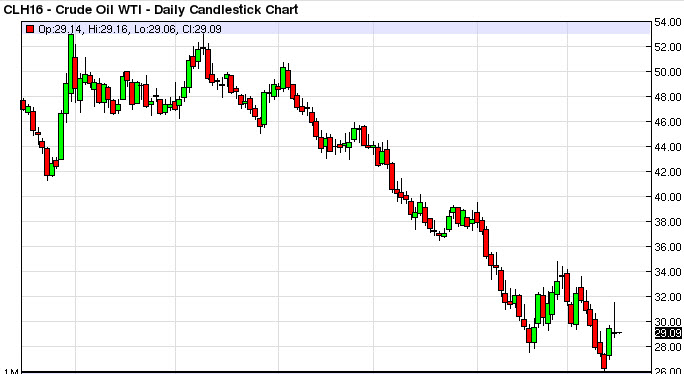

WTI Crude Oil

The WTI Crude Oil market initially rallied during the session on Tuesday, testing the $32 level but turning back around and showing extreme exhaustion. The shooting star that formed just below the $30 level is of course an excellent shorting opportunity, and a break below the bottom of that range has us going down to at least the $28 level, if not the $26 level. At this point in time, I do have a longer-term target of $25 but I think we’re even going to go much lower than that.

I think that rallies will continue to offer shorting opportunities, and with that it’s probably only a matter of time before we get exhaustion every time we try to rally. It’s very unlikely that the markets will be able to hang onto gains for any real length of time as there will be so much jittery noise in the marketplace going forward. On top of that, you have to keep in mind that the demand simply is not there. We are sellers.

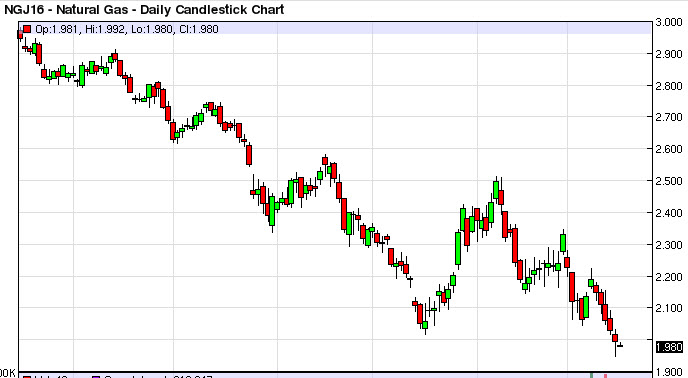

Natural Gas

The natural gas markets fell significantly during the course of the day but got a little bit of a reprieve late in the session. Ultimately, we ended up forming something akin to a hammer but at this point in time I feel that any time we rally natural gas you have to be thinking of shorting the market. I think that the market will continue to go much lower, and at this point in time I believe that we are probably heading towards the $1.75 level if not even lower than that.

The higher this market goes; the more interested I am in shorting as I think the markets will continue to punish natural gas as the supply is simply far too strong for the demand to take care of it. With that being said, it is likely that the markets will be volatile, but most decidedly a one-way trade over the longer term.