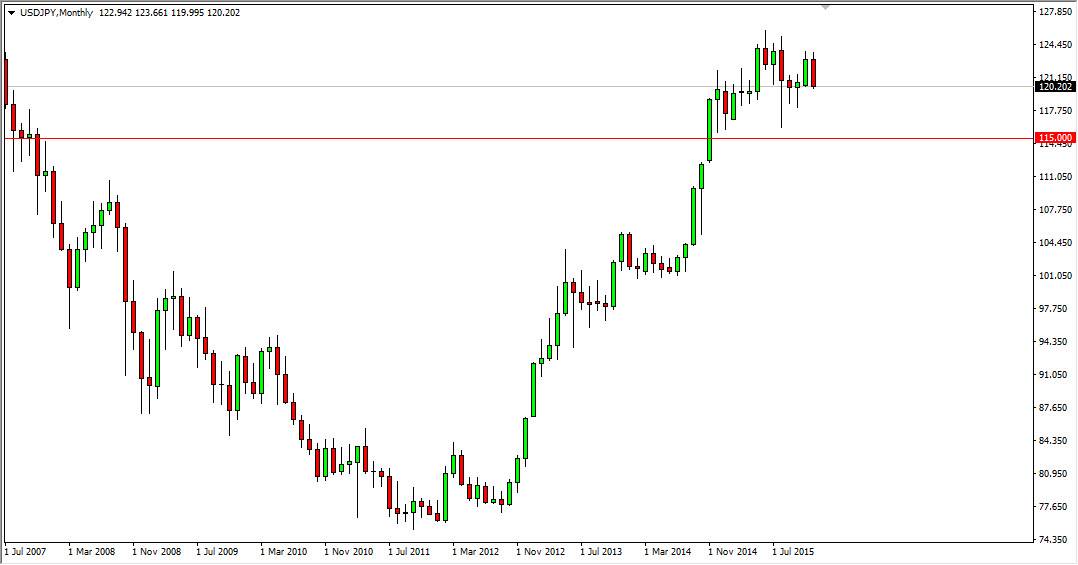

The USD/JPY pair spent most of the year going sideways between 115 and 125. Previously to that, the market had risen quite significantly, and with that I still believe that this pair is essentially in an uptrend. However, we have to get above the 125 level for the market to feel comfortable enough to continue to push even higher. I think the 125 level is going to be key for the longer-term perspective of this pair, but getting above there is going to be difficult.

The 115 level below will continue to be the “floor” in this market, and as a result I do not think that this pair will get below there for any real length of time during the year. I believe that essentially will continue to be massively supportive, and unless there is some explicit move by the Federal Reserve to turn back around and start offering quantitative easing again, I feel this support is fairly secure.

Buying Dips

I am continuing to buy dips in this market, as the uptrend is so ensconced. I think that given enough time we will break above the 125 level, so we will enter a “buy-and-hold” situation at that point. I don’t think it’s going to be easy, and it may take a little while to get above that level, but once we do it should be a nice move to the 128 level, and then eventually the 130 handle.

The interest-rate differential will continue to favor the US dollar overall, and having said that I don’t see any reason why this pair will fall for any real length of time unless of course there is some type of financial crisis, which let’s be honest: seems to happen every few months. However, there’s nothing on the horizon that makes me think this is going to happen, so I like the idea of going long again and again until we finally get the breakout.