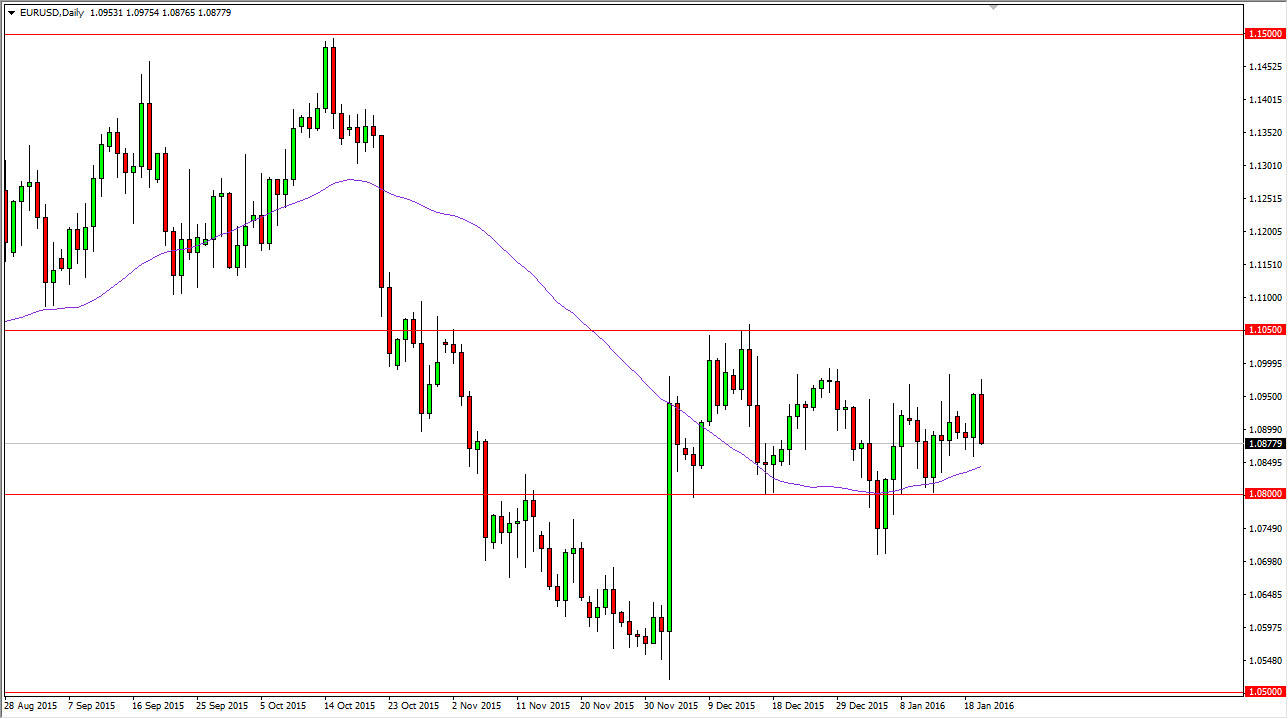

EUR/USD

The EUR/USD pair fell during the day after initially trying to rally on Wednesday, as the market continues to struggle to break above the 1.10 level. Because of this, the market looks as if we will continue to see sellers step into it somewhere in that area. However, we have the 50 day exponential moving average just below, which of course can offer dynamic support.

The session will be important today, because the European Central Bank has an interest rate announcement, and more importantly the accompanying press conference and statement. It’s very likely that traders will wait to see whether or not more quantitative easing is coming, and as a result it’s going to be interesting to see how the day plays out. At this point in time, I am on the sidelines and waiting to see if we get an impulsive candle in one direction or the other.

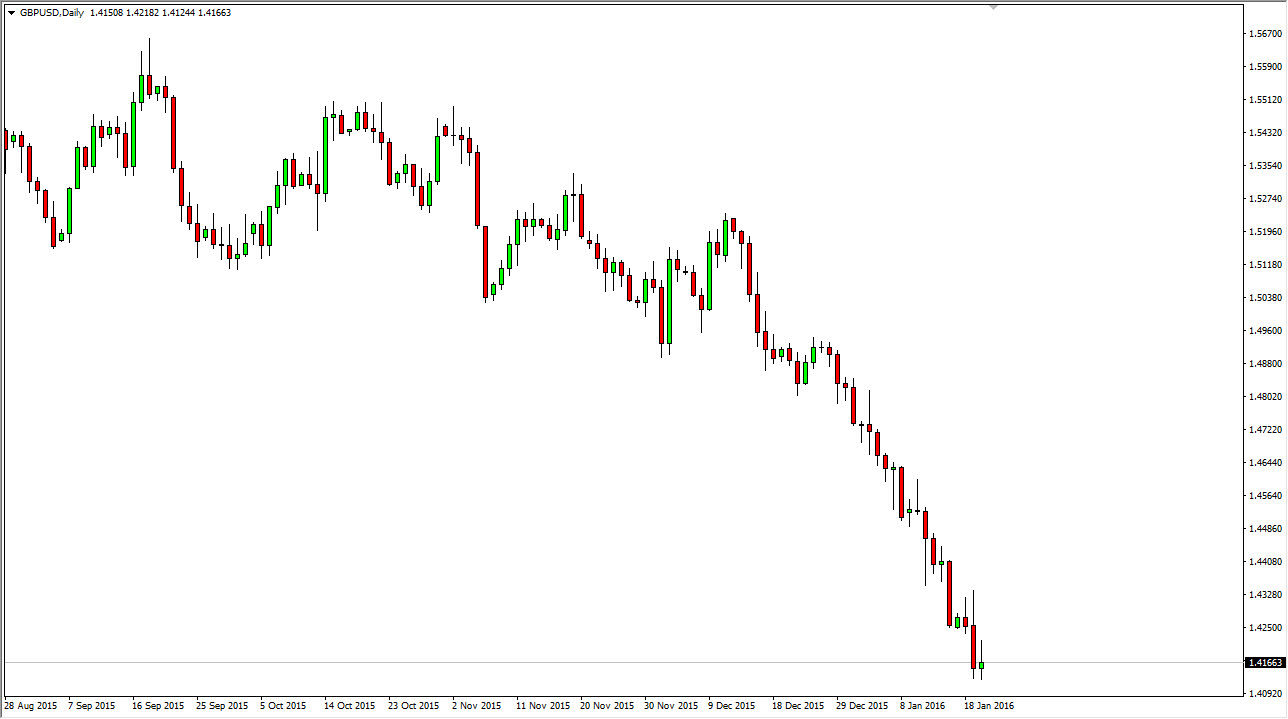

GBP/USD

The GBP/USD pair initially tried to rally during the day on Wednesday, but at this point in time you can see that we fell backwards and ended up forming a shooting star. The shooting star forming at the bottom of a downward trend is a very negative sign, and as a result I believe that the British pound will continue to sell off. Quite frankly, I have no scenario in which I’m willing to buy this market and I only have 2 potential trades coming up: either selling rallies that fail and show signs of exhaustion, or selling a break down below the bottom of the range for the session on Wednesday. Ultimately, I would need to see a longer-term “buy-and-hold” type of situation arise to get involved, which is something that I do not see happening anytime soon. I believe at this point in time the market will try to reach down towards the 1.40 level.