The EUR/USD pair had a very volatile month of February, and now that we are starting the month of March, I think that we will start to see selling pressure in the beginning of the month, followed by a bit of a bounce. With that being the case, think March is going to be very volatile as there are quite a few concerns out of both central banks. The Federal Reserve now seems as if it cannot raise interest rates anytime soon, and the European Central Bank has suggested recently that it was willing to expand its monetary policy. In other words, I think this is going to be one of the most volatile pairs out there, and as a result you are going to have to stick to short-term charts at best.

Various Levels

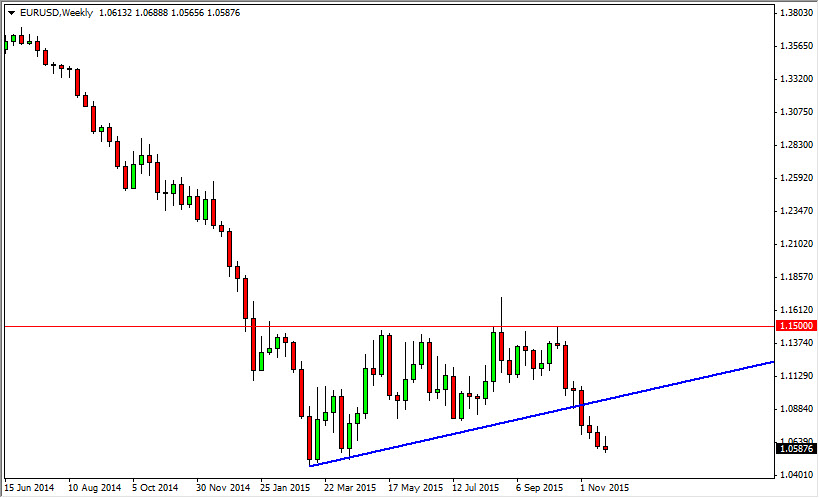

I’m looking at the market as one that has various levels that we are paying attention to. The 1.1050 level is important, but even more important is the 1.08 level. If we can break down below there, then we could go down to the bottom of the recent consolidation and perhaps try to reach towards the 1.05 level. I highly doubt that we are going to break out to the upside during the month of March, which would involve a move above the 1.15 level.

I suggest a perhaps most of the month we will bounce back and forth between the 1.1050 level on the top, and the 1.08 level on the bottom. I do recognize at this point though, there seems to be more of a downside risk than upside risk. With that being the case, I do prefer shorting on short-term charts, and will probably do so time and time again but at this point in time I believe that we’re talking trades that will be no longer than a session or 2.