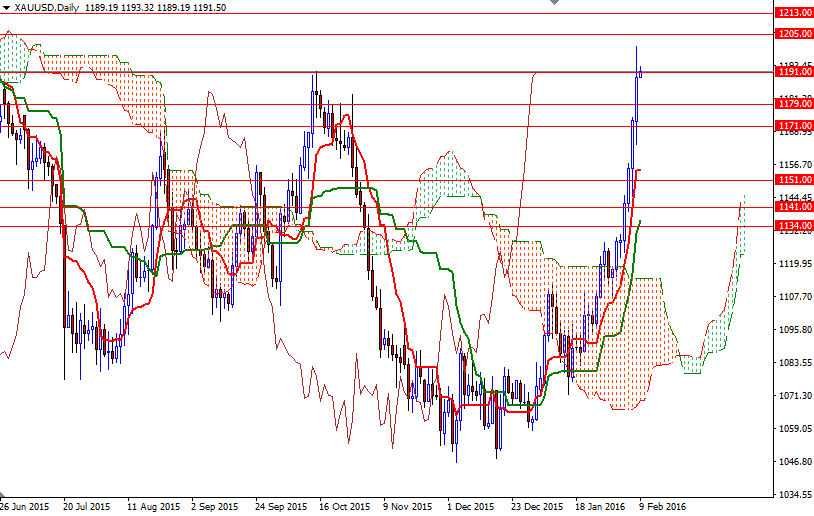

Gold prices ended Monday's session up $16.31, extending gains from last week, as pressure on global stock markets spurred demand for the precious metal. The XAU/USD pair traded as high as $1200.80 an ounce after breaching a key resistance at $1179 provided extra momentum as expected. The market is moving in a tight range in Asian trade as investors took a cautious stance ahead of Federal Reserve Chair Janet Yellen's congressional testimony. Yellen is scheduled to appear before the House Financial Services Committee today.

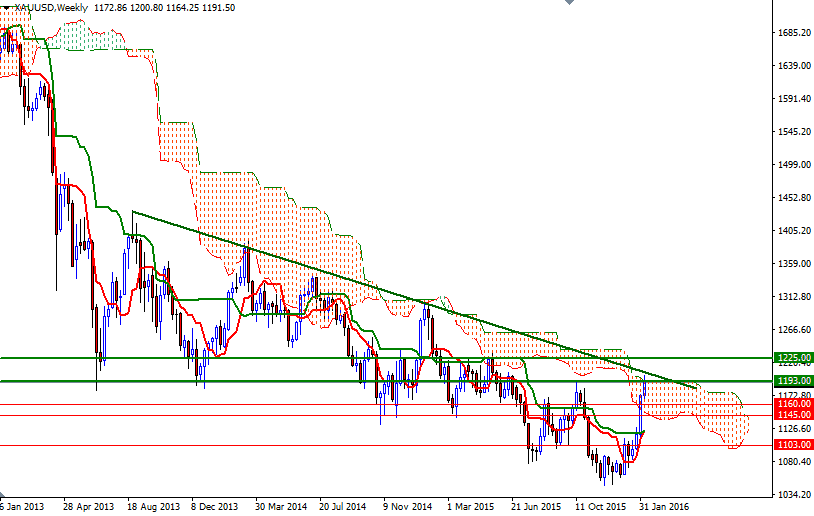

Gold has gained more than 12% so far this year on weaker U.S. dollar and concerns over increased volatility in other assets. The bulls have been dominant since the market climbed above the 4-hourly Ichimoku cloud and ultimately we reached a significant resistance zone that stretches from 1205 to 1225. The bulls will have to push prices above 1205 to test the long-term bearish trend line which is confluent with a horizontal resistance at 1213. But before that they will need to anchor above the 1193/1 area. A daily close 1213 could open a path to 1225.

However, as long as the resistance at 1205 is not surpassed, the risk of a pull back remains high. If the bears take over and prices fall through 1079, then it is likely that XAU/USD will test 1072.65/1, where the bottom of the Ichimoku cloud on the 4-hour time frame sits. Breaking below 1071 would make me think that the market will be aiming for 1064/0 afterwards.