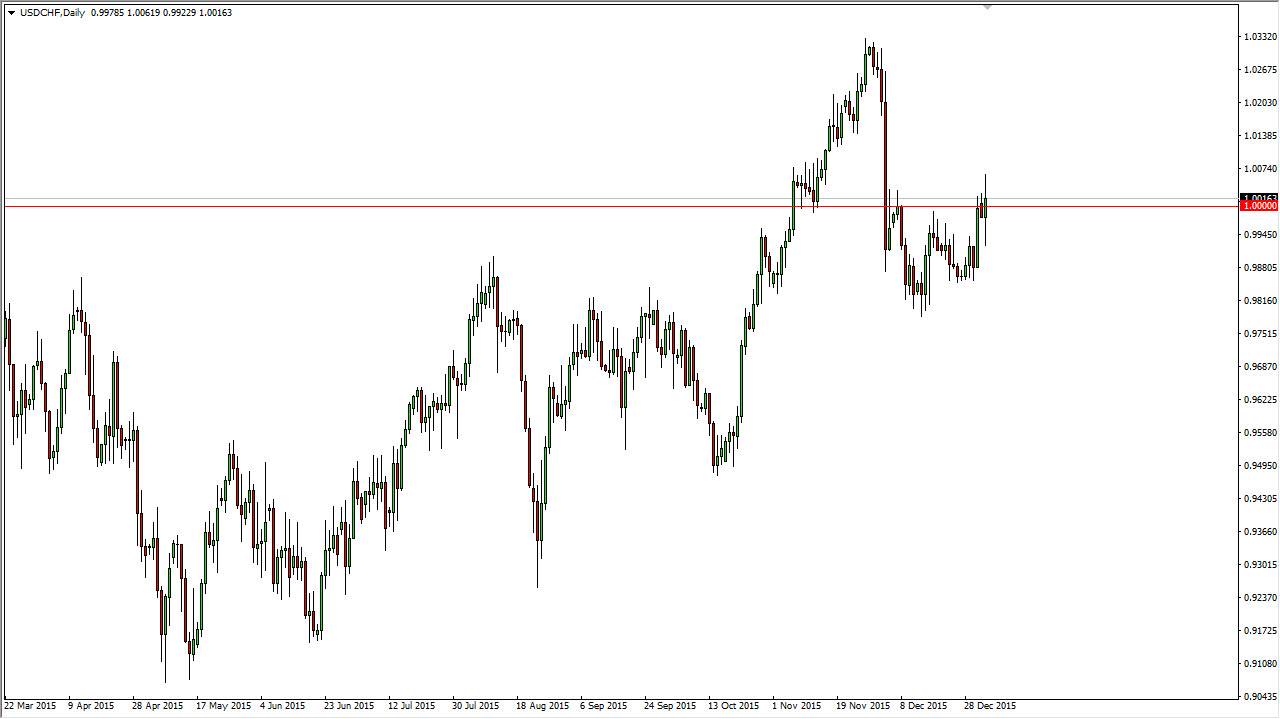

During the day on Monday, the USD/CHF pair went back and forth in a rather volatile session. This was true with most Forex related pairs involving the US dollar and anything European, and as a result I believe that it’s only a matter of time before you get a significant move in one direction or the other. In this particular pair, I believe that we are going to go higher. In fact, I believe that the move higher during the day on Monday was essentially the “first shot across the bow” of the Swiss franc.

The Swiss National Bank has been working against the value of the Swiss franc for some time, and as a result I believe that it makes sense that sooner or later this pair does go higher. After all, the US dollar is one of the favored currencies in the world right now, as traders are concerned about economic conditions worldwide. Further adding to concerned during the day on Monday would have been the 7% drop in the Chinese stock markets, which while isn’t directly attached to this particular pair, the reality is that it gets people buying the US dollars for safety.

Break Out to the Upside

I believe that if we can break out above the top of the range during the day on Monday, this pair will continue to go much higher, probably reaching towards the 1.0350 level again. I believe that we will also see buyers on every dip along the way, because quite frankly the Swiss have made it known that they are willing to work against the value of their own currency going forward, and at the same time we have the Federal Reserve which while not necessarily hawkish, is the most hawkish central bank of the G 10 at the moment.

Ultimately, I do believe that we not only reach the 1.0350 level, but we continue to go much higher than that. The real question remains as to whether or not the Swiss will help push it that way, or it will be a simple grind higher. Right now, I am not necessarily looking for the Swiss to intervene, but I do think that they are trying to put a bit of a “floor” in the EUR/CHF pair, and that has a knock on effect in this market.