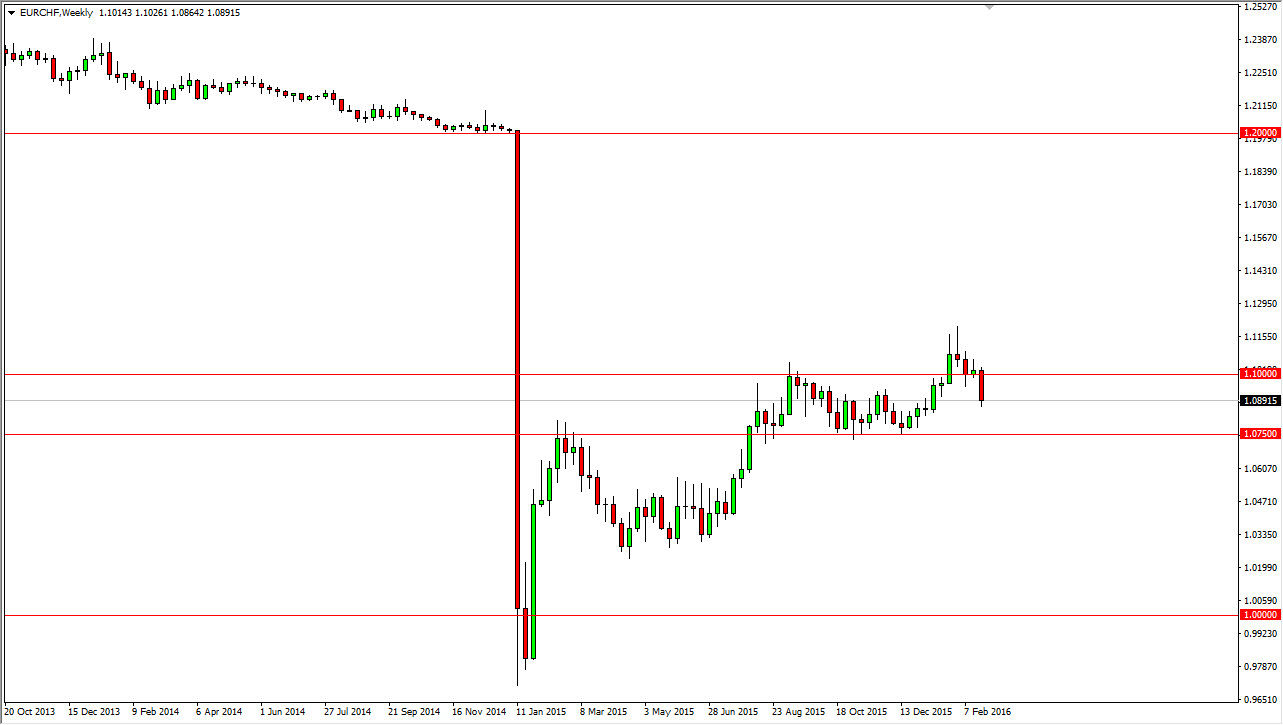

The EUR/CHF pair fell significantly during the course of the month, and I have to admit that I was a bit surprised. However, there are a lot of different ways you can look at this chart. The fact that the market fell below the 1.10 level, suggests that perhaps there was a little bit of a capitulation when it comes down to support. Ultimately, the 1.0750 level below should be massively supportive.

With that being the case, I am simply waiting to see whether or not we are going to bounce from that area, and a supportive candle of course would be a reason to start buying again. A break above the 1.10 level is also reason enough, and most certainly a break of the most recent high would be as well. I have no interest in selling this market until we break down below the 1.0750 level with significant.

Swiss National Bank

The Swiss National Bank has been supportive of this pair for some time, and as a result it looks as if the buyers will get involved sooner or later, knowing that they have been slightly supportive themselves. Having said that, we will have to pay attention to whenever we get some type of support, and when we do it’s very likely that the buyers will pile in. I still believe that you can buy and hold this pair, but you going to have to be leery of massive leverage.

The 61.8% Fibonacci retracement level was hit by the shooting star from a couple of weeks ago, and that of course is a very bearish sign, but ultimately I think if we break above the top of that shooting star, we should then go all the way to the 1.20 level as quite often the 61.8% getting broken above means that we’re making a complete round-trip. Ultimately, I do think that happens but we probably have to deal with quite a bit of volatility.