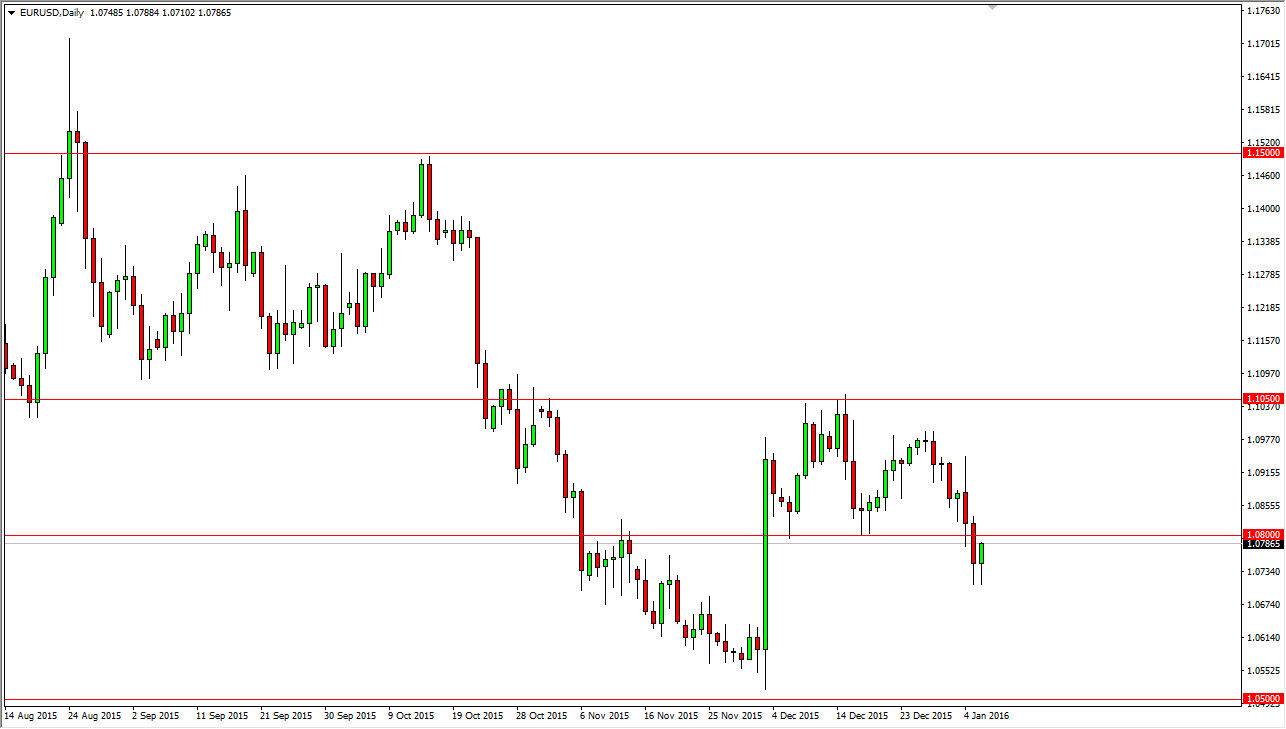

EUR/USD

The EUR/USD pair fell again during the day on Wednesday, but did find enough support at the 1.07 level to turn things back around and form a hammer. The FOMC Meeting Minutes weren’t necessarily a major market mover, so having said that it appears that the Euro will bounce from here for the short-term. However, I have no interest whatsoever in buying this market, as it looks so bearish overall. I also recognize that the 1.08 level previously had been supportive, so it should now be the beginning of some resistance. Even if we get above there, there’s a lot of noise all the way to the 1.10 level. Simply put, I think that eventually we get a bit of exhaustion that we can use to take advantage of “value” in the US dollar.

Having said that though, these days can be very volatile by the end, as the Federal Reserve doesn’t look like it’s ready to raise rates anytime soon. Nonetheless, the European Central Bank is probably even farther away, so any knee-jerk reaction should be punished.

GBP/USD

The British pound fell again as well during the session on Wednesday but did get a bit of a bounce as we are quite overextended to the downside. I believe that the market will continue to offer short-term selling opportunities though, as we have seen several times recently on the shorter-term frames. Every time this market rallies, sellers come in to take advantage of value in the US dollar, and continue to put on short positions. At this point in time, I believe that there is a significant ceiling upon this market at the 1.50 level, and it’s not until we break well above there that I would even remotely consider buying this pair.

Going forward, I fully anticipate seeing this market reach towards the 1.45 handle, although it will more than likely take a few attempts to get all the way down there.