Gold settled down $3.22 at $1097.70 on Friday as a recovery in risk appetite dented interest in the metal as an alternative asset. Stock markets around the world posted their first weekly gains in a month and crude oil prices rallied above $30 a barrel. A retreat in the euro from earlier highs after hints of more monetary stimulus from the European Central Bank added to pressure on gold. ECB President Mario Draghi said "We have the power, the willingness and the determination to act. There are no limits to how far we are willing to deploy our instruments within our mandate to achieve our objective of a rate of inflation which is below but close to 2%" at a press conference after the bank left interest rates unchanged at its policy meeting

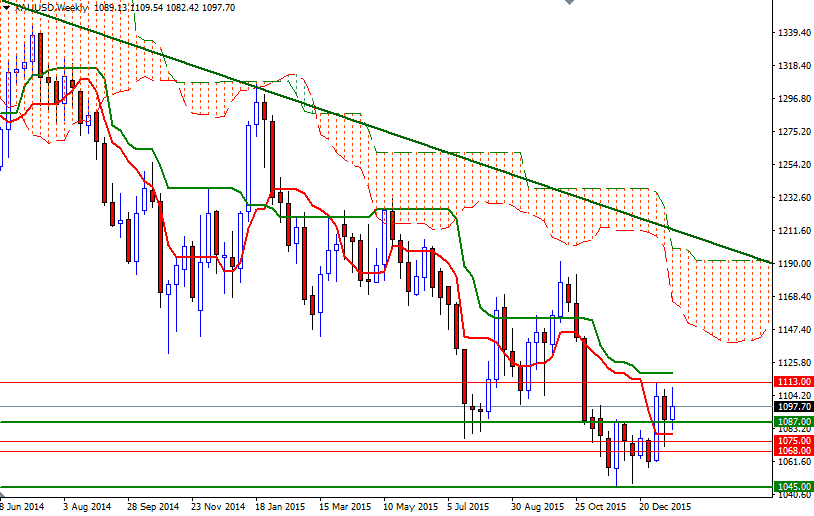

Steep slides in equity markets, uncertainty in China and fresh lows in oil prices helped gold gain nearly 3.3% since the start of the year. However, gold's upswing so far is modest in comparison with the sharp slump in other markets. I think this shows the difficulty gold has in rallying when the long-term fundamental reasons to hold gold are getting smaller. The long-term technical outlook also suggest that the bulls will have trouble gaining significant momentum while prices are moving below weekly Ichimoku cloud that defines the major resistance area.

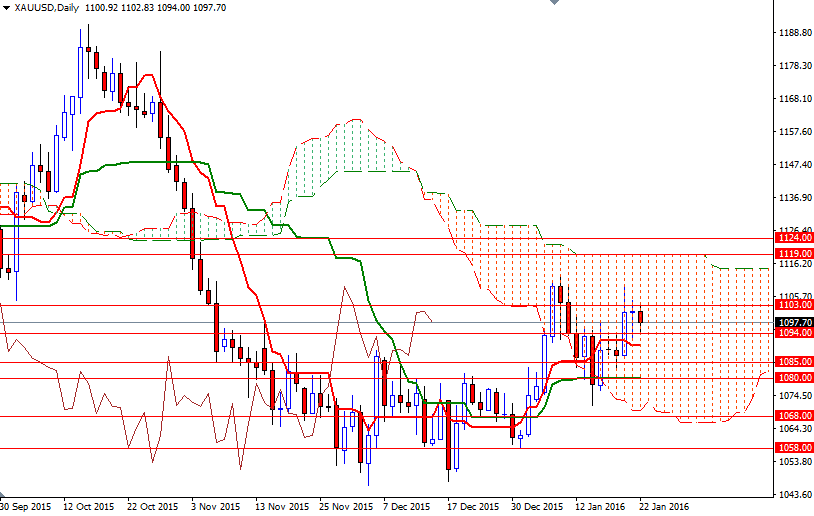

On the other hand, the XAU/USD pair has been slightly bullish since the market left a two-month long consolidation period roughly between 1085 and 1045. The market is moving above the 4-hourly Ichimoku cloud and the Tenkan-Sen (nine-period moving average, red line) and the Kijun-Sen (twenty six-period moving average, green line) lines are positively aligned on the daily and 4-hourly charts. The first hurdle gold needs to jump is located in the 1105.50 - 1103 region. The market will need to pass through this region in order to test the next resistance levels at 1113 and 1119. If the bears take the reins and drag prices below 1094, I would expect prices to revisit the 1091.88-1090.47 support. Breaking below that would suggest that the market is getting ready to challenge 1086.41-1085, and possibly 1080.