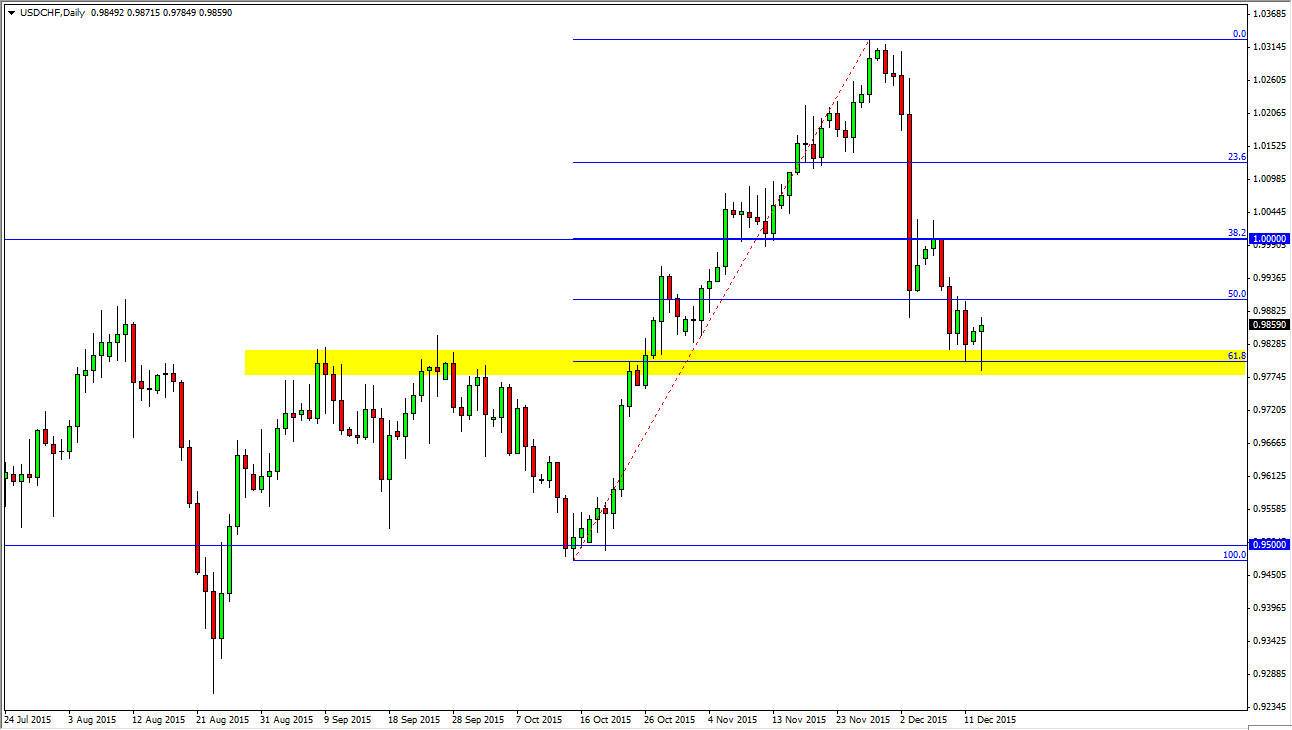

The USD/CHF pair initially fell again during the session on Monday, testing the 0.98 level for support. Ultimately, this area is important for several different reasons, even beyond the fact that it is a large, round, psychologically significant number.

The fact that we bounced off of that area and formed a hammer of course is very supportive as far as I can see. So having said that we also have to look at the previous resistance at this area as potential support. I have also drawn a Fibonacci retracement level tool on the chart, and you can see that the 61.8% Fibonacci level coincides quite nicely with this area. With all these things coming together, this of course has caught my attention.

Buying the Breakout

I am buying the breakout above the top of the range for the Monday session, as it should be a sign of rather significant bullish pressure. I think at this point in time the market should then reach towards the parity level, as it is a natural area to attract a lot of attention. I think that the pullback to the 61.8% Fibonacci retracement level is one of the most common moves to see, so I think a lot of traders are going to be very interested in this area.

Remember that this pair is essentially the opposite of the EUR/USD pair, and that pair looks like it is trying to break out to the upside, but quite frankly is running into a significant amount of resistance. If that pair falls, this pair tends to naturally go higher, but keep in mind that there are a few other dynamics working with the Swiss franc right now, mainly the problem with the European Union, and the fact that the Swiss rely on the Europeans to purchase 85% of their exports. On top of that, the Swiss National Bank has been working against the value of the Swiss franc for some time, so having said that I think that this pair is more than likely to continue to show interest to the upside. A break down below the bottom of the hammer of course is a negative sign, but think there’s so much in the way of support just below I will probably avoid selling.