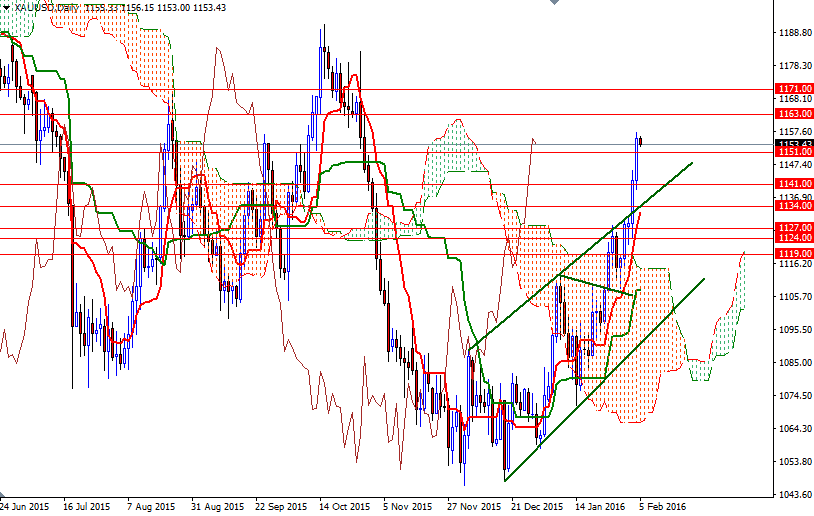

Gold prices ended Thursday's session up nearly 1.2%, marking the fifth consecutive rise, as equity markets turned lower to surrender earlier gains and the dollar extended losses versus a basket of currencies. The greenback remained under pressure after the Labor Department said the number of people filing new claims for unemployment benefits climbed by 8K to 285K and the Commerce Department reported factory orders fell 2.9%. The XAU/USD pair is trading at $1153.43, slightly lower than the opening price of $1155.33. The January U.S. employment report due later today may determine whether the dollar sell-off will continue.

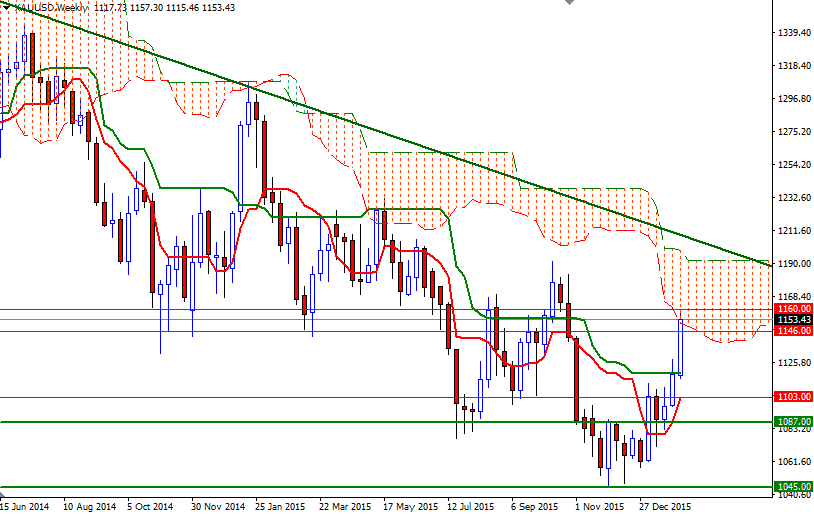

The Ichimoku cloud on the weekly time frame is right on top of us and it occupies the area roughly between the 1200 and 1150 levels. Keep in mind that the Ichimoku clouds define an area of support or resistance depending on their location and in our case the weekly cloud represents resistance. The thickness of the cloud is relevant as well, as it is more difficult for prices to break through a thick cloud than a thin cloud.

With that in mind, I think the bulls will have to push the market beyond the 1163/0 area if they intend to approach the top of the weekly cloud. On its way up, there will be tough barriers such as 1171 and 1179/6. However, a failure to hold the market above 1151 could lead to some profit taking and pull us back to the 1145 level. Breaking below 1141 would set the XAU/USD pair up for a test of the support in the 1136/4 zone.