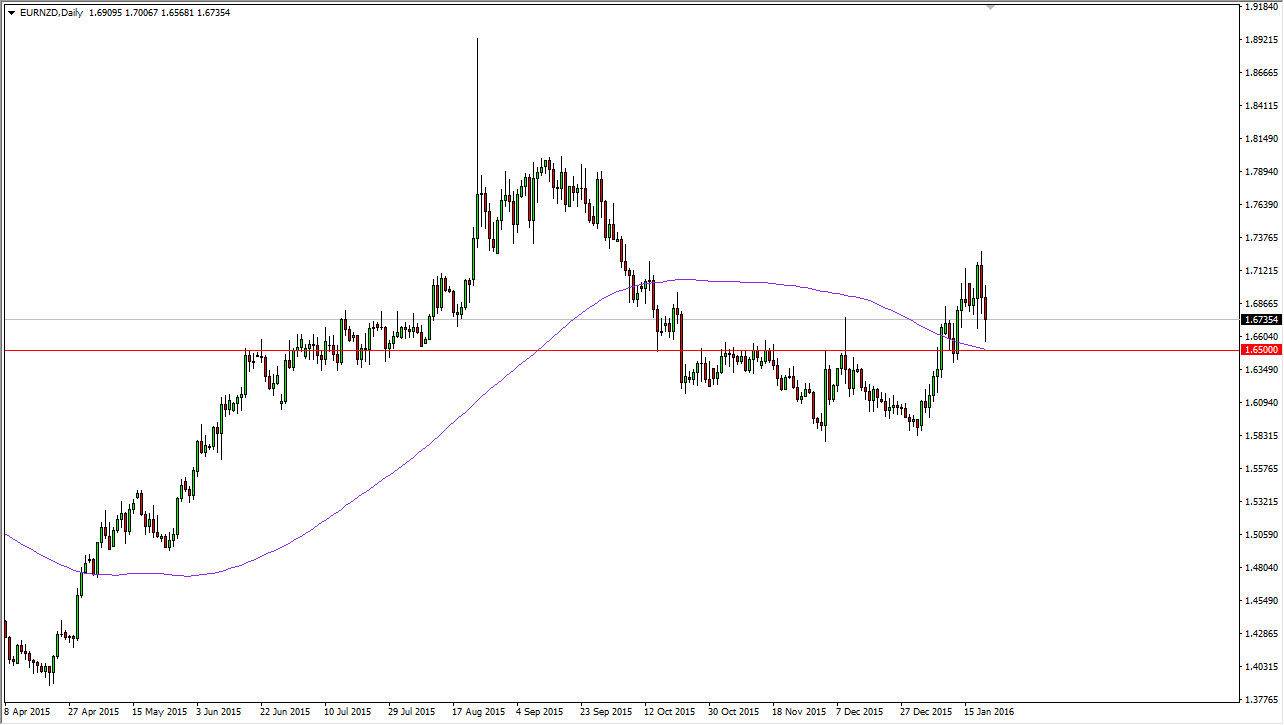

The EUR/NZD pair fell during the day initially on Thursday, but found support at the 1.65 region and bounced rather significantly. That being the case, I believe that the Euro is going to continue to try to climb against the Kiwi dollar as we are now cleanly above the 100 day exponential moving average which is on this chart as well. I don’t necessarily think that it’s going to be the easiest move higher, because quite frankly the Euro is a bit beat down in general. When you look at the EUR/USD, you can see that the Euro is struggling to find some type of footing in one direction or the other. Simultaneously, the New Zealand dollar has shown a bit of resiliency so it does of course favor a bit of stagnation because of a lack of clarity.

Commodities

I don’t like commodities right now, so anytime that the market rallies, I am a seller of most commodities. The New Zealand dollar of course is very sensitive to those commodity markets, so I believe it’s only a matter of time before it falls. That should push this market higher, although the Euro isn't exactly a screaming buy against the rest of the Forex world, so this is going to be more of a grind higher. I do ultimately believe that we go as high as 1.80, as the Euro with all of its faults is still not a commodity currency, so therefore it will do better than the Kiwi dollar in this type of environment.

I see a significant amount of support below at the 1.65 level and I think it extends all the way to the 1.608 handle. I think this is a support zone, which is a much bigger deal than a simple support level. The fact that we have fallen back to this level and bounced also suggests that we should continue to see some resiliency going forward.