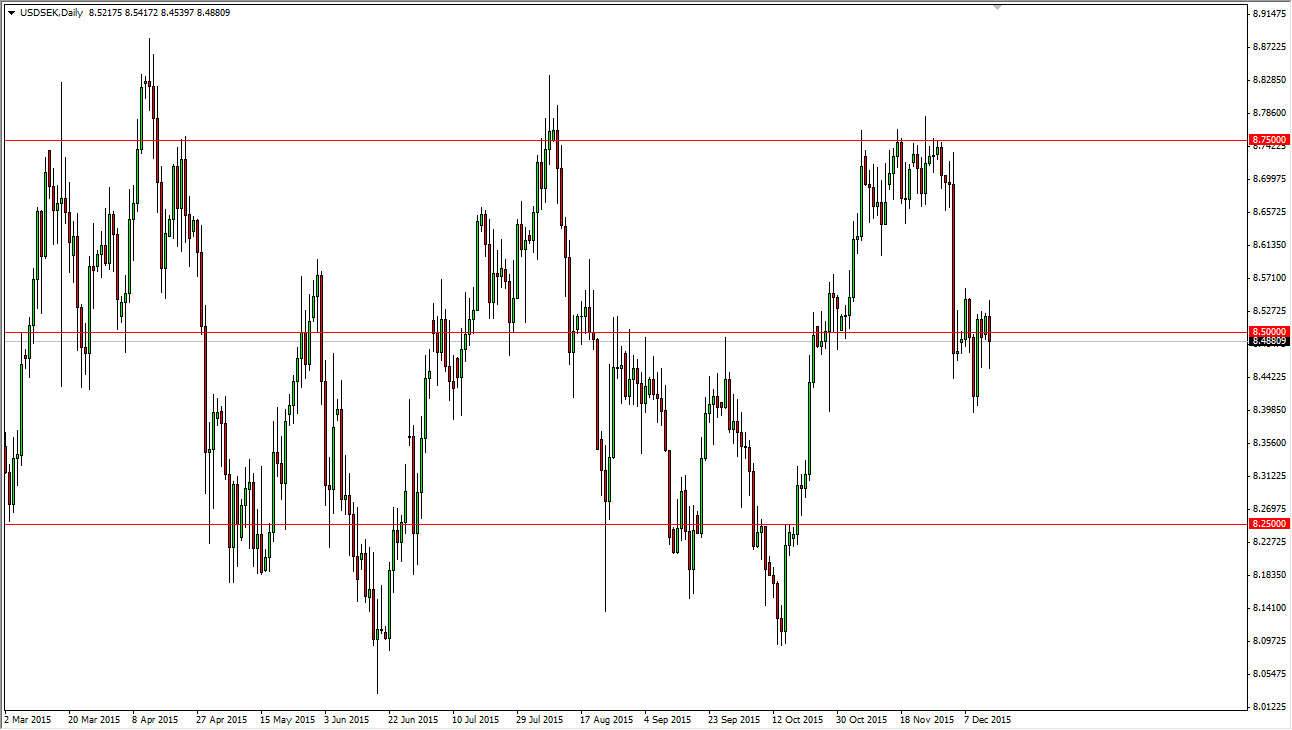

The USD/SEK pair initially fell during the course of the day on Monday, as the Swedish krona picked up a little bit of strength. However, we continue to see quite a bit of noise in the vicinity of the 8.5 level, which is an area that has both been supportive and resistive over the last several months. With that being the case, I like the idea of placing a trade on a break out in one direction or the other, but we have not had that yet.

Having said that though, we ended up forming a hammer, and that of course suggests that there is more buying pressure than selling. If we can break above the recent consolidation area, which I see as the 8.55 handle, I would be a buyer and aiming for at least the 8.70 level, if not the 8.75 level. That being the case, it’s only a matter of time before the buyers should continue to push this market higher in my opinion. This of course is mainly because the US dollar has been strong overall.

Buying Pullbacks

Once we break out though, I would be a buyer of pullbacks from time to time as they appear. This particular market tends to be somewhat choppy, and there is a large spread. However, you have to keep in mind that the PIP value is smaller than other major pairs, so you have to adjust your position size to allow for what appears to be huge fluctuations. However, the value of the trade itself all works out to be the same. Keep this in mind when you place a trade, and do not fear putting a stop loss of that can be as much as 500 pips.

There is the possibility that we break down though, but I’m not interested in selling until we get below the 8.39 handle. If we do, I think at that point in time the market will more than likely reach towards the 8.25 handle.