USD/CAD Signal Update

Yesterday’s signals expired without being triggered.

Today’s USD/CAD Signals

Risk 0.75% per trade.

Trades must be entered before 5pm New York time today only.

Long Trade 1

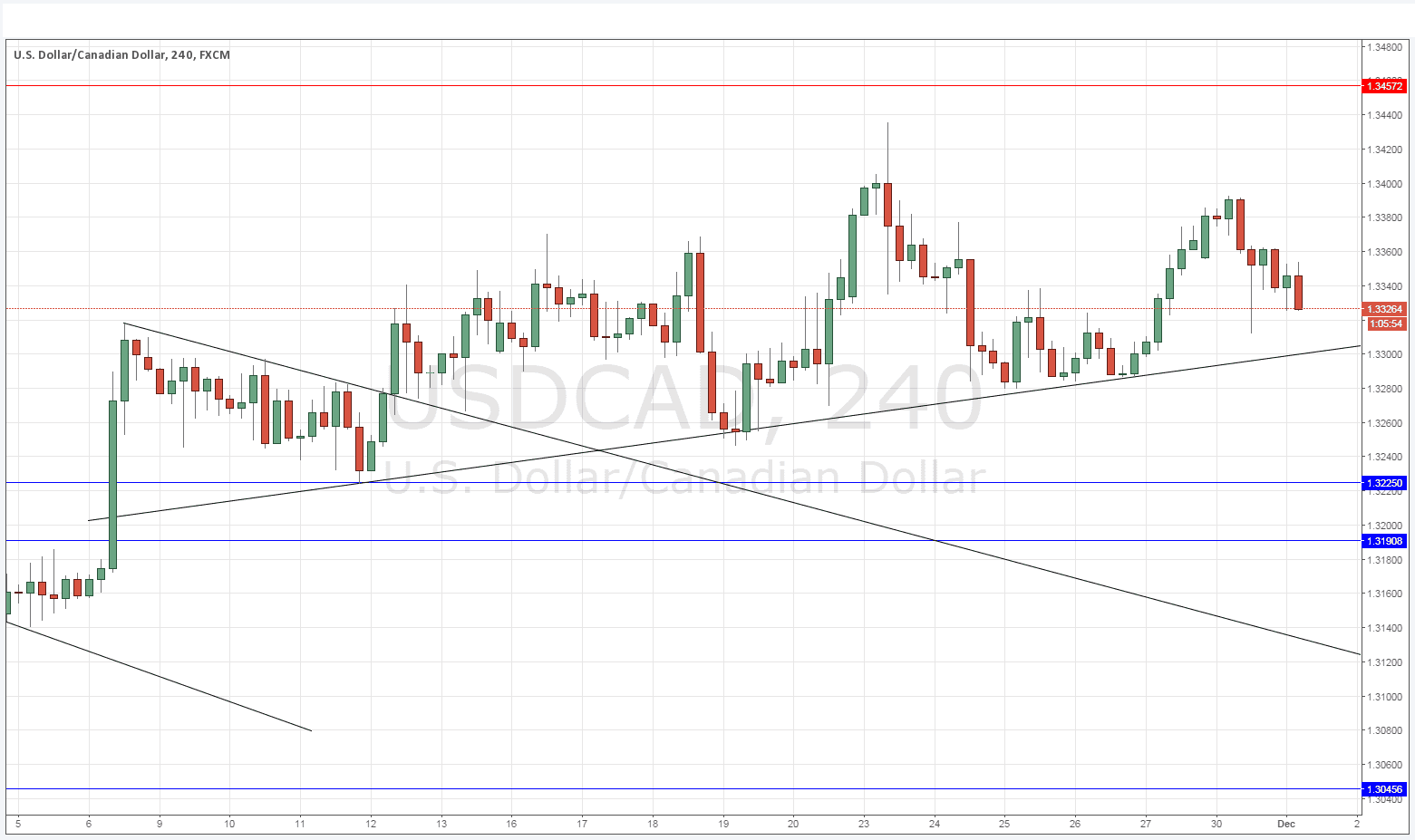

* Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of the supportive bullish trend line currently sitting at around 1.3300.

* Place the stop loss 1 pip below the local swing low.

* Adjust the stop loss to break even once the trade is 20 pips in profit.

* Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Short Trade 1

* Go short following a bearish price action reversal on the H1 time frame immediately upon the next touch of 1.3457.

* Put the stop loss 1 pip above the local swing high.

* Move the stop loss to break even once the trade is 20 pips in profit.

* Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

USD/CAD Analysis

This pair is quite choppy and hard to predict, so it has been quite difficult to trade lately. The best that I can say right now is that it looks likely that the price will continue falling to test the round number and weakly supportive trend line at 1.3300. If sentiment changes later to USD-positive when the price is around 1.3300, it could be a good opportunity for a long trade. Otherwise, I do not see much opportunity here with this pair.

Regarding the CAD, at 1:30pm London time there will be a release of Canadian GDP data. Concerning the USD, there will be a release of ISM Manufacturing PMI data at 3pm.