Gold prices ended Tuesday's session down $5.83, to settle at $1072.34 an ounce, pressured by the recovery in equity markets and better-than-expected U.S. economic figures. The Commerce Department reported that the U.S. economy expanded at a revised 2% annualized rate in the third quarter. Today's trading volume is expected to be thin ahead of the Christmas holiday.

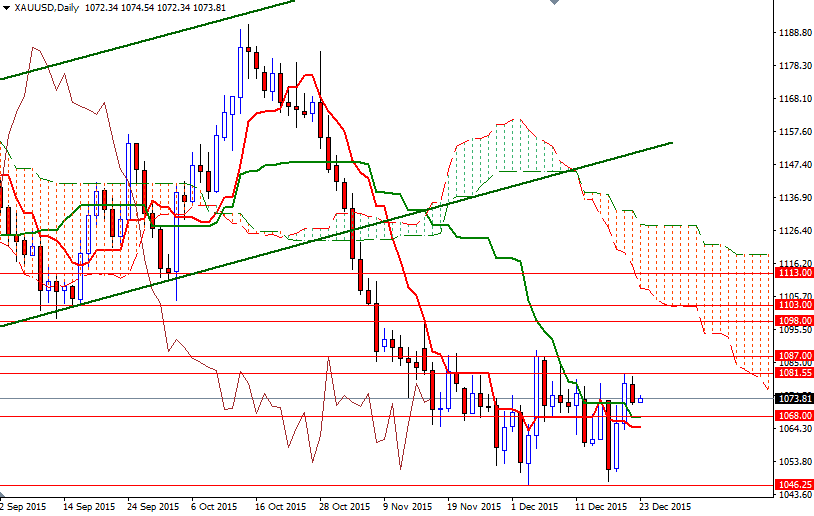

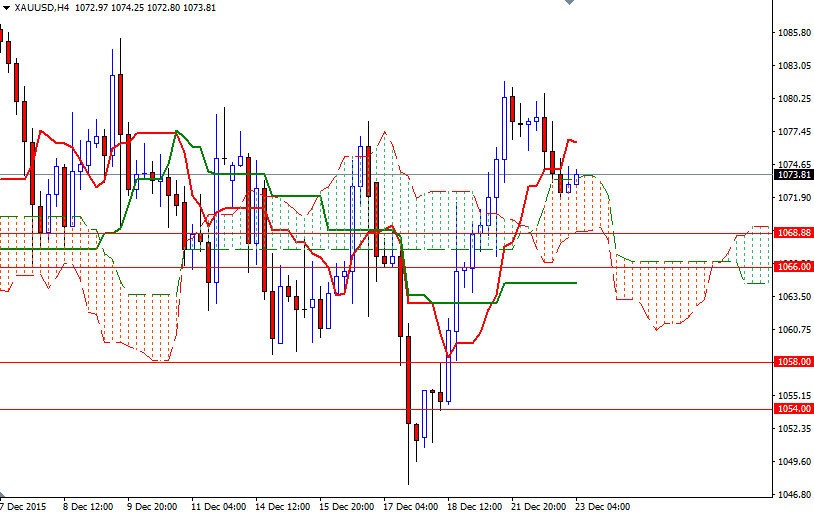

Meanwhile, the short-term and long-term charts are giving us mixed signals. On the 4-hour chart, the XAU/USD pair is trading right above the Ichimoku cloud and we have a bullish Tenkan-sen (nine-period moving average, red line) - Kijun-sen (twenty six-period moving average, green line) cross. On the weekly and daily time frames, however, prices are still under the cloud and negatively aligned Tenkan-Sen - Kijun-Sen lines create a tough situation for the bulls.

In other words, gold prices will struggle to climb significantly higher over the long term but the short term trend will probably continue to favor the upside. If the support down below at around 1068/6 remains intact it is possible to see the bulls challenging the 1081.55 resistance again. Recently the XAU/USD pair has been held in check by 1081.55, so shattering this barrier is essential for a bullish continuation. Once above that, I think the bulls will be aiming for 1087. The bears will have to drag prices back below the 1068/6 support in order to increase the pressure on the market. Breaching this support would make me think that XAU/USD will test 1063/2 afterwards. A close below 1062 would indicate that 1058 will be the next stop.