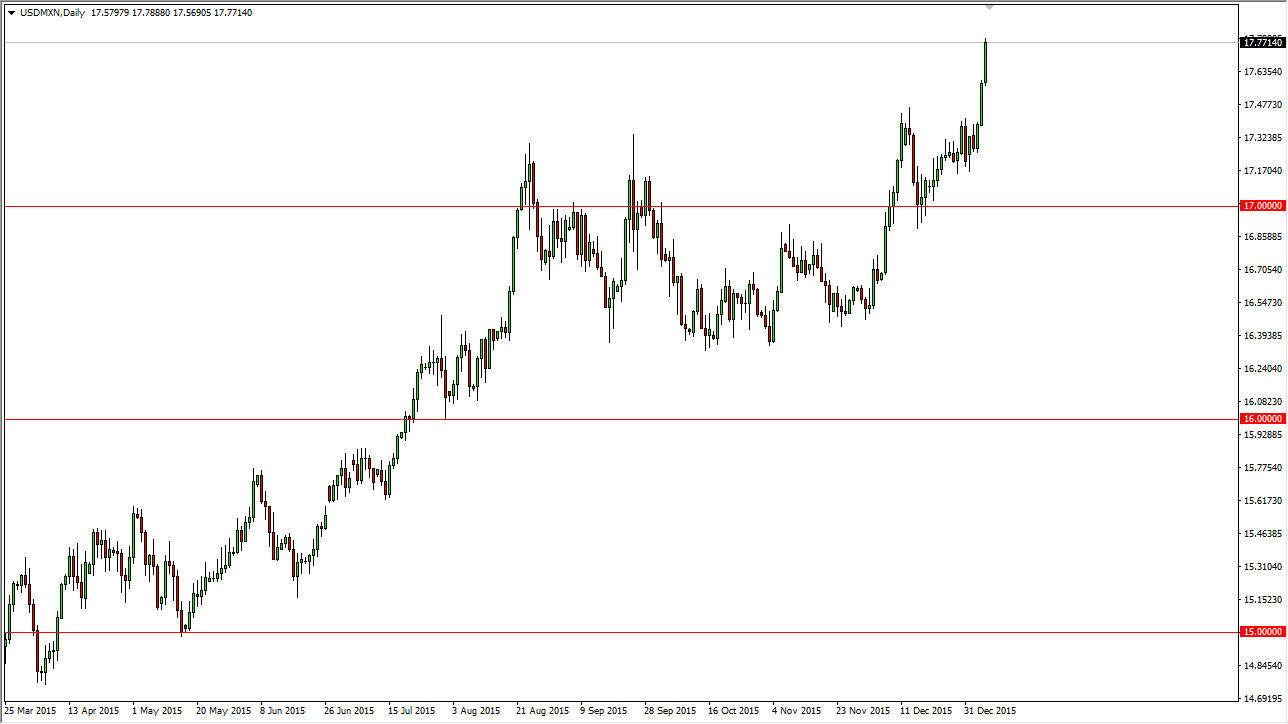

The USD/MXN pair had a very strong session again on Thursday, following an extraordinarily strong session on Wednesday. Because of this, I believe that the uptrend should continue, and it’s only a matter of time before we break out even higher. I think that pullbacks at this point in time offer nice buying opportunities for traders, as we should see more than enough support below. Keep in mind that the Mexican peso of course is considered to be a “risky currency”, and as a result as long as there is concern about global growth and economic foundations around the world, the Mexican peso will always play second fiddle to the US dollar. Ultimately, it is also a proxy for Latin America, and when times are a bit tough, people were not looking to invest in that part of the world.

Don’t Forget the Oil Markets

Oil markets look absolutely horrible right now, and of course Mexico is an exporter of crude oil. People use the Peso as a proxy for the oil markets as well, as the Mexicans control quite a bit of the drilling platforms in the Gulf of Mexico. With that being the case, I don’t really see a scenario where this market should turn back around and fall for any real length of time. Because of this, I think that longer-term traders are simply holding onto this position and possibly even aiming for the 18 level right now.

I think that there is a bit of a floor in the form of the 17 handle, but quite frankly I would be surprised if we went back that far. Ultimately, I do have a longer-term target of 20, but it’s going to take a while to get there. Pay attention to the oil markets, as long as they are soft, this pair will be very strong. Buying dips on daily charts will probably be the best way to play this particular market.