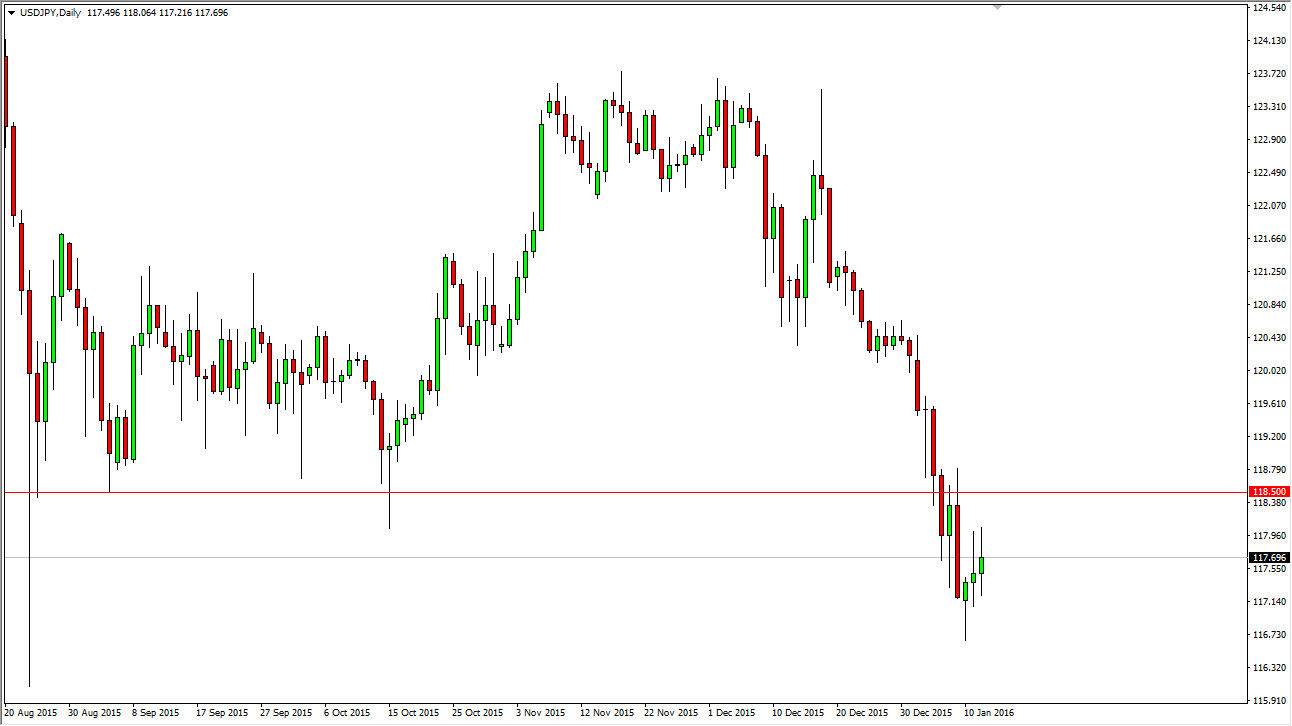

USD/JPY

The USD/JPY pair had a very volatile session on Tuesday, as the indecision continues around the world. That being the case, the market looks as if the 118.50 level continues to be the ceiling of this market. Every time we rally, we turned back around and form a resistive candle. After all, the Monday and the Tuesday sessions both formed something along the lines of a shooting star, and with that it shows that the sellers still run this market, and as a result it’s very likely that we should reach down towards the 116 level.

It’s not until we break cleanly above the 118.50 level that I am willing to start buying at this point in time, especially if it’s above the 190 level as I feel that will show the resistance finally getting smashed through. With that, it’s very likely that short-term rallies will continue to offer selling opportunities going forward.

AUD/USD

The AUD/USD pair went back and forth during the course of the session on Tuesday, showing quite a bit of volatility near the 0.70 handle. With this, the market looks as if every time it rallies, it will be an opportunity to start selling. If that’s the case, I continue to short the Aussie dollar as not only is the US dollar the strongest currency out there, but we also have the gold markets falling rather significantly. We recently had broken down below an uptrend line, which of course is a very negative sign. That shows that we should continue to show negativity in this market, so I really don’t have any scenario in which a willing to buy at this point in time.

We have almost formed a fresh new low, and that of course would be extraordinarily bearish. I have no interest in buying this pair at the moment, and believe that the sellers will reenter this market again and again every time we form a short-term rally.