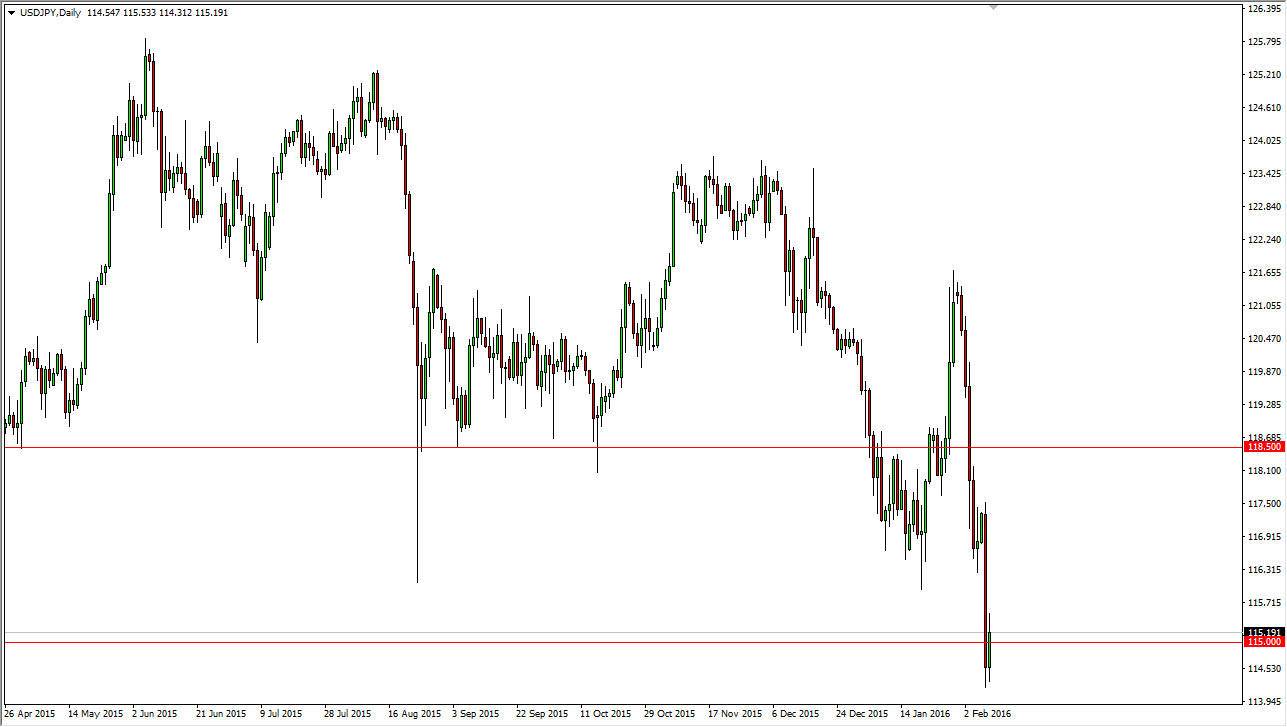

USD/JPY

The USD/JPY pair initially trying to break down a bit during the course of the day on Tuesday but we did get a little bit of a bounce. The 115 level looks to be like a bit of a magnet at this point, and I do think that even though we bounced a bit, it looks very halfhearted indeed. If we can break down below the recent low over the last couple of days, I feel that the market will then really start to accelerate to the downside. In fact, I think the 114 level is the trapdoor that sends this market looking for 110 given enough time. I have no interest in buying this market, at least not until we get above the 170 level, which doesn’t look very likely at this point in time.

NZD/USD

The NZD/USD pair rose during the day on Tuesday, as we continue to bounce around current areas. I believe that there is a significant amount of support at the 0.65 level, but also that there is a significant amount of resistance somewhere near the 0.6750 level as well. So having said that, I feel that this market will more than likely continue to go back and forth and that it’s only a matter of time before the market turns around every time it makes a move.

However, I am watching to see if we get a more stringent move, and an impulsive candle would be reason enough for us to start trading again. In the meantime, I just do not see the likelihood of that happening, so I’m sitting on the sidelines. Short-term traders may be willing to go back and forth, but I find it very difficult and most certainly very dangerous to be involved in this market. One thing you have to keep in mind is that the New Zealand dollar is highly influenced by commodities.