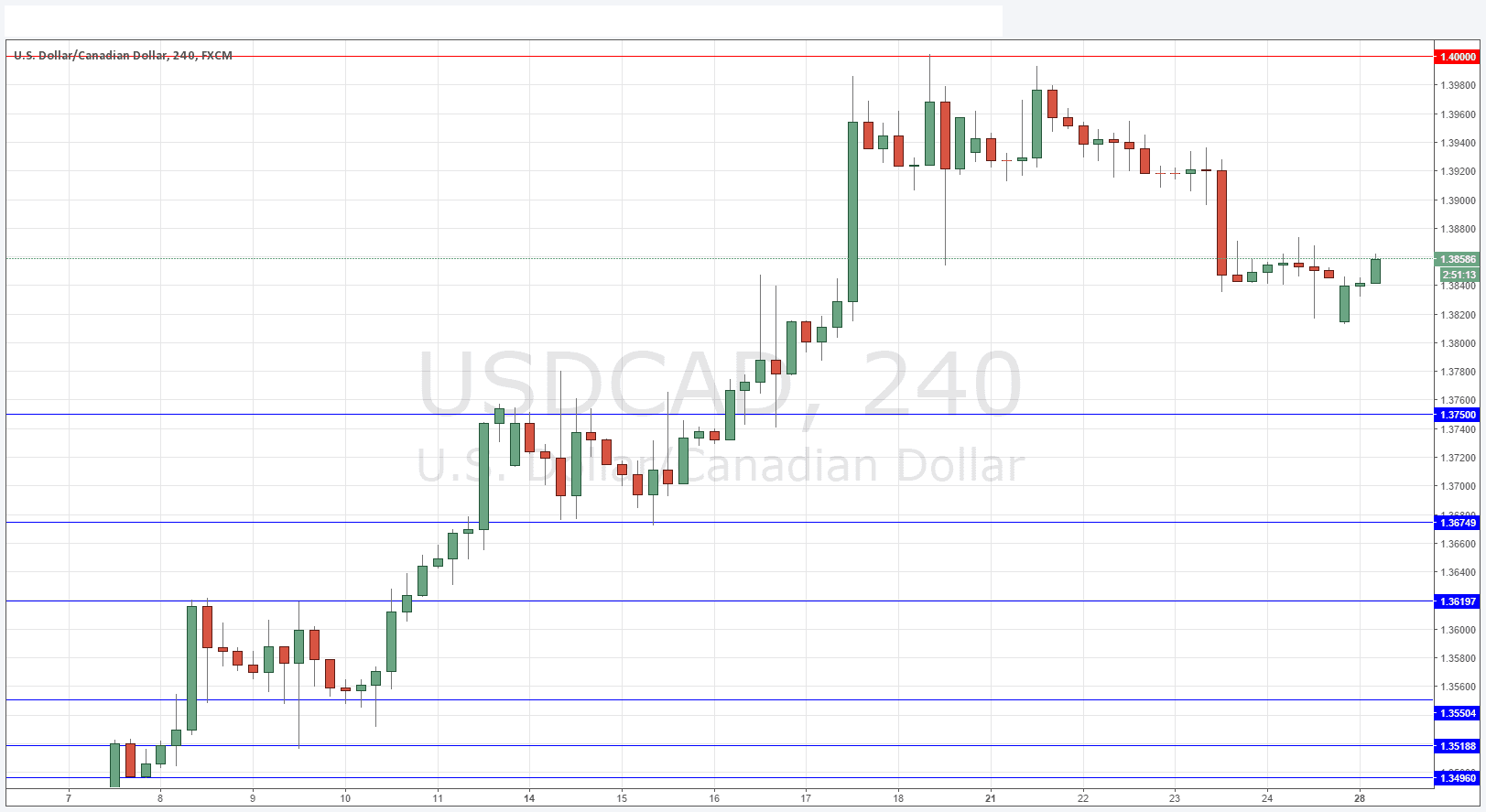

USD/CAD Signal Update

Last Thursday’s signals were not triggered as there was no appropriate bullish price action when the price reached 1.3840.

Today’s USD/CAD Signals

Risk 0.75% per trade.

Trades must be taken between 8am and 5pm New York times today only.

Long Trade 1

* Go long following a bullish price reversal upon the next touch of 1.3750

* Put the stop loss 1 pip below the local swing low.

* Move the stop loss to break even once the trade is 20 pips in profit.

* Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Short Trade 1

* Go short following a bullish price reversal upon the next touch of 1.4000.

* Put the stop loss 1 pip below the local swing low.

* Move the stop loss to break even once the trade is 20 pips in profit.

* Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

USD/CAD Analysis

The level at 1.3840 was acting as weak support last week, and we opened this week some way below that level, and the price has been rising quite strongly ever since. Crude Oil seems to have just turned at key resistance and this may be why this pair might have bottomed out. Of course as Tokyo closes volume will drop significantly as London is on holiday today, so we may not get much more movement until New York opens.

We are some way from either of the key levels remaining nearby, and it is very unlikely that either will be hit today. The thing to watch for now will probably be whether the price continues to move up or whether it runs into strong resistance at around 1.3920.

There is nothing due today concerning the CAD or the USD, it is also a public holiday in the U.K.