone between 1.4043 and 1.4017.

* Put the stop loss 1 pip below the local swing low.

* Move the stop loss to break even once the trade is 25 pips in profit.

* Take off 50% of the position as profit when the price reaches 25 pips in profit and leave the remainder of the position to ride.

GBP/USD Analysis

This pair has been falling very strongly since late last Friday, after looking like it was making a serious bullish reversal. It just goes to show you that when a price is in a long-term downwards trend, you should not be too quick to give up on that trend. Even yesterday, ahead of today’s FOMC release, in a period where USD pairs are typically quiet, this pair continued its strong downwards move, breaking down past support at 1.4250. At the time of writing it is sitting on another key support level at 1.4106 but as we are still some time away from the London open, I cannot give this as a good level, it is impossible to tell if it will hold or not.

If the FOMC produces a bullish USD sentiment later, this pair could retest the multi-month lows below quite soon.

Concerning the GBP, there will be releases of Average Earnings Index and Claimant Count Change data at 9:30am London time, followed at 12:30pm by the Annual Budget Release. Regarding the USD, there will be a release of Building Permits and CPI data at 12:30pm, followed later by Crude Oil Inventories at 2:30pm and then the FOMC releases commencing at 6pm.