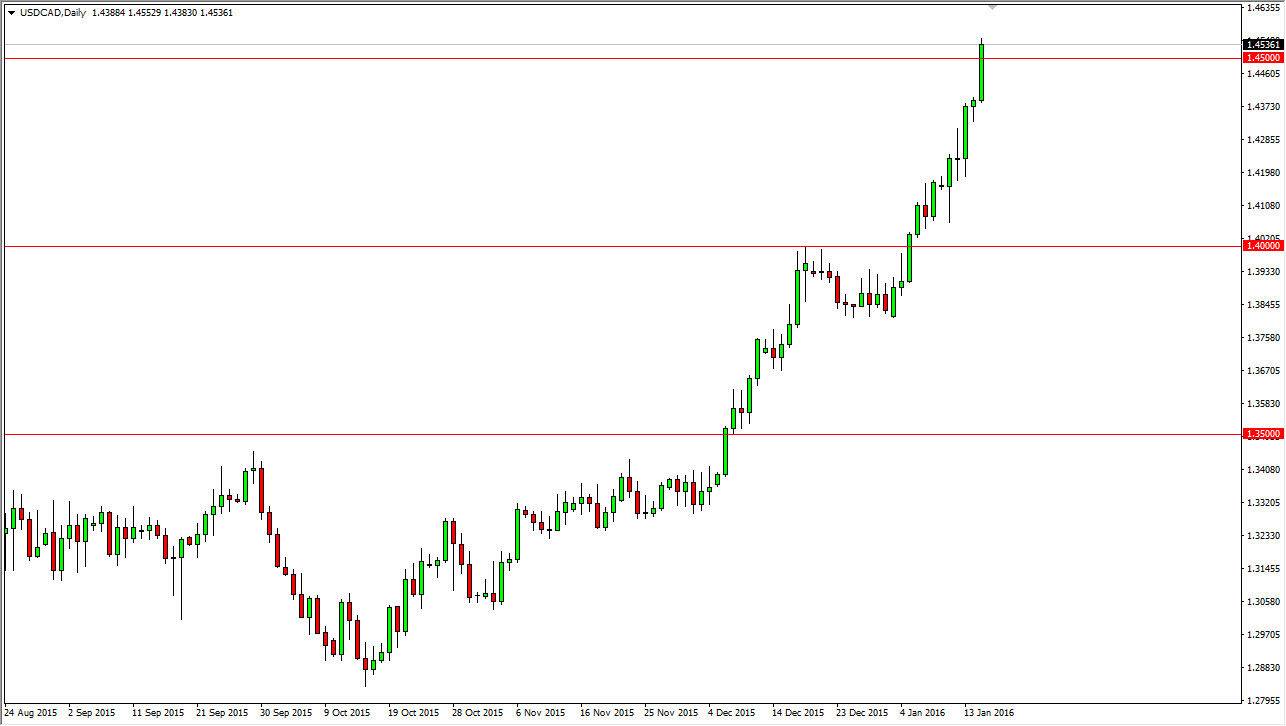

The USD/CAD pair broke higher during the course of the day on Friday, finally cracking above the 1.45 handle. That’s a very bullish sign obviously, as it is a large, round, psychologically significant number, and we have seen the oil markets fall. After all, as long as the oil markets fall, I feel that the Canadian dollar will continue to come apart.

Currency traders typically use the Canadian dollar as a proxy for crude oil, and as a result this market tends to be the exact inverse of what’s going on in the WTI Crude Oil market. We did manage to break below the $30 handle during the course of the day, and that of course is very bearish and it coincides nicely with a break above the 1.45 handle. At this point in time, I believe that this pair is going to continue to go much higher, and that the buyers are going to become aggressive every time we pullback.

Buying the Dips

I think at this point in time you have to be a buyer of dips as we go forward considering that the trend is so strong. It wasn’t that long ago that I was wondering whether or not we can break above the 1.30 level, and we haven’t looked back since. Because of this, I feel that this is a long-term trend that should continue to go higher, especially considering that the US dollar is considered to be a “safety currency” as well, and of course you have seen all of the stock markets around the world take a real beating.

It is not until oil markets can find some stability that this pair will fall significantly, and as a result I feel that every time this market pulls back people will look at it as value in the US dollar and start buying. Currently, I feel that the 1.40 level is essentially the “floor” in this market.