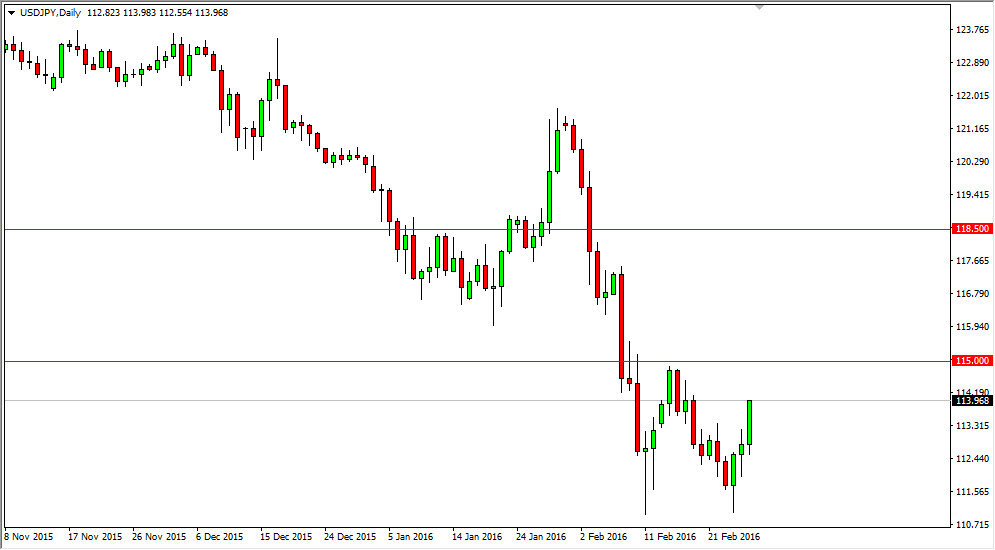

USD/JPY

The USD/JPY pair rose during the course of the day on Friday, as the market reached towards the 114 level. Ultimately, I think that there is quite a bit of resistance all the way to the 115 level, so it’s unlikely that it’s going to be easy to go much higher. Although, one thing that I do notice is that the close of the day was at the very top of the range, which is very bullish. So I do think that there’s going to be follow-through but it’s going to be difficult to go much higher than the aforementioned 115 level.

It is not until we break above the 115.50 level that I feel comfortable enough to start buying this market. At this point in time, keep in mind that the pair does tend to be very sensitive to the risk appetitive traders around the world, so pay attention to the stock markets as well.

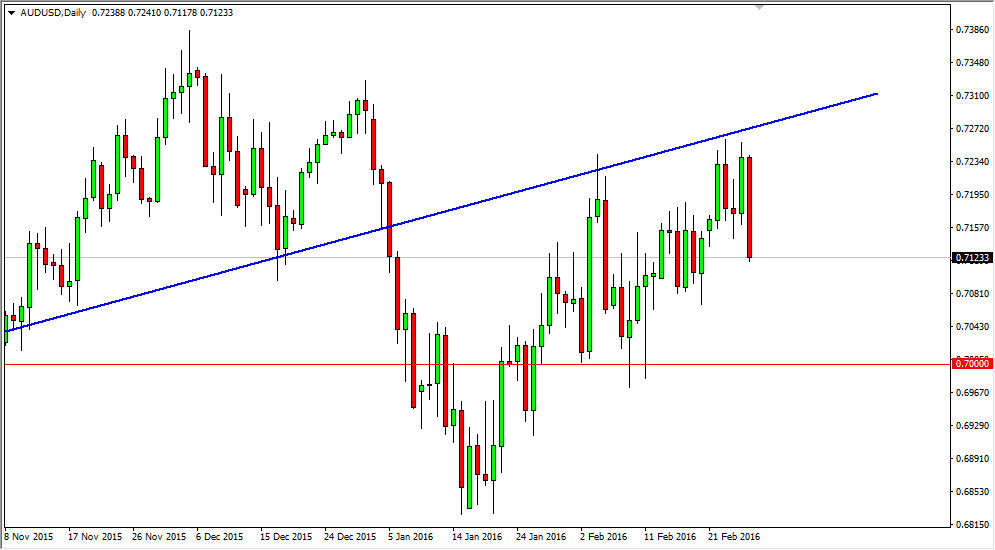

AUD/USD

The AUD/USD pair fell rather significantly on Friday, completely wiping out the gains from the previous week. With that being the case, every time this market rallies and shows signs of exhaustion on a short-term chart, I am willing to start selling again. With that being the case, looks as if short-term charts might be the best way to go on this market, but I can also imagine selling on a break down below the bottom of the range for the day.

The market should reach down to the 0.70 level given enough time, and as a result that is my target as is the recent support that has been found there suggests. With this, I remain a seller and I have no interest in buying this market until we break above the previous uptrend line, which of course has offered quite a bit of resistance of until this point in time.