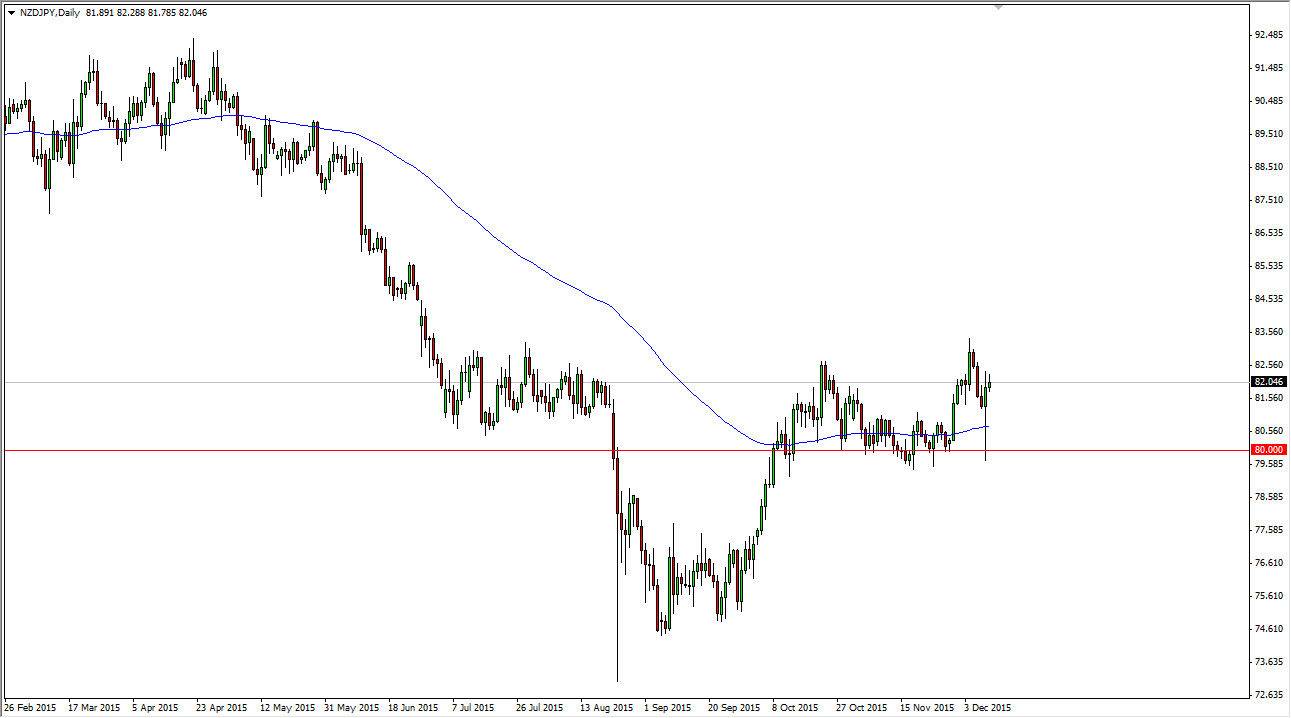

The NZD/JPY pair broke higher during the course of the day on Thursday, although did not explode to the upside showing massive bullish pressure. However, we had formed a nice-looking hammer during the session on Wednesday, bouncing off of the vital 80 handle. This is an area that had been supportive in the past, so I find that it’s very likely that the market will continue to bring in buyers on short-term pullbacks. I think that the Japanese yen will continue to be worked against as we have to find some type of return on money in general, and in a world that has nothing but low interest rates, it makes sense that a lot of traders will be buying this simply for the swap at the end of the day.

Another thing that has my attention is the fact that we are starting to rise above in a fairly dramatic fashion from the 100 day exponential moving average that recently was flat, but now is starting to turn to the upside. Quite frankly, I feel that this is a market that not only can be bought but held onto if you are patient enough and use the correct position size.

Bank of Japan

I believe that the Bank of Japan will continue to work against the value of the Japanese yen in general, so it makes sense that this market as well as anything that has the JPY in it will continue to favor the other currency. I think that it’s only a matter time before this market breaks out above the 83 handle, and once we do we should send the market to the 88 handle.

I have no interest in selling this market until we get well below the 80 handle, perhaps even the 79 handle. At that point in time we will more than likely reach towards the 75 level, but I do not see that happening without some type of financial calamity or seriously negative headline.