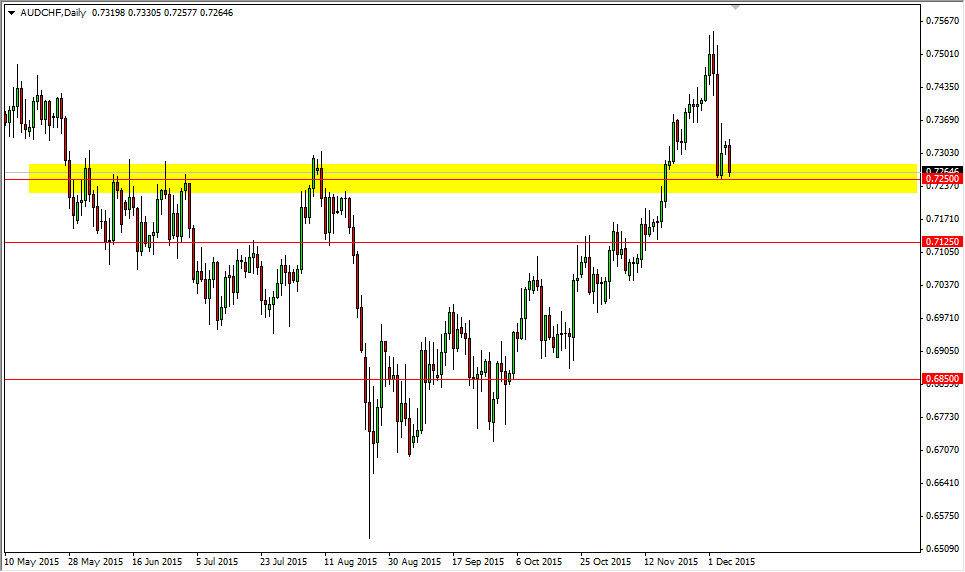

The AUD/CHF pair fell during the course of the day on Monday, testing the 0.7250 level. This is an area that has been massively resistive, so at this point in time it should be supportive. After all, the massive selloff that we saw last week stopped right at this level, and with that I would expect to see some type of buying pressure. On top of that, we have seen a massive uptrend since last October, so I think that it’s probably only a matter of time before the buyers get involved.

However, I would be cautious about buying until we get some type of supportive candle on a daily chart, as the probability of a “false bounce” is fairly strong. I think that there is not only massively supportive pressure underneath at the 0.7250 level, but also extending all the way down to the 0.7125 handle. Because of this, I think any type of supportive candle has to be looked at seriously as a potential buying opportunity.

Risk Appetite

Risk appetite is highly influential when it comes to this particular currency pair, as the Australian dollar is highly leveraged to gold and commodities in general, while the Swiss franc is highly leveraged to safety. On top of that, there is another dynamic that is at work in this currency pair: The Swiss franc is highly susceptible to what’s going on in the European Union, which of course is in exactly stable. Remember, Switzerland sends 85% of its exports into the European Union. If it’s greatest customer is suddenly in trouble, Switzerland will sell less goods in general.

Gold markets have rebounded a bit, and that of course works in the favor the Australian dollars well, but I think the fact that there is a positive swap in this pair probably continues to pushes market higher overall. The 0.75 level was the previous high, and I think that’s eventually where we’re going to go.