USD/JPY

The USD/JPY pair went back and forth during the course the day on Friday as it typically will do after a Non Farm Payroll announcement. That being said, it looks like we are trying to find a bit of support down at the 116 level, so we could be working on a bit of a bounce here. If we get that, I feel that this market will probably try to get to the $118.50 level, or perhaps even higher than that. On the other hand, if we break down and make a fresh new low, I don’t see any reason why this market will reach towards the 115 handle after that. Ultimately, this market does tend to be very in tune with the risk appetite around the world, so if stock markets start falling apart, this market will fall and of course vice versa.

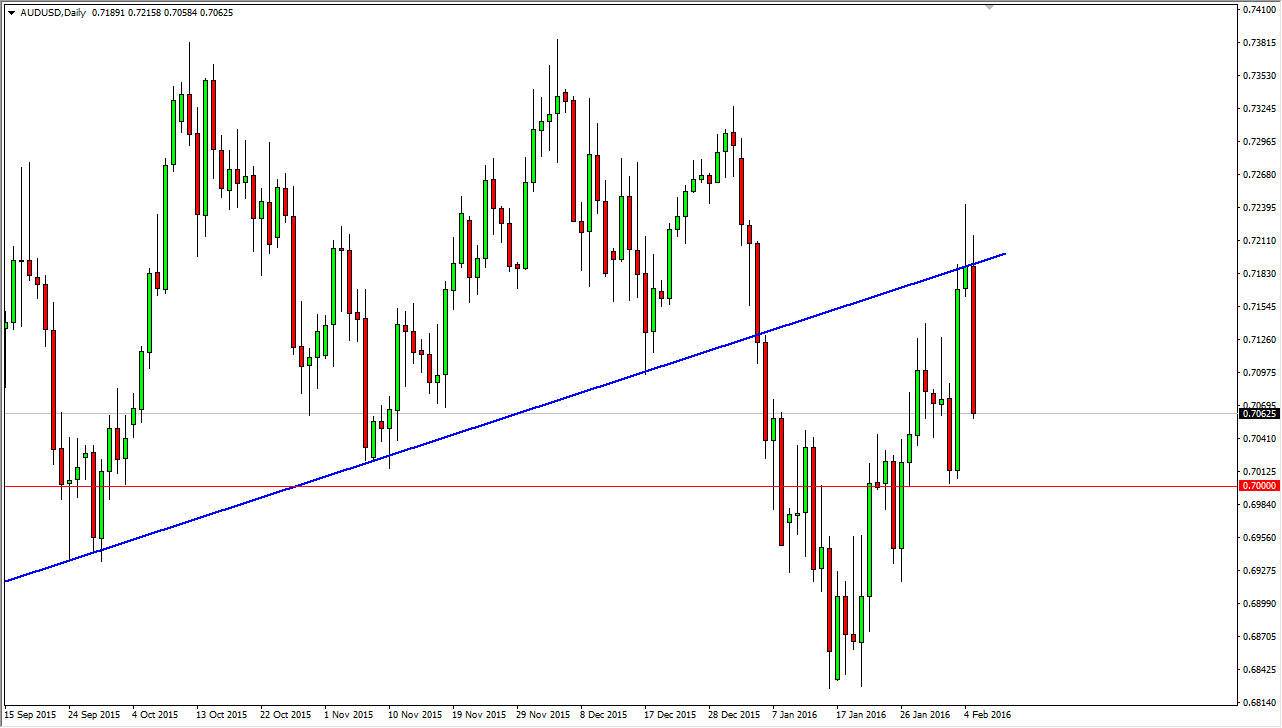

AUD/USD

The AUD/USD pair had a very negative day during the session on Friday, as the markets found the previous uptrend line to be far too resistive to continue going higher. With that being the case, it looks like we are bound to test the 0.70 level for support, and then possibly break down below there. With that being the case, I feel that short-term rallies will continue to be selling opportunities as well, and therefore this market should continue to find sellers again and again. I have no interest in buying the Australian dollar as there are far too many negatives pieces to the puzzle out there, with the Asian economies showing significant signs of weakness.

It is not until we break above the top of the shooting star from the Thursday session that I would consider buying this pair, and at this point in time that does not look very likely. I believe that the Australian dollar continues to suffer as Asia simply offers no real hope of demand increasing.