AUD/USD Signal Update

Yesterday’s signals were not triggered.

Today’s AUD/USD Signals

No specific signals are given today.

AUD/USD Analysis

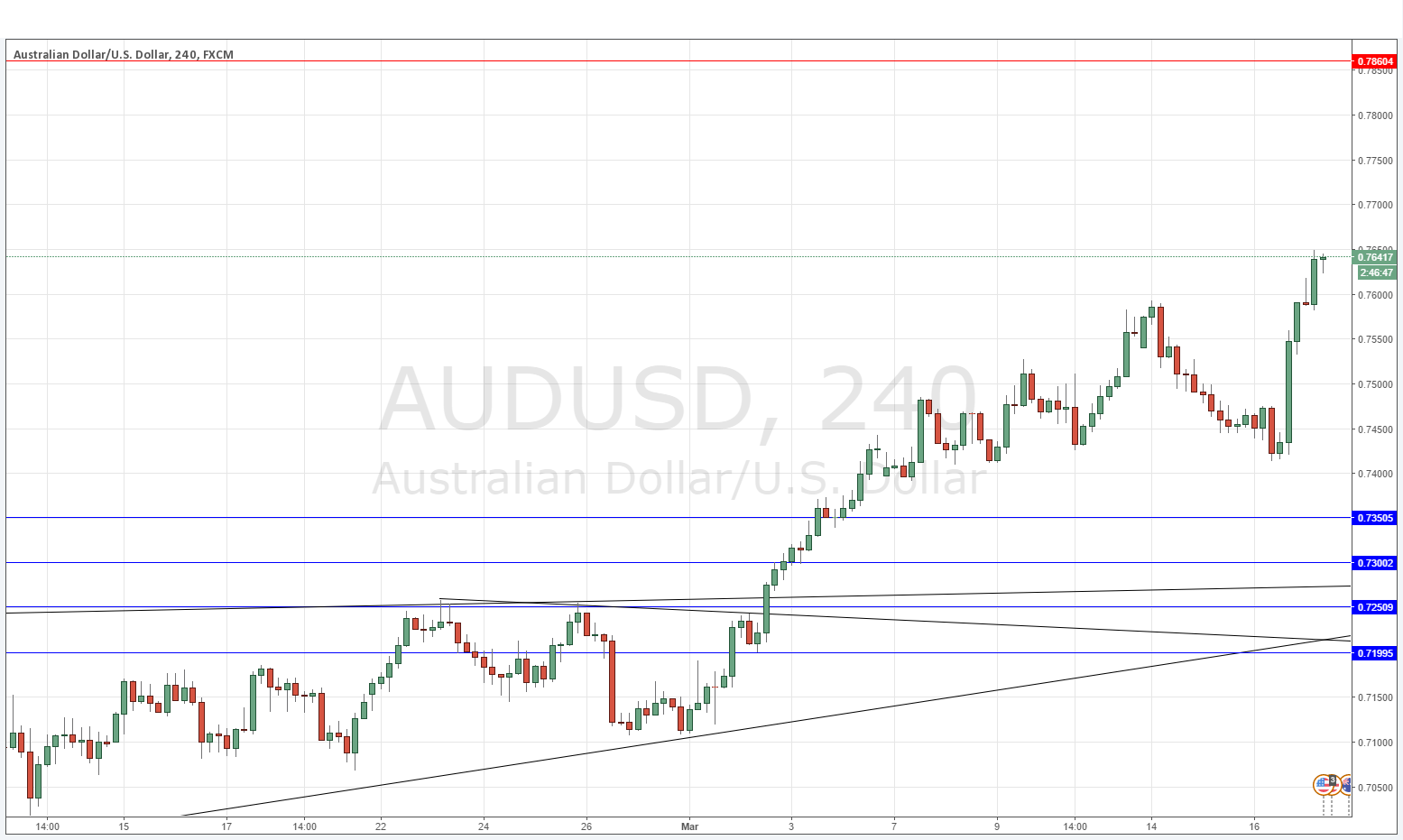

The closest key support and resistance levels are so far away from the current price that there is no point in giving any precise signals today. Key support is at 0.7350 and key resistance is at 0.7860. Generally this pair looks extremely bullish and this was the case even before yesterday’s FOMC release which has triggered a serious weakening of the U.S. Dollar. The Australian Dollar is the strongest of all the other global currencies, so being long of this pair is a good opportunity and very much in line with the fundamental environment as well as the long term trend, not to mention relative yields as the Reserve Bank of Australia pays 2.00% interest while the Federal Reserve still pays less than 0.50%. So just about everything is working in favour of a long position here.

Probably the best strategy today is to look for short-term pullbacks on low time frames and just enter long once the price begins to turn. It seems quite possible that the price is going to go higher still before there is any pullback deep enough to satisfy more prudent strategies of buying after serious pullbacks.

It has to be said that the fundamental factors affecting the Australian Dollar are not completely without flaws and ambiguities. However it looks as if the Reserve Bank of Australia has no intention to weaken its monetary policy in the near future and that should be enough to keep this pair rising for the time being. There is also something of a historical gap up to 0.7860 which could allow for a speedy rise through this area.

There is nothing due today concerning the AUD. Regarding the USD, there will be a release of Unemployment Claims and Philly Fed Manufacturing Index data at 12:30pm London time.