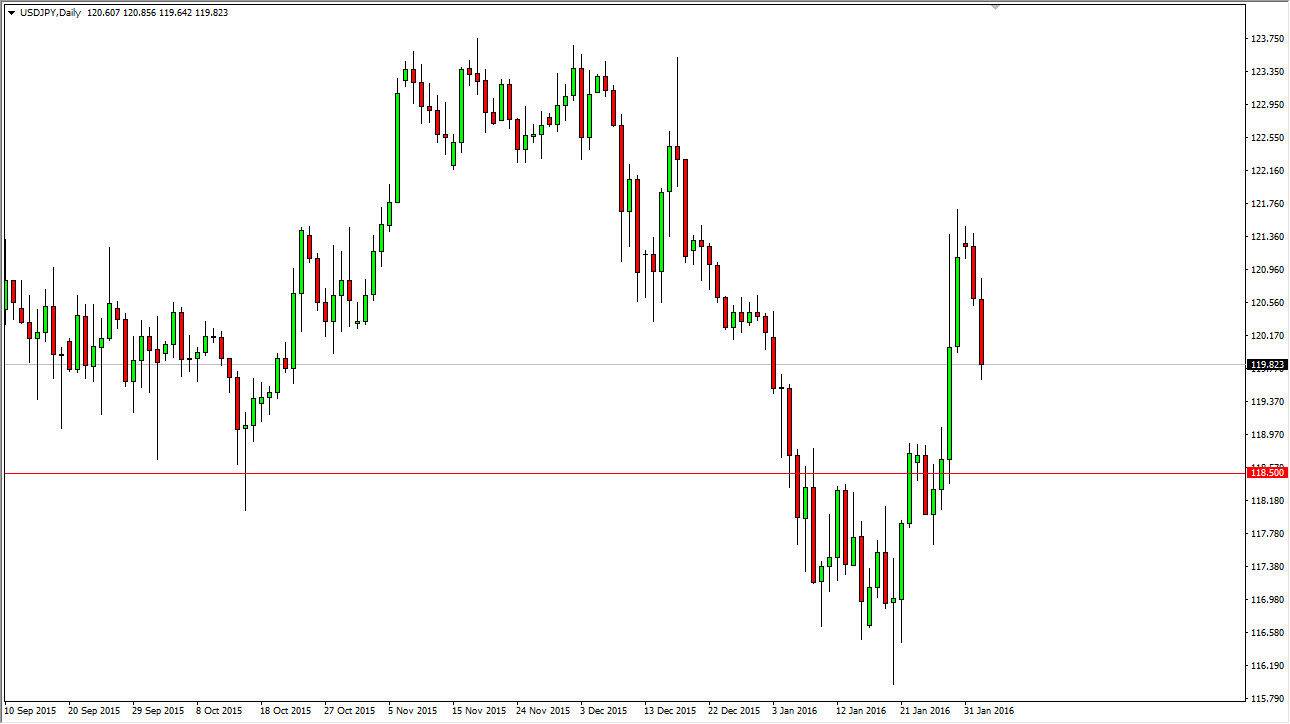

USD/JPY

The USD/JPY pair initially tried to rally during the day on Tuesday but turned back around to form a fairly negative candle as we sold off significantly. Because of this, I believe that the market will more than likely continue to go a little bit lower but I think that there is more than enough support below so having said that looks as if sooner or later we will get a supportive candle so that we can start buying again. Remember, the Bank of Japan is threatening negative interest-rates, so the Japanese yen will more than likely continue to soften. I believe that the market will try to reach the 123.50 level, as it is the next major resistance barrier. I have no interest in selling this market at this moment in time.

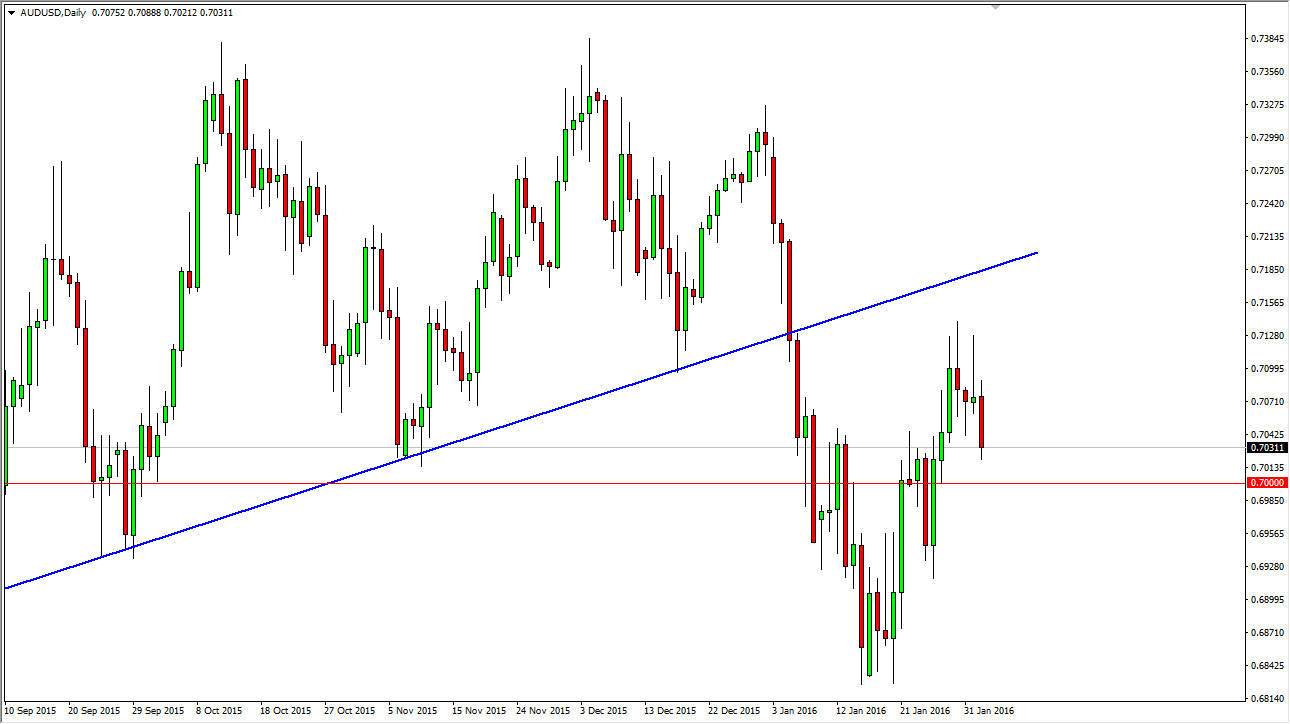

AUD/USD

The AUD/USD pair fell significantly during the course of the day on Tuesday, but I believe that the 0.70 level below will more than likely be supportive. Ultimately, I think that we will break down below there, but it could be a little bit difficult to go lower. However, after a bit of volatility I think we will extend all the way down to the 0.68 handle.

The uptrend line that is marked on the chart should continue to offer resistance, so it is probably only a matter of time before rallies would sell off anyway. Because of this, I believe that this market continues to drop from here and then reach down again and again. I do not anticipate that this market will be able to break out, but I do recognize that a move above the uptrend line would be very bullish. At that point in time, I would think that the uptrend could start with some earnestness, and at that point in time I would have to reevaluate my bearishness on the Aussie.