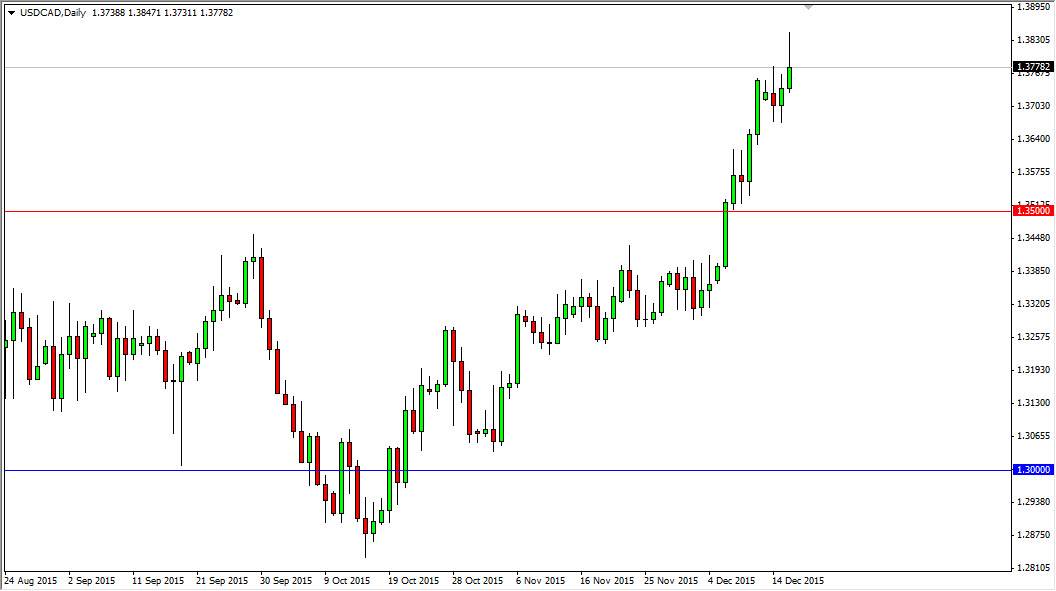

The USD/CAD pair rose during the course of the session on Wednesday, testing the 1.3850 level. However, by the time the day ended we ended up pulling back in forming a bit of a shooting star. Because of this, and looks as if the market will more than likely pullback, but at this point in time. I have no interest whatsoever in selling this market, because quite frankly the US dollar should still continue to be very strong. While we did have a bit of a lackluster reaction to the interest-rate hike coming out of Washington, the reality is that the US economy is doing better than the Canadian economy. On top of that though, we have the oil markets which are putting a bit of a drag on the value of the Loonie, and I believe this will continue to be the case.

Buying Pullbacks

I believe that this is the type of situation that you can buy pullbacks on, and as a result I am looking for supportive candles after those pullbacks in order to go long. I believe that the 1.35 level below is essentially to be a “floor”, and that buyers will continue to be attracted to this market as long as we can stay above that general vicinity. On top of that, oil markets have a massive amount of bearish pressure in them, and as a result it’s only a matter of time before rallies get sold off, putting more pressure on the Canadian dollar due to the lack of demand for crude oil.

With the oversupply of crude oil in the market right now, which is roughly an extra 2 million barrels a day, I don’t see any reprieve for the Canadian dollar anytime soon, and that every time we pullback there should be plenty of reason to start going long. The Bank of Canada is also light years away from raising interest rates, so having said that this seems to be a bit of a “one-way trade.”