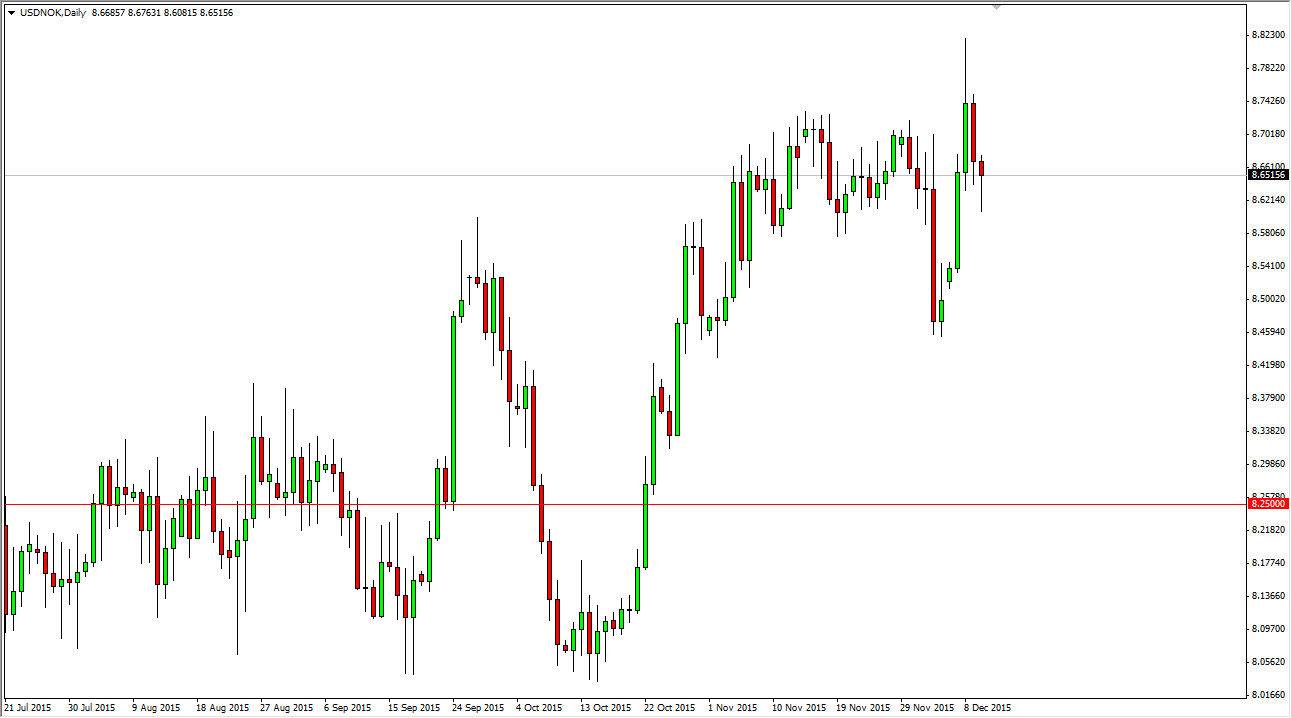

The USD/NOK pair fell initially during the course of the session on Thursday, dropping down to the 8.60 handle. However, we bounced enough to form a nice-looking hammer. This is interesting to me because the market had recently seen quite a bit of resistance in this area. The fact that we pulled back and formed a hammer suggests that the market is following the classic technical analysis tenet of “what was once the ceiling now becomes the floor.”

Because of that , I feel that a break above the top of this hammer could be a nice opportunity to start going long yet again. After all, you have to keep in mind that the Norwegian krone is highly sensitive to the whims of the crude oil market, which has of course been falling apart. Most of the rigs in the North Sea now are Norwegian in nationality, so a lot of Forex traders will use the Norwegian krone as a simple proxy for the oil markets.

US dollar strength

The US dollar continues to strengthen overall anyway, and the fact that the main commodity of the Norwegian economy is falling makes this a bit of a “perfect storm” in my opinion. The fact that we have pullback and then ended up forming a hammer suggests also that the buyers are starting to see value in the US dollar at the moment, and with that being the case I feel it’s only a matter of time before we go much higher. In fact, at this point in time I have a longer-term target of 9.00, and perhaps even higher than that.

At this point in time, I do not see a selling opportunity anytime soon, at least not until we get below the 8.45 level. Granted, I recognize that many of you will be a bit leery of trading this pair, as it has a 50 PIP spread. However, keep in mind that the PIP value is much lower than most other pairs. In the end, it’s really not any different than trading most other minor pairs. With that being said, just simply pay attention to your position size before getting involved, as this pair tends to facilitate longer-term trades.