The difference between success and failure in Forex trading is very likely to depend upon which currency pairs you choose to trade each week, and not on the exact trading methods you might use to determine trade entries and exits. Each week I am going to analyze fundamentals, sentiment and technical positions in order to determine which currency pairs are most likely to produce the easiest and most profitable trading opportunities over the next week. In some cases it will be trading the trend. In other cases it will be trading support and resistance levels during more ranging markets.

Big Picture 31st January 2016

Last week I highlighted short AUD/USD and GBP/USD as the probable best trades of the week. This did not work out well as the AUD/USD pair actually rose by 1.21% although the GBP/USD pair did fall by 0.14%.

For this coming week, in spite of the fact that there are counter-trend moves happening, I have to remain with the long-term trends where the candlestick action of recent days does not look as if it has a very strong continuation due for the counter-trend movement. Therefore I would still look to be short GBP/USD and EUR/USD as well as long USD/CHF. Basically, the European currencies are all looking weak right now.

Fundamental Analysis & Market Sentiment

The strongest currency is the USD now that the Bank of Japan has cut its interest rate. Regarding the USD, the fundamental data could be stronger, however there have been no bad surprises. The problem is that the Federal Reserve has just signaled that the course of rate hikes is quite likely to happen more slowly than was previously expected. Federal Reserve of gradual rate rises. The position technically for the USD also looks quite strong. The currency is now trading higher than it was 6 months ago against every major global currency except the JPY.

Weaker currencies are very clear: all the European currencies.

Eurozone fundamental data has been showing the beginning of a recovery, but the talk by the ECB of further QE is likely to act as a weakening factor upon the Euro.

British fundamentals are also looking dubious and the Bank of England is seen as unlikely to raise rates any time soon.

Swiss economic fundamentals are not great and with the maintenance of negative real interest rates for large depositors, the SNB seems happy to sit back and watch the CHF weaken so exports can become more competitive, which has been a big problem for Switzerland.

Technical Analysis

GBP/USD

The price has generally been in a clear, long-term downwards trend, making new 5 year lows and breaking through support. However last week the price did not make a new low. The end of the week saw a sell-off that pushed the price down and printed a bearish semi-doji as a weekly candle following the rejection of resistance at around 1.4400. The candlestick action is indicative of a further fall.

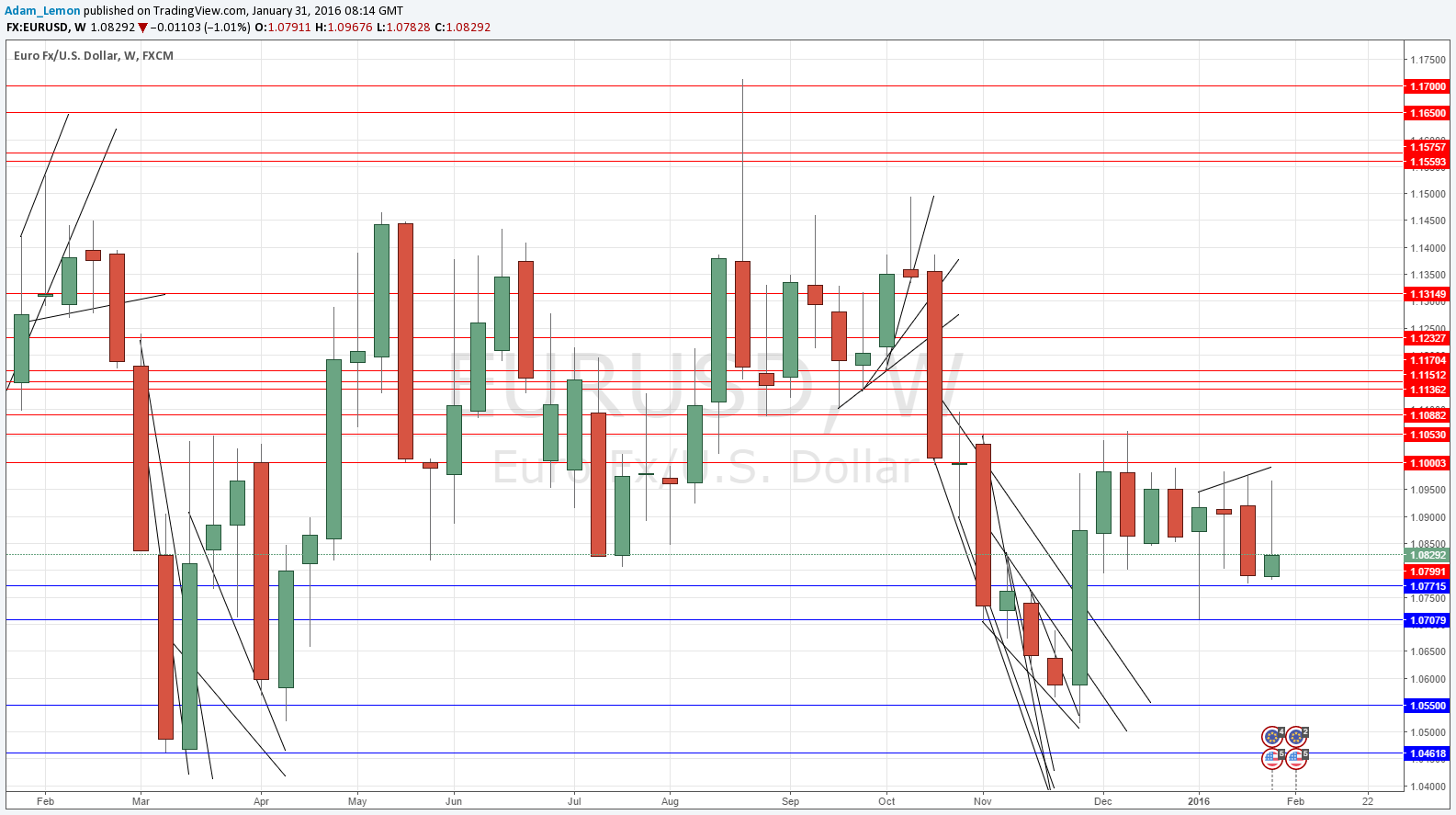

EUR/USD

The weekly chart below shows how for several weeks now, the price has been trying to rise above the area that begins at around 1.0960 and is essentially focused on the key psychological number at 1.1000 although this zone really stretches up to about 1.1050. This pair again tried to get up there before falling sharply. It may now be poised to finally break down past the key lows just below 1.0800 and again at around 1.0700. It is not really that we have so much momentum here, it is a more a case of the resistance just seeming too well-defended to break and the price has to go somewhere, so it should go down.

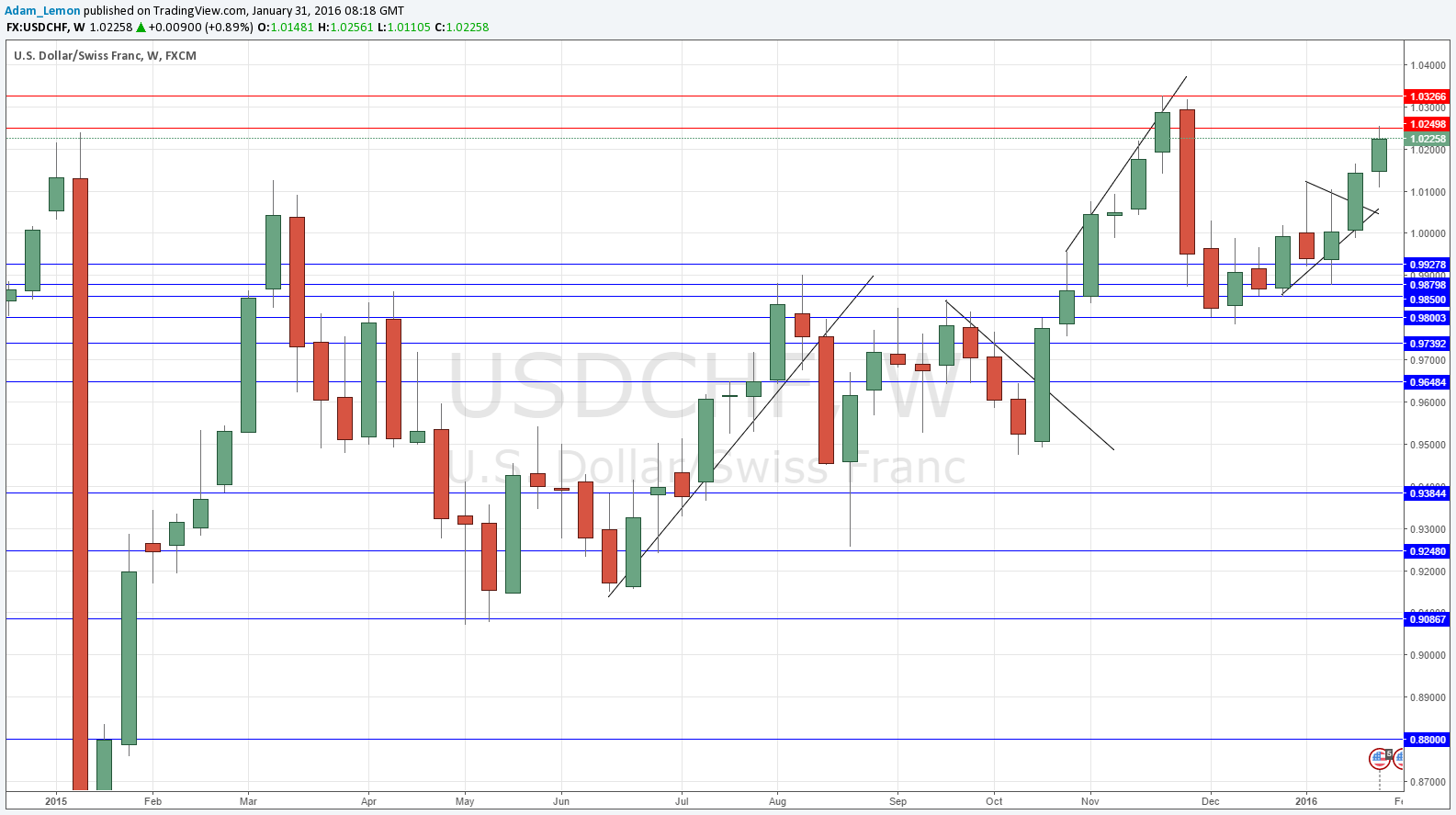

USD/CHF

The weekly chart below shows there has been a clear upwards trend for quite a long time, although it has suffered from quite deep pullbacks. We are approaching a new multi-year high and last week reached the key psychological level of 1.0250. We can expect some resistance above there, but every indication is of bullish momentum and a continuing trend. The area at around 0.9800 has proved to be extremely strong and significant support.

The safest trades of the week are probably going to be short GBP/USD and long USD/CHF.